How employers can manage employee productivity in a remote working environment

The coronavirus pandemic ushered in a new world of work when organizations in most sectors were forced to find ways to operate virtually. Three years…

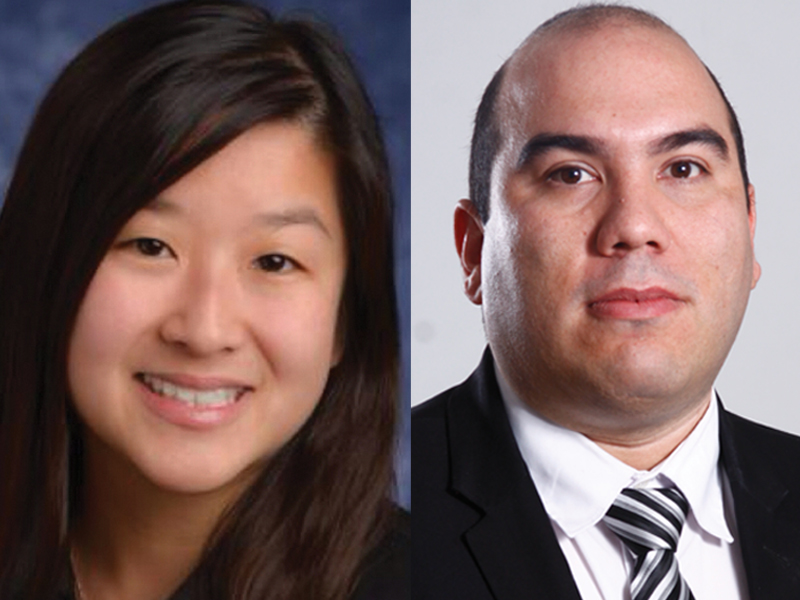

- By: Moira Potter

- April 14, 2023 April 12, 2023

- 08:53