As Canadians face continued economic uncertainty, a recent university graduate and a long-time teacher share their views on balancing different financial priorities.

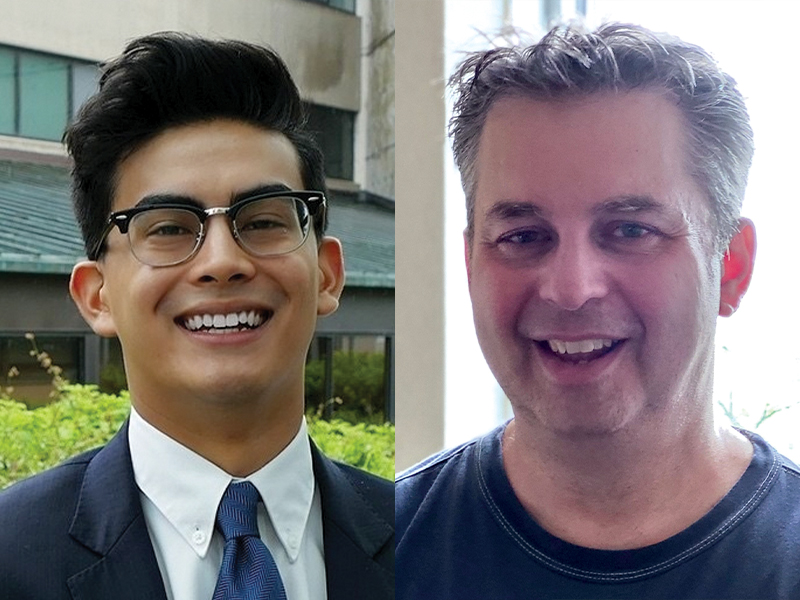

Sul Mahmood, age 24, a product specialist at OpenPhone Technologies Inc.

Canadians should be saving for a combination of retirement and other financial priorities.

If there’s anything I know (and from all the stuff I’ve read and just talking to my parents), retirement planning or investing, in general, is something that’s better done earlier than later, even if you have rent payments or student debt.

When you’re young, even with other financial priorities, it’s important to put five to 10 per cent of your income away. Through my workplace registered retirement savings plan, I’m being very aggressive and trying to save as much money and invest as much money as possible to gain the benefits of compound interest.

Read: Young Canadians focusing on retirement, financial security amid coronavirus crisis: survey

When it comes to my student debt, it was interest-free for the first 12 months. Obviously, you want to be paying down some of it, but at the same time, if you think about it from a financial standpoint, it’s advantageous to invest when your interest is zero so you can pay that debt down more slowly.

I graduated from Wilfrid Laurier University last year and I know a lot of people who’ve moved out of their parents’ homes and to Toronto because they have to go to the office four or five days a week. With my situation, there’s a big difference. I’m lucky to be working fully remotely, living with my parents and not paying rent. That’s a huge benefit compared to having to pay rent on a condo in the city and dedicate a huge chunk of my income to that.

Other than my debt and retirement savings plan, I’m putting money towards an emergency fund to help in case I get laid off. For example, I’ve heard six months of expenses is a good goal for that and I’m slowly saving money towards it. I also plan to create a travel savings account, since I’m planning to travel and work at the same time at some point next year.

Mike Goldberg, age 54, a teacher at Martingrove Collegiate Institute in Etobicoke, Ont.

From my perspective, it’s very easy to say, ‘Well, you should always be saving for retirement.’

I have a defined benefit pension plan through my employer, so I have an automatic savings plan in place. But I also save a bit on top of that.

I have the original The Wealthy Barber sitting in front of me. The book’s advice is to put 10 per cent towards your long-term savings and 10 per cent towards short-term goals. I share this with my students. The idea is that you can be self-sufficient when you retire. Again, this is easy for me to say because around 12 per cent of my annual income is tucked away in my DB pension, so I’ve got something waiting for me once I retire if all goes well.

Read: Sounding Board: Modern defined benefit plans combine the best of DB and DC pensions

But for someone who’s starting out, it isn’t as easy to do. I remember when I finished university and started my first full-time job, it was really hard to save money. For me, it’s a no-brainer because it comes off my income. It can still be a struggle, but I always have that long-term view.

Even as we’re facing inflation and rising interest rates and the future looks a bit disastrous, my attitude has always been that this too shall pass. If you look long term at the S&P/TSX composite index, for example, eventually you see a growth, even with horrible financial situations. If you look over the last 100 years, there’s generally an eight per cent increase or somewhere around that.

Again, for someone like me, my mortgage is almost paid off and I’m locked into a really good rate, so this is easy for me to say since I’m not looking at 20 years of mortgage payments ahead of me. But my attitude is stay the course and things will eventually work out if everything happens as it has in the past — which I think it will, even if it looks pretty bad right now.

Read: 71% of Canadians finding it challenging to save for retirement amid rising inflation: survey