Conference Coverage: 2022 Investment Innovation Conference

During history's turning points, fortune favours the innovators. As the world moves beyond the coronavirus pandemic and the global workforce entrenches the improved labour conditions it created, the need for businesses to welcome new ideas is at an apex.

At the 2022 Investment Innovation Conference at the Fairmont Scottsdale Princess in Scottsdale, Ariz. on Nov. 2-4, leading institutional investors and defined benefit pension plan sponsors shared the novel strategies they're using to identify the innovative businesses set to thrive in the coming decades.

Find out what you missed!

University of California, Berkeley

How the pandemic kickstarted an automation revolution

The robots of the near-future won’t replace people, but will free them to focus on what they do best — empathizing, communicating and innovating, said Ken Goldberg, professor of engineering at the University of California, Berkeley.

MFS Investment Management

Navigating the complexities of ESG in fixed income

Climate change presents an ongoing challenge to institutional investors’ allocations to domestic corporate bond, according to Soami Kohly, fixed income portfolio manager at MFS Investment Management.

AllianceBernstein

Finding differentiated sources of growth and alpha in emerging markets

Emerging market economies with strong domestic structural growth stories are likely to thrive in the next 10 years, said Alexis Freyeisen, investment strategist for emerging markets equities at AllianceBernstein.

Nelson Lam

Trans-Canada Capital Inc.

Using thematic strategies to derive more value from private markets

Institutional investors should be adopting innovative thematic approaches to derive more value from private markets, according to Nelson Lam, senior vice-president of equity and alternative investments at Trans-Canada Capital Inc.

Schroders

Rethinking the role of carbon-intensive assets in investment portfolios

Reduced investment in the fossil fuel sector will lead to higher energy prices, encouraging the development of transition technologies, according to Mark Lacey, head of global resource equities and global thematics at Schroders.

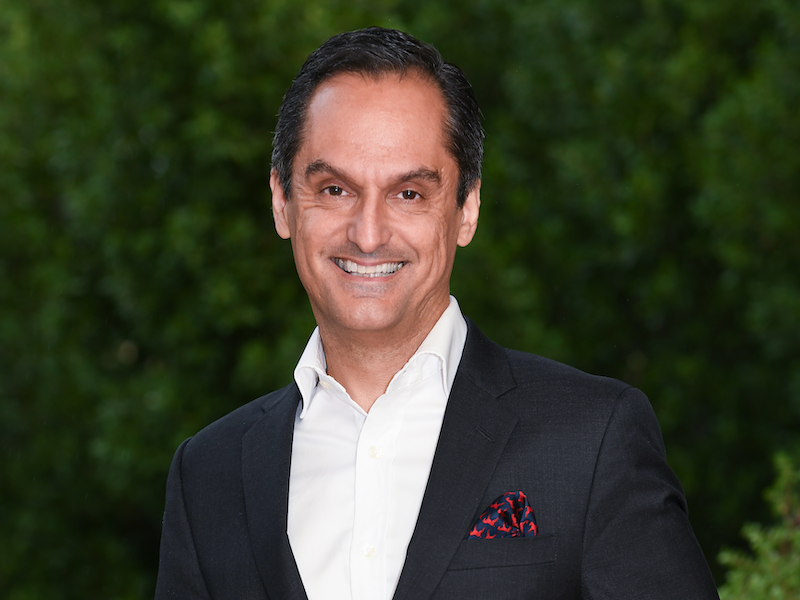

Patrick Vizzone

Franklin Templeton

Identifying emerging opportunities in ESG investing

Environmental, social and governance investment strategies can improve a portfolio’s ability to generate alpha, according to Patrick Vizzone, managing director of global private equity at Franklin Templeton.

T. Rowe Price

Four major misconceptions about fixed income impact investing

Four major misconceptions about fixed income impact investing have taken root in the minds of many institutional investors, according to Matt Lawton, fixed income portfolio manager of global impact credit strategy at T. Rowe Price.

Steve Guignard

Sun Life Capital Management

Diversifying fixed income portfolios with alternatives

“What we’ve observed year to date is nothing short of historic in nature,” said Steve Guignard, senior director of client solutions at Sun Life Capital Management, referring to the poor performance of the FTSE Canada Universe Bond Index, which dipped 12 per cent in 2022.

Insight Investment

The role of innovation in high-yield corporate bonds

“There’s been some tremendous innovation in fixed income markets, especially in the last decade. Technology has made transparency and liquidity blossom in areas that have traditionally been very illiquid, such as high-yield,” said Paul Benson, head of efficient beta at Insight Investment.

Read session coverage

Jurrien Timmer

Fidelity Investments

Investing in a time of quantitative tightening

“I’m starting to become a glass half full person. . . . I think that at least one of the two anchors of the 60/40 [balanced portfolio] is going to start working. I wish I could tell you which one,” said Jurrien Timmer, director of global macro at Fidelity Investments.

University Pension Plan Ontario

Building the UPP’s ambitious climate action plan

“As the preceding presentations showed quite clearly, the climate is changing and the impact won’t have a linear correlation with temperature rises,” said Aaron Bennett, chief investment officer of the University Pension Plan.

Read session coverage

Darace Rose

Oppos Inc.

Protecting technology infrastructure critical for institutional investors

The most important asset in the world is people’s personal information because every piece of data that we provide to the internet through social media or through interactions with pension funds and online banking are valuable information sources, said Darace Rose, co-founder and chief technology officer at Oppos Inc.

Acadian Asset Management

Using AI to eliminate greenwashing and generate sustainable alpha

Since interpretations of environmental, social and governance investing can vary, institutional investors can leverage artificial intelligence tools to strip away the noise and reveal data sets required to eliminate greenwashing and generate sustainable alpha, said Andy Moniz, senior vice-president and director of responsible investing at Acadian Asset Management.

Read session coverage

Sunil Wahal

Arizona State University

Pension funds urged to leverage value, profitability model

Value and profitability are inextricably linked and, when they’re combined in a portfolio, institutional investors can garner a healthy premium, said Sunil Wahal, professor of finance at Arizona State University.

Arizona State Retirement System

A Canadian view of the Arizona State Retirement System

Few people have as clear a perspective on the differences between public sector defined benefit pension plans in Canada and as Paul Matson.

Colyn Lowenberger

Möbius Benefit Administrators Inc.

Alison McKay

Saskatchewan Healthcare Employees’ Pension Plan

Pension plan sponsors discuss role of communication, education in member engagement, support

In 2021, the Saskatchewan Healthcare Employees’ Pension Plan set out to gauge just how well-versed its 60,000 members were about their defined benefit pension plan.

Sponsors

To view highlights from the 2021 Investment Innovation Conference, click here.