Natasha Trainor has overseen the pension strategy at NAV Canada for nearly half a decade and she’s made her imprint by adding a novel review process.

“We went through an exercise over the past few years of looking at each asset class and coming up with what we called asset class designs,” says the organization’s assistant vice-president of pension investments.

The review process allowed Trainor and her team to examine the goals of each asset class allocation and how they all fit together in the portfolio. “It’s my job to make sure . . . everything fits together nicely from a risk-reward perspective.”

Getting to know

Natasha Trainor

Job title:

Assistant vice-president, pension investments, NAV Canada

Joined the organization:

2020

Previous role:

Director, pension investments, NAV Canada

What keeps her up at night:

Ensuring her team is engaged and feels challenged in their day-to-day tasks while making sure they have a successful work environment

Outside of the office she can be found:

Enjoying the outdoors with a run alongside her two teenage kids on the trails around Ottawa

The exercise can’t be 100 per cent accurate, she says, since the pension plan sponsor now relies on third-party investment management, which Trainor calls an integral part of the decision-making process. She also believes consultants must be viewed as people you’d want to invest in alongside the solutions they offer.

Read: Nav Canada, Goodyear share experiences with LDI in low interest rate world

“I really like to think of them as an extension of our team or our partners because they are able to share their insights with us.”

The review process has also introduced an additional layer of accountability within NAV Canada’s investment team and its goals. In the review, Trainor pushed for the inclusion of what each asset class stood for, as well as their geographic and sectoral allocations.

“Now we can go back and look at that — we refresh this every few years now — and say, ‘OK, does adding this new mandate fit in with what we’re trying to accomplish with the asset class?’ And the rest of the team can hold the person in charge of that asset class accountable to it.”

As a result of the process and a review of the pension plan’s private equity strategy, Trainor and her team learned it was too heavily weighted in growth equity. “There are lots of other areas in private equity that we could be in, including buyouts and secondary exposure,” she adds. “We realized we were quite imbalanced when we looked at it through this lens.”

Read: Expert panel: Institutional investors should re-evaluate fees in ‘turbulent twenties’

The review process has also helped the organization define asset allocation strategies and compare that with larger investment trends, says Trainor. For example, NAV Canada reviewed its real assets roadmap and elected to drop office exposure in the U.S. in favour of more infrastructure investments.

The organization’s rigorous liquidity risk model offers up-to-date information since the pension fund is in a net cash outflow position, she adds, and needs to have capital to pay its pensioners every month.

“We’ve structured our asset mix in such a way that we can live without the capital from these private markets. We have enough that we can access from our public equity and our public fixed income.”

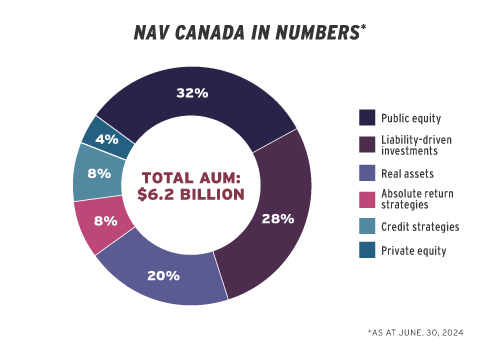

At the end of its fiscal year on Aug. 31, 2024, NAV Canada’s pension plan held approximately $6.2 billion in assets under management with its largest allocation (32 per cent) to public equities. It also has a 28 per cent liability-driven investment allocation, which is a leveraged portfolio of long-dated Canadian inflation-linked and nominal bonds.

According to its latest annual financial report, the plan is in a surplus position on a going-concern basis with a solvency deficit that remains below the threshold requiring the organization to make special cash payments to the plan.

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.