As talks of U.S.-China trade tensions dominate headlines, many investors are keeping a close watch.

On June 29, 2019, U.S. President Donald Trump and Chinese leader Xi Jinping met on the margins of the G20 in Japan.

What really stood out from the meeting is that an agreement was reached to resume trade negotiations, says Andy Rothman, investment strategist at Matthews Asia.

This reinforces that Trump thinks he needs a trade deal with China to get re-elected, Rothman says. “And that’s why I am optimistic that sometime in the not too distant future we’re going to see a deal.”

Trump also indicated the U.S. will hold off imposing additional tariffs on China. As well, he shifted his tone about the U.S.’s relationship with China, saying he thinks China and the U.S. will be strategic partners.

The meeting’s actual outcomes went beyond Rothman’s expectations, noting he didn’t think Trump would address concerns about the broader nature of the relationship. “I thought he was going to stick just to the trade deal part, and so this has the potential to be very positive if Trump is going to now continue down this path of following a more constructive engagement-focused approach to China, rather than the confrontational containment approach that the rest of his team has been advocating for the last year.”

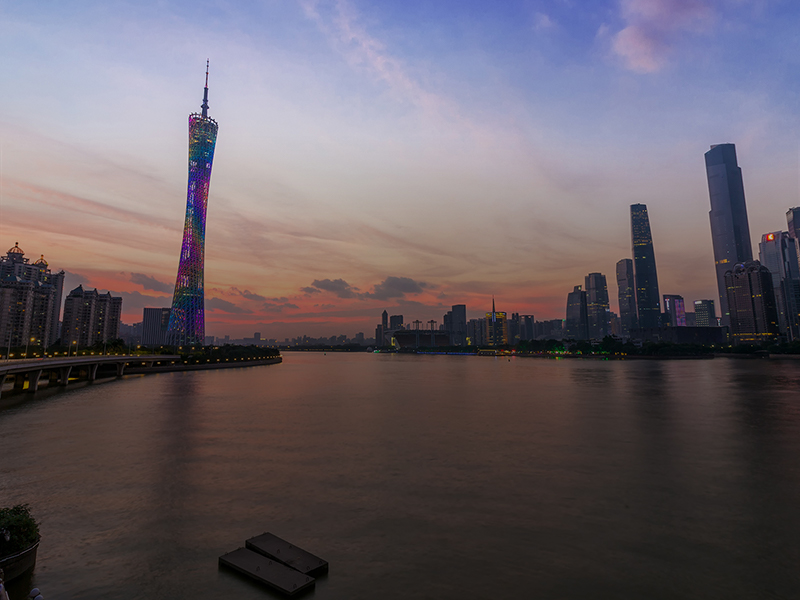

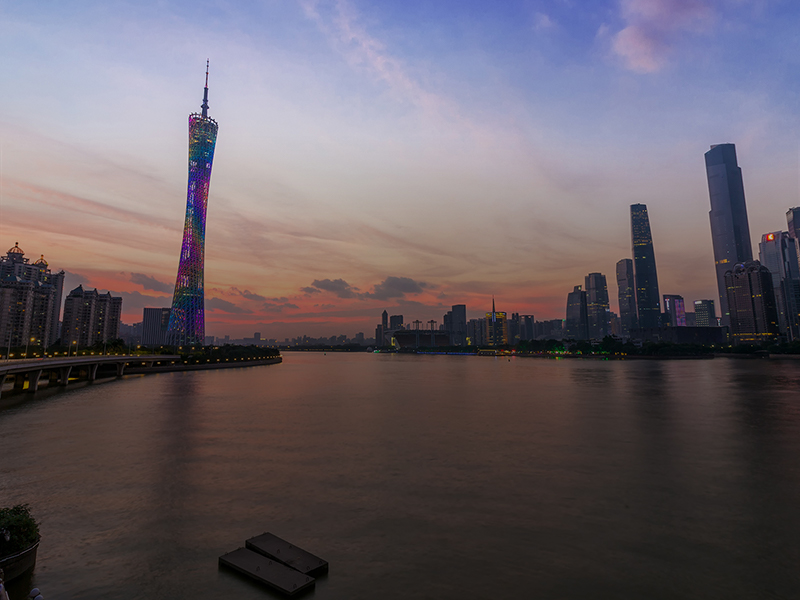

More broadly speaking, the Chinese economy has been doing reasonably well, especially on the consumer side, says Rothman. The industrial side, on the other hand, has been dampened due to trade tensions. With second quarter numbers coming in shortly and if trade talks stay on track, industrial numbers may pick up a little bit too, he adds. “And in the first half of the year, the Chinese stock market — despite these tensions — did pretty well and so that’s something for investors to keep in mind.”