The selection of a target-date fund glide path is more crucial than ever as the migration from DB to DC pension plans continues.

Since its formation in the mid-1990s as an optional alternative to the company’s longstanding defined benefit offerings, the DC plan has amassed more than $1.5 billion in total assets as members gradually migrated over following the closure of the DB plans to various categories of Telus employees.

But by 2018, two decades had passed since the DC plan’s last major review — an eternity in Canada’s fast-evolving pension space — so Tam and her team were tasked with streamlining the 18 investment options available to members at the time.

Read: Revisiting TDFs in the aftermath of market chaos

Following a rigorous survey of the marketplace, they selected a TDF as the default fund, swayed by research suggesting that less engaged or financially literate members fare better in them over time. In addition, a suite of six more investment funds was made available to plan members.

“The TDF caters to the bulk of our DC members very well,” says Tam. “It’s a very complex product, but one that is packaged in a way that is very easy for people to understand. . . . For the knowledgeable ones and those who do want to spend some time making their own decisions, that’s where our à la carte options come in.”

Setting the stage

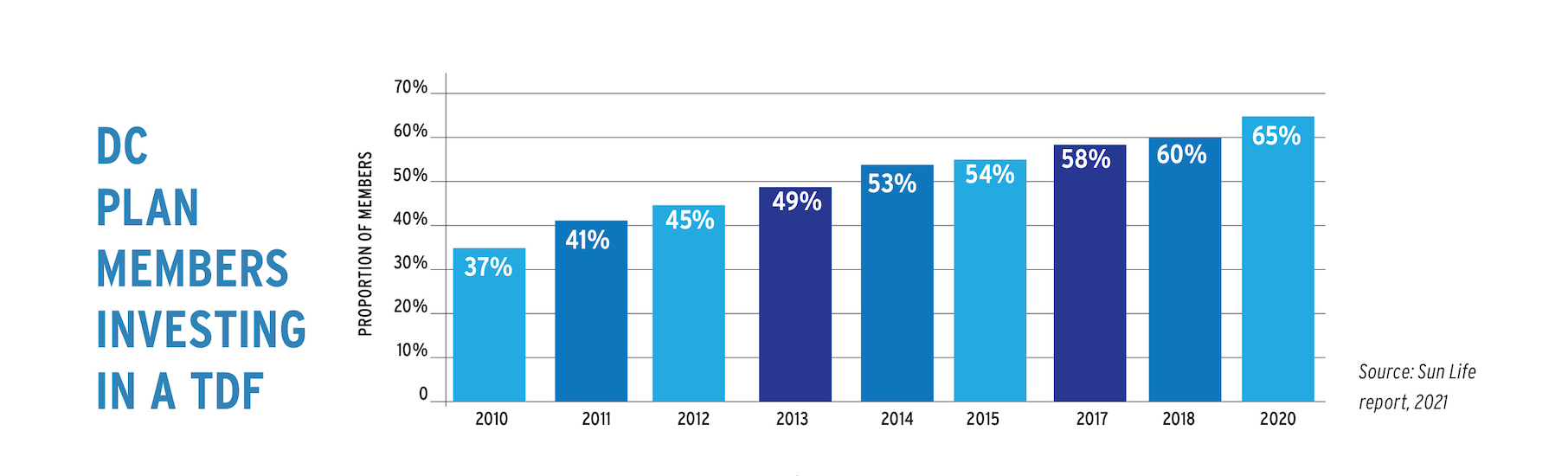

Telus isn’t alone in its thinking, says Anne Meloche, head of institutional business at Sun Life Global Investments Canada Inc. The majority (84 per cent) of the capital accumulation plans administered by the company now use a TDF as their default options.

Meanwhile, Sun Life’s own estimates put the advantage of TDF-only investors over non-TDF investors at one per cent per year in average outperformance, net of fees. “You can imagine how that stacks up over five, 10 or 30 years,” she says.

Read: Coronavirus prompting CAP sponsors to review TDF suites

Although their origins can be traced back to the 1990s, Meloche says the stage was really set for TDFs to thrive when the U.S. Congress passed its landmark Pension Protection Act in 2006, forcing plan sponsors to re-evaluate their approach to adequate funding for their employees’ retirement accounts.

But the model only took off a couple of years later, she says, when the 2008/09 financial crisis crystalized the dangers of over-reliance on the low-risk, low-return money market funds traditionally favoured as default options in DC plans. Employers searching for alternatives largely landed on TDFs, whose automatically adjusted asset allocations help mitigate the natural risk-aversion of the average plan member by winding down exposure to equities from a high baseline as they approach their retirement date.

“From a fiduciary standpoint, it also made sense for Canadian sponsors and they have embraced and moved to TDFs over the years,” says Meloche.

At the same time, Canadian employers’ longer-term flight from DB has continued unabated, particularly in the private sector, where Statistics Canada data shows that the proportion of workers with registered DB pensions fell from 57 per cent in 2008 to just 41 per cent in 2018.

Read: CAAT to introduce new DB plan

Despite several rounds of solvency reform designed to ease the burden on plans sponsors and innovations like the Colleges of Applied Arts and Technology pension plan’s DBplus, few analysts predict these developments will arrest DB’s decline any time soon, let alone reverse it.

Indeed, according to the most recently available figures, another 19,000 people dropped off the rolls of DB-covered plan members in Canada’s private sector in 2019, while the ranks of DC members swelled by around 25,000 in the same year.

Mixed profiles

At the confluence of these two trends, a growing number of plan sponsors are selecting default TDFs for use by members with mixed benefit profiles.

Depending on whether a legacy DB plan was closed to new entrants or frozen, the same TDF may have to cater to senior employees with significant DB accruals, mid-career workers with more modest DB accounts and newer staff with only DC assets.

Lorie Latham, senior DC strategist in T. Rowe Price’s Americas division, says the pension sector north and south of the border is still coming to terms with the effect that differing levels of DB coverage can have on optimal TDF glide paths, which control the rate at which strategic asset allocation changes are made over a plan member’s working lifetime. If plan sponsors know it’s something they should be considering, they’re not always sure exactly how.

“There has been some over-simplification in the past, but we’re getting smarter about it as an industry, trying to improve the process for plan sponsors,” she says.

By the numbers

1% — Average net-of-fee outperformance by TDF-only investors over those not invested in a TDF

29% — Proportion of all Sun Life CAP assets in TDFs in 2018, up from 7% in 2010

41% — Proportion of private sector workers with a DB pension plan in 2018, down from 57% in 2008

29% — Proportion of all Sun Life CAP assets in TDFs in 2018, up from 7% in 2010

US$430 billion — Value of the U.S. customized TDF market at the end of 2017

$1.5 billion — Approximate total assets in Telus’ DC plan

Sources: Sun Life, Statistics Canada, Defined Contribution Institutional Investment Association, Telus Communications

For example, where DC plan members also receive a defined benefit, T. Rowe Price’s research team found the reflexive reaction for many would be to boost equity exposure all along the glide path, based on the assumption that the DB assets should be treated as an extra fixed income allocation.

However, the company’s glide-path design theory leads to the possibly counterintuitive conclusion that equity allocation should drop where DB coverage is also available, because the base-level income it provides reduces members’ need to absorb market volatility.

T. Rowe Price’s outcome-oriented model reduces the focus on pure risk-adjusted returns, instead seeking a TDF glide path that will maximize investors’ satisfaction by incorporating economic utility measures of wealth, consumption and behavioural preferences.

Read: Sounding Board: Tips for evaluating a target-date fund

“One of the things that’s helpful is that it is more advanced in its thinking about how we define risk, as deeper than just market risk,” says Latham. “We’re starting to apply deeper scrutiny in the way in which we think about the benefit package as a whole.”

Still, T. Rowe Price’s modelling indicates that the link between members’ possible DB coverage and glide-path shape isn’t a direct one, with higher levels of DB eligibility having a disproportionate effect on optimal shifts in asset allocation.

Looking under the hood

Whatever the specifics of a plan sponsor’s current or future mixed pension structure, Justin Harvey, a solutions strategist with T. Rowe Price’s multi-asset department, suggests they take a fresh look at their TDF glide path to make sure it’s working as well as it can for members.

“We’re finding that there’s no one-size-fits-all solution for how a DB plan should impact the TDF glide path,” he says.

George Turpie, senior vice-president of group retirement savings and investments at Canada Life Assurance Co., says plan sponsors shouldn’t be afraid to look under the hood of the TDF products their providers are offering.

“The glide path is the core element of TDF plans. . . . There is so much riding on it. When you’re evaluating a TDF, you want to know that there is significant rigour in the methodology, not only behind the design, but also in the commitment to maintain the glide path in future and how it will evolve as things change. Whoever is building it needs to be up to date on the market and behavioural assumptions that are relevant, as well as the plan member base, because the better the assumptions that go in, the better the glide path design will be.”

Read: Employees must accumulate 10.9 times final pay to maintain income in retirement: report

Although the existence of a DB plan is one of the most important factors for plan sponsors when it comes to setting an appropriate glide path, it’s not the only one, says Zaheed Jiwani, a principal at Eckler Ltd.

Retirement adequacy analyses are becoming more routine among larger and more paternalistic plan sponsors that have realized that demographic data — including average salary levels, savings habits and government benefit entitlement — can help them tailor glide-path design to their specific membership profile, he says. “Retirement adequacy assessments not only help you decide how to tweak the glide path, but also inform plan sponsors in other aspects, such as what areas you need to focus communications on. You can almost look at it like an asset-liability analysis for DC programs, but instead of plan sponsor liabilities, you’re looking at how well the underlying plan members’ needs are being met.”

In some cases, employers may have such distinct groups of employees that they can justify the creation of separate TDFs to suit each one. For example, Tommy Perron, a financial risk consultant at Aon, once worked with a large U.S. employer that put together one TDF for its office employees and another for its sizeable cadre of pilots. “Because of the size and sophistication of the plan, they were able to design two sets of custom TDFs.”

As a result of the pilots’ significantly lower life expectancy, their glide path started from a lower base level of return-seeking assets than the general population and remained lower as they hit the typical retirement age of 65.

However, such an approach would mean a culture shift for the bulk of Canadian plan sponsors, which typically favour off-the-shelf TDF products with fixed glide paths. “The U.S. is typically a good 10 years ahead of us because their DC industry is very mature compared to Canada’s,” says Meloche.

Read: Target-date funds a game changer for plan member outcomes: research

Since the U.S. began its shift away from DB earlier, total DC assets have long outweighed those in DB plans. According to Willis Towers Watson’s 2020 global pension assets study, U.S. DC plans are worth almost twice as much as their DB counterparts. Meanwhile, Canada edged closer to parity, with 61 per cent of plan assets in DB, compared with 39 per cent in DC plans.

To the extent that customization occurs in Canada, Meloche says it’s largely in a TDF’s building-block assets. Rather than glide-path considerations, it tends to be driven by plan sponsors seeking to leverage existing relationships with DB asset managers.

Individual needs, preferences

DC plan members with DB assets always have the option of rolling forwards or backwards on their TDF glide path by selecting a vintage that doesn’t match their actual age, performing their own customization depending on their individual retirement needs and investment preferences, says Jiwani.

Key takeaways

• Canada’s continuing flight from DB to DC combined with the popularity of TDFs as the default option is forcing more plan sponsors to consider legacy DB plans in the selection of appropriate glide paths.

• An accurate picture of the demographics and habits of plan membership is critical when setting a default TDF glide path and plan sponsors are increasingly undergoing retirement adequacy assessments to make sure their selection fits their member profile.

• Glide-path customization allows plan sponsors to tailor asset allocation shifts to the mixed benefit profiles of members, but is less common in Canada than in the more mature U.S. DC market.

Plan sponsors can prompt this sort of individual adjustment by signing up for risk-adjusted TDFs, which typically offer slightly more conservative and aggressive glide paths in addition to the main product. Instead of being asked just for their age on enrolment, plan members are asked for their level of comfort with risk and are then slotted into the appropriate glide path based on their answer. “We view this as better than offering

one set of funds for moderate risk,” says Meloche.

However, even small interventions can be a tough sell to plan sponsors whose attraction to TDFs as defaults is built on simplicity and members’ ability to set and forget. That’s especially true if their workforce population is moving over from a DB plan, where everything was effectively taken care of for them, says Naren Daniels, a DC consulting principal in LifeWorks Inc.’s retirement and financial division.

Read: Language, communication shaping DC plan members’ retirement decisions: survey

“It adds a layer of complexity in educating plan members. The membership as a whole really needs to improve their financial literacy and it gets tough when they’re choosing between multiple options. The minute you go from DB to DC, you have to start making decisions. But being equipped to make them is a different story altogether.”

Michael McKiernan is a freelance writer.