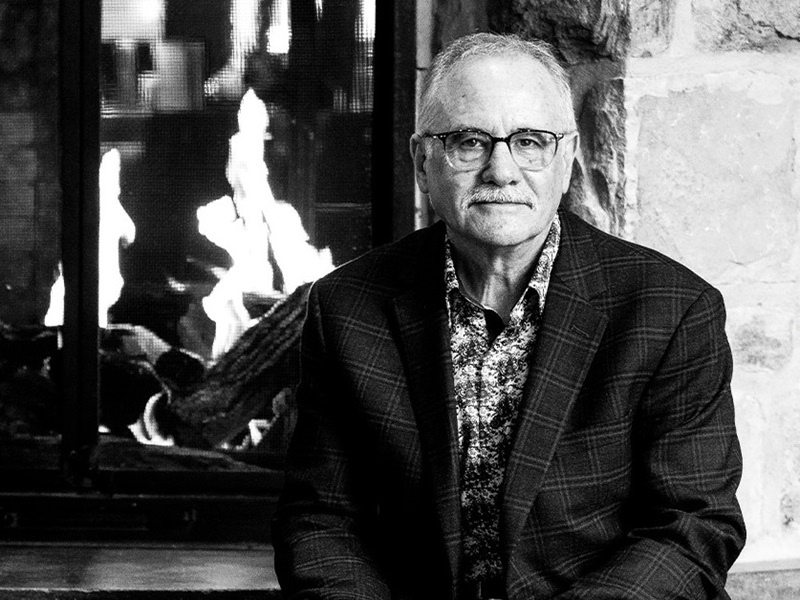

While Blair Richards understands why the industry is moving away from defined benefit pension plans, he worries about what may be lost in the process.

When Richards — the chief investment officer at the Halifax Port ILA/HEA pension plan — joined the institutional investor 40 years ago, DB plans were an attractive hiring and retention tool for private sector employers. Now, he says the risk associated with these plans has led to a widespread exit strategy.

Read: Offering DB benefits for DC members at Halifax Port ILA/HEA pension plan

Getting to know

Blair Richards

Job title:

Chief investment officer, the Halifax Port ILA/HEA pension plan

Joined the Halifax Port ILA/HEA pension plan:

1984

Previous role:

Chief executive officer, the Halifax Port ILA/HEA pension plan

What keeps him up at night:

The impact that short-term concerns can have on the long-term performance of a pension plan

Outside of the office he can be found:

Making the most of trips around the world and staying in touch with family

The organization opted to keep its DB plan, which has been closed since 1984. “I have unfortunately lived through what I guess was the high point of DB plans and what will eventually be a complete loss. . . . I had hoped . . . [they’d] come back around. [They have] slightly, but [not] like . . . before.”

The Halifax Port ILA/HEA continues to manage the DB plan’s investments, but without further financial support from its employers, the investment team knew it had to take a conservative approach.

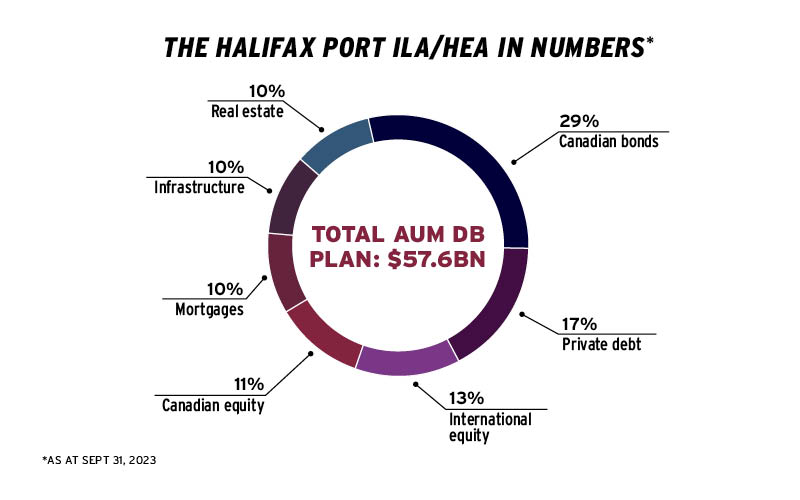

Due to its size, the breakeven point is low compared to most, which motivated the team to focus on alternative investments early on, says Richards, noting the plan has also reduced its allocations to fixed income over time.

“Now as the rates have come back up, the reason we got away from that high weighting is that if your breakeven is five per cent and your expected return around a 10-year bond is two per cent, you can’t sit on that position. You’re forced away from that very bond that has served you so well for decades.”

The development of advanced life deferred annuities and variable payment life annuities has helped the plan provide lifetime payments to members. Indeed, for more than 30 years, the plan has been providing raises to members, says Richards. “Not only did we increase pensions, we . . . increased those pensions by 155 per cent . . . above inflation over the period, so we’re sitting on a very successful plan here.”

While increasing pension benefits is a priority for the Halifax Port ILA/HEA, an internal policy on excess interest has prevented an increase over the last two years, during which the plan’s surplus grew to 134 per cent on a solvency basis as of the end of September 2023.

Read: Blair Richards moves to CIO of Halifax Port ILA/HEA pension plan

He says the plan has shifted away from this policy and increases are expected to begin again this year.

Employees enrolled in the Halifax Port ILA/HEA’s defined contribution plan can also purchase a pension from the DB plan. “At the point of retirement, they can take part of their balance, put it in the DB [plan] and create a floor between that and their government benefits — they can roll a portion into a registered retirement income fund or a life income fund to have the flexibility that a lot of people want.”

He credits much of the success of the DB plan with a long-term strategy, rigorous discipline and always asking questions from the perspective of members. “What we did was take that notion of fiduciary to heart. We wanted the best for the retirees in particular, but [for] pension members in general and we’ve proven that it is possible.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.