From 2016 to 2024, fewer plan members are confident they’ve saved enough for retirement.

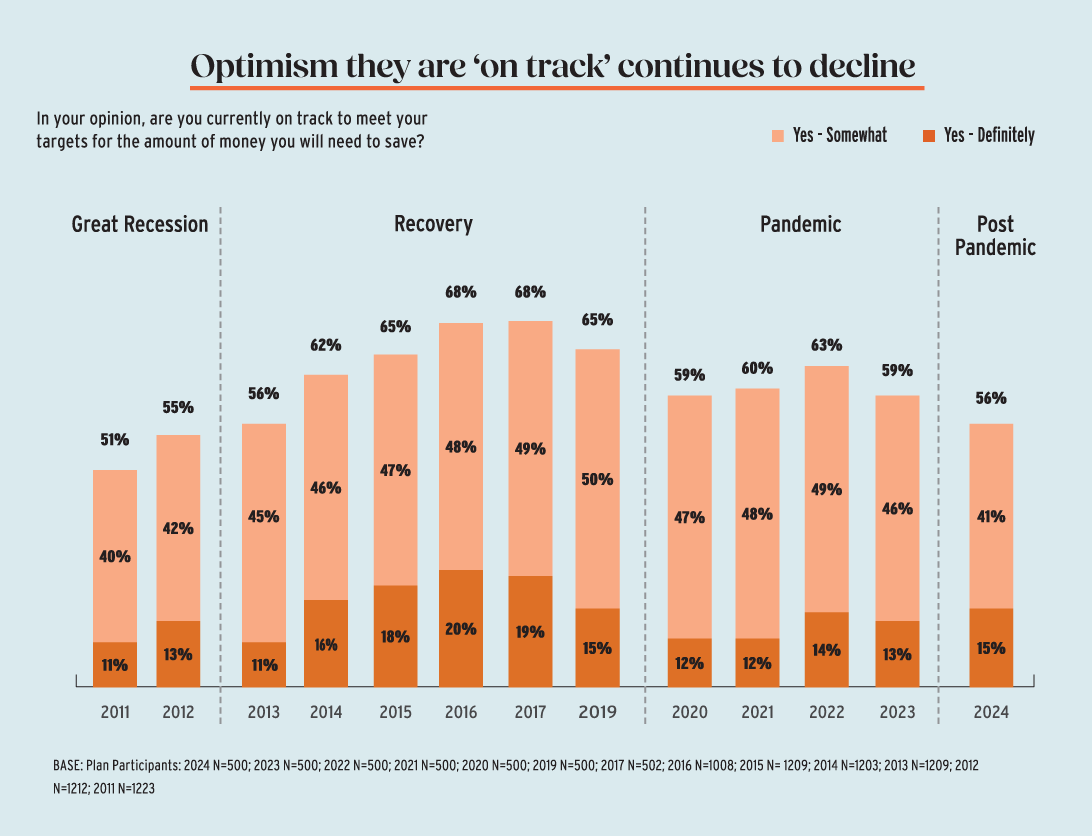

Indeed, Benefits Canada’s 2024 CAP Member Survey found plan members’ optimism that their retirement is on track declined to 56 per cent from 63 per cent in 2022, while three-quarters (73 per cent) said they’re worried they won’t have enough saved when it comes time to retire.

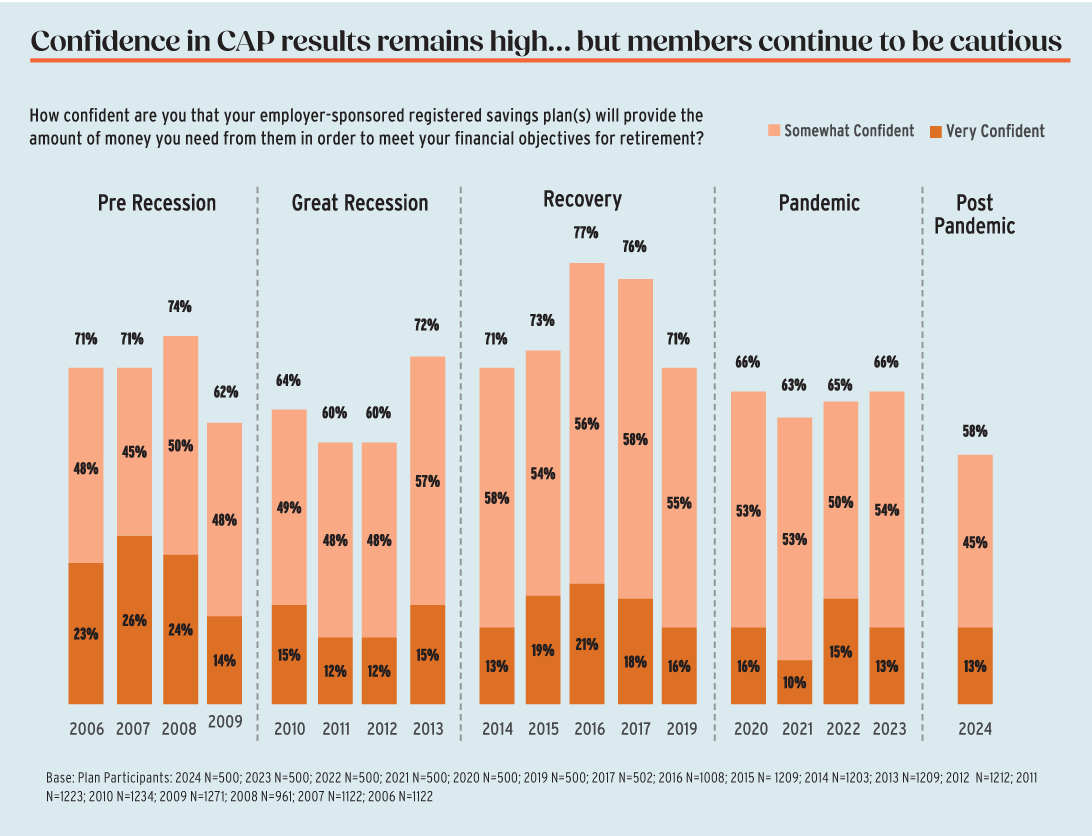

Similarly, just 58% of plan members said they’re confident their employer-sponsored registered savings plan(s) will provide the amount of money they need to meet their financial objectives for retirement. Just 13 per cent said they’re very confident in their employer-sponsored capital accumulation plan.

Read: CAP member outcomes continue to increase in Q2 2024: report

Notably, employees aged 18 to 34, aged 35 to 54 and those aged 65 and older shared similar levels of confidence (62 per cent, 59 per cent and 60 per cent, respectively), while confidence was lower among workers aged 55 to 64 (48 per cent).

“One interesting thing from the survey results was that the confidence was higher for the older folks who are closer to retirement, which is kind of a good thing,” said Jason Vary, president of Actuarial Solutions Inc., during a webinar that discussed the survey results. “People get more and more confident as they get closer [to retirement]. . . . What we’re seeing is people are healthier, they’re living longer and they’re working longer.”

Also speaking during the webinar, Melissa Carruthers, a partner in the life and health insurance strategy division at Deloitte Canada, said the firm’s plan sponsor clients are expressing increased interest in a mandatory financial health check for plan members five years prior to retirement.“[They want to] be able to drive the conversation around [whether plan members] need to think differently about how they’re managing debt [and] how [they] can optimize contributions . . . in the final years leading up to retirement. I think having financial advice and a personalized plan for your household is such a big and instrumental component of setting you up for success in retirement.”

A consideration for plan sponsors is that plan members are often looking at their finances in the moment, said Mara Notarfonzo, vice-president of total rewards at CAA Club Group. “What we try to do is reinforce that holistic view. There are programs and services available to help [plan members] save in the moment, but [it should also] be anchored to retirement planning.

Read: What can the Canadian pension industry learn from U.S. CAP litigation?

At Kraft Heinz Canada, retirement is differentiated from other savings options, a strategy that helps younger employees, in particular, to set aside money, said Tracy Fogale, the company’s senior manager of benefits.

“As soon as you start to use the word ‘retirement,’ particularly among the younger generation, it’s a bit daunting. They may think, ‘Well, you know, I’m 25, I’m not ready for retirement, that’s many moons away.’ But we do have savings programs and retirement programs to help set them up for success. What we’re trying to do is to take the [approach] of saving for your dreams, whatever that might be, because then we’ve got their ear.”

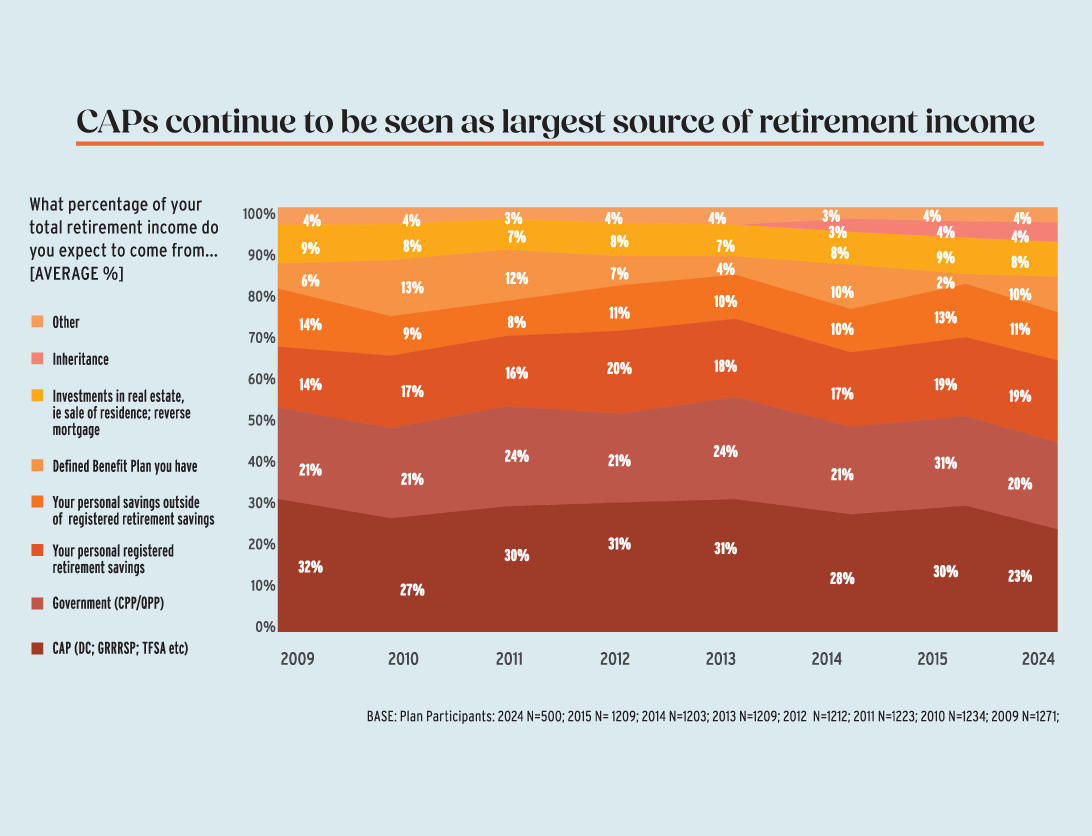

When asked about where they expect retirement income to come from, respondents cited their workplace CAP (23 per cent) as their main source of income, down from 30 per cent last year, followed by government sources (20 per cent), personal registered savings such as a private registered retirement savings plan (19 per cent), personal non-registered savings (11 per cent), a defined benefit pension plan (10 per cent) and real estate, such as investments or the sale of their primary residence or a reverse mortgage (eight per cent).

Employees aged 18 to 34 (26 per cent) were more likely to cite their CAP as their No. 1 source of retirement income, compared to workers aged 55 and older (20 per cent). Conversely, plan members aged 55 and older were more likely than those aged 18 to 34 to cite government pensions as their main retirement income source (29 per cent and 15 per cent, respectively).

To reverse this decreasing lack of confidence, employers can turn to enhanced pension communications and education to help employees better understand their plan, particularly investments and contributions, said Carruthers.

“I think part of that is being able to show . . . what they would be missing out on [by] not participating in the CAP and the additional value that they get by maxing out their contributions relative to just the minimum contributions. I also find that many [plan members don’t] really appreciate how affordable that investment option is for them, versus an individual RSP or tax-free savings account.”

CAA’s plan is focused on providing flexibility to employees to make an informed decision, said Notarfonzo. “There’s a core option, which is mandatory enrolment and there’s flexibility of optional contributions that still have the same 100 per cent match. . . . It’s going back to that holistic view of educational sessions that look at various topics [such as] economic changes [and] interest rates.”

Read: Canadian CAP providers’ assets up 12.9% in 2023: report

In Kraft Heinz’s CAP, roughly 86 per cent of employees are maximizing the company match, said Fogale. “At any given point, they can reduce or come out of that voluntary [contribution] component. . . . Since implementation, very few [plan members have] reduced that voluntary component. Because they’re not seeing necessarily a drop [in income] because they’ve started with those maximum contributions coming off and therefore getting the maximum company match.”

While flexibility is an important aspect of CAPs, it can also be detrimental to plan members by allowing them to delay contributions or forgo them altogether, cautioned Vary.

“People do need to be forced [to contribute] and even though [an employer] might think, ‘Giving them flexibility is better, it often works against them. . . . I’m not a fan of matching contributions — if employers want to spend up to five per cent of [a plan member’s income], they should just put in the full [amount] and then encourage the employees to contribute more.”

With workplace CAPs typically offering lower fees, employers can emphasize this aspect to encourage savings, particularly among younger employees, he added. “Young people are very savvy about fees and the fees for large CAPs can be very, very low. It’s much better [for plan members] to save their extra money with an [employer-sponsored] TFSA or RSP.”

The survey also asked respondents when they anticipate they’ll start to collect payments from the Canada Pension Plan/Quebec Pension Plan. Two-fifths (43 per cent) said they plan to start collecting CPP/QPP at age 65, while a third (33 per cent) said they plan to start collecting earlier than age 65 and a quarter (25 per cent) said they plan to delay payments.

Among the latter group, a quarter (27 per cent) said they’re planning to maximize their payments, followed by not being able to afford to not work (19 per cent) and wanting to work longer (18 per cent). On average, plan members said they expect to retire at age 63 — unchanged from last year and consistent with the survey’s findings since 2012 — and expect their retirement funds will need to last 29.8 years, up slightly from 27 years in 2023. Based on respondents’ planned retirement date and how long they feel their funds will last, the average life expectancy was calculated to be age 92, up slightly from age 90 last year.

“[Delaying CPP/QPP] can be advantageous to an individual, especially a person who doesn’t have a DB pension plan at their work. By delaying CPP past [age] 65, your benefit actually goes up 8.4 per cent per year for the rest of your life, so if you go all the way to age 70, [the annual benefit] will be 42 per cent higher. That’s an index benefit, which is also good in these days of higher inflation and that can be a hugely advantageous choice for an individual who has a CAP.”

The discussion around when to collect CPP/QPP is an opportunity for plan sponsors to enhance financial literacy among CAP members, by giving them a fuller understanding of sources of retirement income and how much they’ll need to save, added Fogale.

“Once you piece that all together, you can make the best educated decision possible. I do believe that [CPP/QPP benefits] should be part of the planning journey and conversation — retirement is a life event, and it happens once.”

Read: 2023 CAP Member Survey: How CAPs are evolving to address changing financial priorities

Key takeaways

• While CAP members are less confident about their retirement savings, they expect their CAP to be their main source of retirement income, putting increased pressure on plan sponsors.

• Fewer plan members reported an excellent or good understanding of concepts such as decumulation and retirement risk, but communication and education can help reverse this trend.

• The conversation around delaying CPP/QPP benefits is becoming increasingly prominent, as CAP members expect to live longer but retire earlier.

Notably, the survey found plan members’ understanding of their CAP appears to have declined over the years. Just 27 per cent said they have an excellent or very good understanding of their plan, down from 33 per cent in 2015 and 47 per cent in 2007, when the question was first asked. More than a quarter (28 per cent) said they have a poor or no understanding of their plan.

Similarly, CAP members’ understanding of decumulation is also on the decline. More than two-fifths (43 per cent) said they have a poor or no understanding of how to convert their funds into an income stream when they retire, while just a fifth (21 per cent) said they have an excellent or very good understanding, down from 26 per cent last year.

Regarding risks that can impact retirement savings, a quarter said they have an excellent or very good understanding of inflationary risk (26 per cent) and interest rate risk (24 per cent), while a fifth (21 per cent) said the same about longevity risk. Conversely, nearly two-fifths (38 per cent) said they have a poor or no understanding about longevity risk, while more than a third indicated the same response regarding inflationary risk (36 per cent) and interest rate risk (35 per cent).

The solution to these declines in understanding may lie in improved plan communications and financial advice, noted Carruthers. “Decumulation is a complex concept [as is] being able to really understand and appreciate all of the different funding sources that you have available. . . . I don’t know that we should expect the average Canadian to truly understand all of [the] different levers that they have available to them.”

Read: ACPM calling on feds, CAP sponsors to increase focus on decumulation

The method and timing of plan communications is also important, said Notarfonzo, noting CAA’s ‘Who Wants To Be A CAA Millionaire?’ campaign used three-minute videos to communicate concepts such as CAP investments.

“[Employers might also consider] not [holding educational sessions] only during business hours — have a few in the evening because those kind of things are important for [the plan member’s] family.”

Kraft Heinz is currently developing a total rewards hub that will provide employees with access to their pension and benefits information, said Fogale, noting the company’s pension communications strategy also makes use of personas representing several employees at different stages of their retirement journey, in addition to traditional communications methods, such as mailers.

“We’ve had a significant focus on communication to employees at all levels. . . . We’ve got five generations in the workplace right now, so we know that there’s such a diverse group with diverse needs and we need to start personalizing [communications].”

Blake Wolfe is the interim editor of Benefits Canada and the Canadian Investment Review.