As institutional investors’ results expectations continue to expand at a rampant speed, Errico Cocchi doesn’t want to get lost in overcomplicated investment trends.

“At the end of the day you want to buy something that’s going to grow, that’s well managed and that has a good valuation,” says Cocchi, head of pension investments and debt financing at the City of Montreal. “I mean, it’s simple.”

Getting to know

Errico Cocchi

Job title:

Head, pension investments and debt financing, the City of Montreal

Joined the City of Montreal:

2005

Previous role:

Investment manager,

the City of Montreal

What keeps him up at night:

A polarization effect that’s lacking in patience and respect

Outside of the office he can be found:

Planning his next alpine ski trip or biking to the nearest outdoor

environment available

In 2023, equities offered the investment organization some strong returns with Canadian stocks earning 11.6 per cent and global equities earning 14.4 per cent. In particular, the U.S. equity market posted strong results — a 22.9 per cent return as of Dec. 31, 2023 — for the fund due to the performance of a collection of technology stocks. The pack, however, known as the ‘Magnificent 7’ — Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp., Nvidia Corp. and Tesla Inc. — also represent an emerging risk.

Read: Canadian private equity market raises $4 billion in Q1 2024: report

“The size of the U.S. market with respect to the rest of the world, . . . that concentration, I think, that’s the big issue now for the past few years,” he says. “If you still believe in diversification, the risk has increased a lot.”

Cocchi is trying to ensure the portfolio has the right balance between public and private equities since public markets are currently seeing a decline in the holding period of stocks, which is leading to increased volatility. “Everybody’s going to private [equity] like it’s the best thing since sliced bread.”

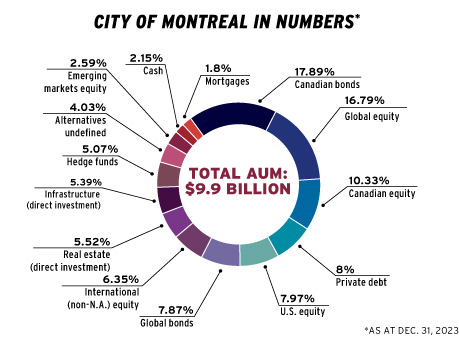

In addition to managing the investments of the pension fund, which serves about 28,000 employees, Cocchi’s team is tasked with issuing debt in the markets for the City of Montreal, then managing the surplus cash, investing it and overseeing it through a fund it calls a “sinking” fund.

Read: Using alternatives to strive for stability at the City of Montreal pension plans

“Let’s say we get to year 10 and issue a 10-year bond for $100 million. Starting next year, we’re going to put $10 million aside every year so that when we get to year 10, we have $100 million to get back, but that fund is invested as well. So we invest that fund, we invest the surplus cash from the City and we issue the bonds.”

ESG as risk management

While environmental, social and governance metrics are now prominent investment guidelines, their adoption has also led to increased skepticism about their benefits and whether they could be a detriment to a pension’s investment returns, says Cocchi.

“Every time we talk to [money] managers, we make sure that, at a minimum, they look at impact and they look at ESG. But in a way, for me, it’s part of the risk management process.”

Cocchi is cautious about how to approach ESG because he considers it a part of any investment’s risk management process. And he isn’t against using the metrics to evaluate investment decisions, but he’s realistic about how much more his team can oversee. “It’s something we’re trying to do more and more. But, at the end of the day, I have such a small team that it’s difficult to do all of these things because we don’t have enough resources.”

He sees it as a prioritization effect that could impact the overall mission of a pension fund, he adds, noting the pressures of increased inflation cycles following the coronavirus pandemic have put a strain on the spending power of retirees. “I’m pretty sure [retirees] don’t care that much that we save the planet because I don’t think they’re basking in money. If you can [deliver their pension needs] and then be sustainable [and] be impactful [then] everybody’s going to feel better.”

Having a reduced amount of resources means Cocchi needs to maintain a constant diet of new investment research to try to stay ahead of every possible risk and downturn.

“Our business evolves all the time. It’s routine, in a sense, but there’s always something new or something exciting.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.