While both experts point to the obligation of the pension promise, one argues that many pension funds are already overweight in Canadian allocations, while the other cites these funds’ risk-return calibrations, highlighting the strategic assets available abroad.

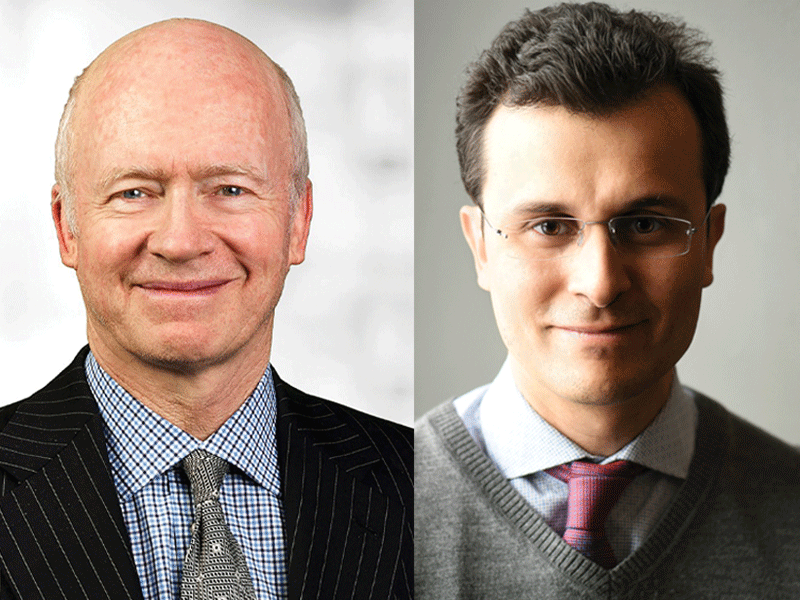

Jeremy Forgie, pension lawyer and senior counsel at Blake, Cassels & Graydon LLP

Whether our governments should try to dictate to Canada’s registered pension funds — through mandates or targeted incentives — how much, in what form and in which sectors to make investments in Canada must take into account the fact that a substantial portion of these assets are represented by employer and, in many cases, employee contributions.

These contributions have been paid into pension funds on the understanding that the paramount obligation of the fund is to deliver on the pension promise. If investment returns are diminished over time as a consequence of an excessive allocation to Canada or in particular sectors, it becomes more difficult to deliver on that promise.

Read: Where do Canadian institutional investors stand on calls for increased domestic investments?

Many Canadian pension funds are arguably already overweight in their domestic allocations. Even a quick review of published annual and other reports by a number of the large pension funds readily demonstrates substantial investment not only in Canadian publicly traded securities and government debt, but also in residential, commercial and industrial real estate across Canada, which impacts literally all Canadians.

Pension funds are already substantial investors in Canadian energy, transportation, logistics and other infrastructure — and these are just some examples. It’s also important to consider the critical economic contribution of pensions paid to thousands of Canadians from our registered pension plan system on communities across Canada and particularly rural communities.

The more important and pressing priority is taking concrete actions to boost productivity and deal with the decline in business investment in Canada, including measures recommended by many commentators such as, for example, corporate tax reform (including to be able to respond to potential changes in U.S. corporate taxation coming out of the recent presidential election) and reducing and streamlining regulatory barriers.

Sebastien Betermier, associate professor of finance at the Desautels Faculty of Management at McGill University and co-author of a Global Risk Institute report on the subject

Canadian pension funds have a mandate to deliver steady pension payments to the millions of Canadians they serve.

To deliver on this mandate in a cost-efficient way, the funds need to carefully balance the complex risk-return trade-offs of their investments. They do so by maintaining a globally diversified portfolio and by tilting their portfolio towards assets that demonstrate distinct strategic benefits. Several domestic assets have certain appreciable advantages that the pension funds are interested in, such as a home-court informational advantage and lower exposure to currency, inflation and interest rate risks.

Read: Read: Mandating Canadian pension funds’ domestic investments could harm plan members: study

These advantages explain why Canadian pension funds have a conspicuous home bias, particularly in bond-like asset classes such as fixed income and real estate. However, there’s a lack of strategic assets available for sale in Canada, such as inflationlinked bonds and infrastructure assets, which deters Canadian pension funds from investing more domestically. Consequently, when other countries such as Australia, India, the U.K. and the U.S. make these strategic assets available on the market, the Canadian pension funds bid for them abroad.

So in response to the question above, we should avoid policies that penalize Canadian pension funds for investing abroad. Such policies will upset the funds’ risk-return calibrations and expose pension plan members to potential financial losses. Instead, we should consider facilitating access to strategic assets such as infrastructure assets — for example, airports, seaports, railroads, roadways, transmission grids, utility companies and digital networks.

Doing so will create win-win outcomes for the Canadian economy and for Canadian pension funds and their millions of members. Moreover, doing so will not only retain and attract capital from Canadian pension funds, but also bring in additional capital from the much larger pool of foreign investors.

The views expressed are those of the authors and don’t necessarily reflect the views of their organizations, colleagues and/or clients.