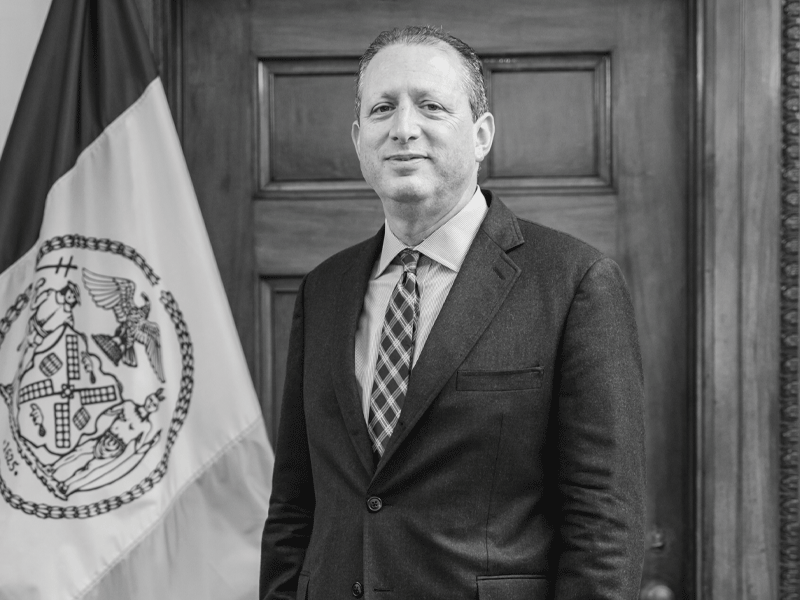

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners.

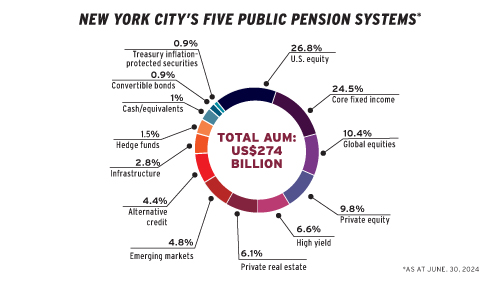

As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy for a combined US$274 billion in assets under management.

Lander gained public notoriety for his commitment to pushing shareholder resolutions against organizations like Citigroup Inc., JPMorgan Chase & Co. and the Royal Bank of Canada. These motions ask the financial institutions to get on board with strict disclosure measurements and reveal how their clean energy funding stacks up to fossil fuel allocations. He also links fiduciary duty to responsible investment mandates to ensure environmental impact is a key consideration for NYC’s public pension funds.

Read: New York City pension funds reach deal with RBC over clean energy funding disclosure

Getting to know

Brad Lander

Job title:

New York City comptroller

Joined the organization:

2010

Previous role:

Council member, New York City

What keeps him up at night:

The ongoing effects of the climate crisis and how it impacts large-scale institutional investors

Outside of the office he can be found:

Getting some exercise by punching bags and pads at a kickboxing gym

“When we do shareholder resolutions, first we put a lot of rigorous research upfront to make sure that what we’re pushing is appropriate. We’re investors — our job is to make sure that we’re getting good returns.”

All three financial institutions signed up with calls to action, but Lander notes other financial organizations haven’t engaged in good faith arguments. “There’s still some work to make sure everyone’s [disclosing] in a way which is clearly apples to apples, as other banks come on board they can join in the system.”

The lack of progress to meet climate change commitments is frustrating, he says, which is why disclosure rules need to evolve. Following a review of its portfolio, Lander’s office found that, despite about 90 per cent of its utility companies signing up for climate pledges, only 11 per cent had submitted transition plans for evaluation under science-based targets. The discovery, he says, revealed a microcosm of environmental impact disclosures giving way to climate hypocrisy.

Read: New York City pension funds divesting $4BN from fossil fuels

At the same time, green investment decisions have been under fire in the U.S. as politicians challenge environmental, social and governance targets, pushing asset managers to reconsider the connection between climate and financial risks, he adds. But despite the political posturing, he recognizes that asset owners in Canada and Europe continue to show the world how to integrate sustainability into their investment strategies.

Lander’s aggressive pursuit to curve exposure to fossil fuels in NYC’s public pension funds expanded in October when he supported a policy to cease future investments by three of the plans in midstream and downstream fossil fuel infrastructure like pipelines and distribution terminals. These three pension funds had all previously divested from fossil fuel reserve owners in their public equity portfolios and agreed to exclude upstream fossil fuel investments in private markets. If approved, the plan administrators would present specific policy language for trustees to review and an assessment of implications and impacts in early 2025.

The five NYC pension funds returned 10 per cent overall net of fees during the fiscal year ending on June 30, 2024, beating a benchmark of seven per cent; on a 10-year basis, the plans saw a seven per cent return. The funded ratio for the combined funds was 83 per cent, exceeding the average (78 per cent) for U.S. public pension plans. Investments in energy and climate solutions have grown to about $11 billion across the systems.

“If you’re like us — a universal investor with a long-term time horizon — saying climate risk is financial risk is like saying gravity causes objects to fall,” says Lander. “But it requires real work. . . . [Other institutional investors] used the cover of the backlash to simply walk back from doing any meaningful work at all.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.