The Investment Management Corp. of Ontario is looking at private assets as an opportunity to support investment returns across various Ontario-based pension plans.

“We believe in private assets,” says Rossitsa Stoyanova, the IMCO’s chief investment officer. “They allow us to use some of our advantages like having a long-term horizon, our [in-house] expertise and taking a view on different trends and picking opportunities to invest in those trends.”

Getting to know

Rossitsa Stoyanova

Job title:

Chief investment officer, the IMCO

Joined IMCO:

2021

Previous role:

Managing director and head of portfolio design, the Canada Pension Plan Investment Board

What keeps her up at night:

The increasingly volatile nature of inflation and interest rates

Outside of the office she can be found:

Exploring new cities through their food offerings and walking options

Read: IMCO returns 5.6% for 2023, driven by public equities

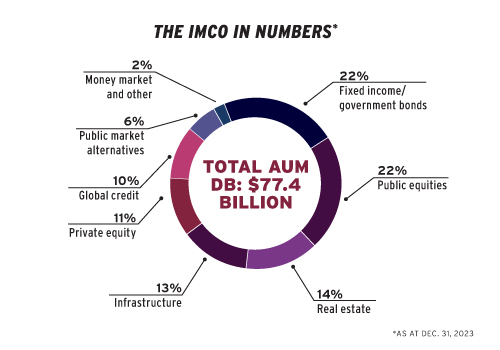

In 2023, the IMCO added two private asset pools to its portfolio, one for global credit and another for private equity, which, as of Dec. 31, 2023, totalled $7 billion and $7.8 billion, respectively. Across the overall portfolio, private equity accounts for 11 per cent of its total assets under management with an allocation of $8.2 billion.

The strategy capitalizes on opportunities that may not easily fit into traditional asset classes, says Stoyanova. Last year, the investment organization’s infrastructure team and fundamental equities division joined forces to close a deal with Swedish battery developer and manufacturer Northvolt.

“Sometimes the mandates of asset classes can overlap. [Rather than] being so distinct that you’re missing opportunities, I think [our approach] allows for a balance.”

Read: U.S.-China business relationship, private credit shaping investments in 2024: IMCO

The IMCO is pursuing private asset investments exclusively through collaboration deals with general partners, she says, adding these arrangements require increased speed and nimbleness on the part of institutional investors. To meet this challenge, the IMCO is prioritizing a streamlined due-diligence process to assess the viability of a deal presented by a GP. The IMCO seeks partnerships with investors that share a similar vision on a variety of investment trends, she says, noting investments in private assets can also allow institutional investors to influence concepts like sustainability.

“We pick partners who think the same way because that means the relationship will outlast the fads.”

The IMCO has committed to invest $5 billion in energy transition investments by 2027. While this commitment has primarily focused on infrastructure investments, the organization is expanding this approach to other parts of its portfolio.

As plan sponsors continue to post negative returns in real estate — the IMCO saw a negative 13 per cent return from the asset class in 2023 — Stoyanova says it’s important to remember the role of leverage and just how critical diversification can be when weathering economic storms.

Read: IMCO committing 20% of its portfolio to climate solutions by 2030

“Diversification is important — [particularly] diversification beyond retail and office into logistics, life sciences, multi-residential properties [and] data centres.”

While increasing volatility is pushing demand for faster investment results, Stoyanova believes organizations with a long-term horizon need to stay the course, adding she’s worried about diminishing patience among institutional investors.

“I just worry about people being impatient and saying, ‘It’s not working, let’s change course.’ I think it requires time to see whether it’s working, whether you’re on the right path.”

As one of the few women CIOs working at a large Canadian pension fund, she wants to see more investment organizations consider the voices of women inside their organizational structures when updating internal policy. Instead of relying on one-size-fits-all policies built on assumptions like parental concession requirements, she argues for more inclusive dialogue to truly help uplift women working in the institutional investment sector.

“I think we should stop assuming and just ask people what works for them and really listen and be flexible. I think that will help.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.