Amid an increasingly volatile global economy, many institutional investors are employing innovative investment strategies to deliver returns, but Suncor Energy Inc. views a methodical adoption of new trends as key to plan stability.

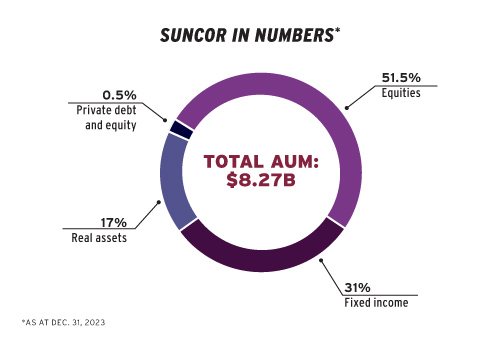

A conservative approach and a balanced portfolio has allowed Suncor to deliver sustainable contributions and growth to its pension plans. At the same time, the investment team has been considering emerging trends for institutional investors and Suncor is in the early stages of exploring private asset investments.

Read: Research finds pensions struggle to determine metrics for ESG goals

Getting to know

Nora Lamb

Job title:

Director of pensions and savings, Suncor Energy Inc.

Joined Suncor:

2008

Previous role:

Manager, total rewards and pensions, Suncor

What keeps her up at night:

The passing of the torch taking place in the Canadian pension industry, as seasoned veterans head off to retirement and a new crop of leaders attempt to keep delivering a long-term sustainable pension environment

Outside of the office she can be found:

Planning her next trip or exploring the outdoors with her husband on a bike or a hike

“There’s some growing interest in the private equity space . . . and we’re starting to explore [it] quite holistically,” says Nora Lamb, the organization’s director of pensions and savings. “But we’re trying to be very thoughtful as we move in and transition. . . . We’re not there yet, we are moving slowly.”

By regularly monitoring the sustainability of Suncor’s pension plans, the investment team pursues new trends at an appropriate time. Its adoption of environmental, social and governance metrics exemplifies this approach, she says.

“Any trend is three to five years in the making to see if it’s sustainable and how you bring it in. We’re generally not the leaders in bringing in new [trends] — we will wait to see how it’s moving.”

While investment organizations are increasingly considering diversity, equity and inclusion factors as part of their due diligence process when reviewing investments and fund holders, she believes there’s still a long way to go before DEI is as widely adopted as ESG metrics, noting institutional investors with diverse and inclusive cultures can create change and growth leading to stronger business outcomes.

Read: 2024 Global Investment Conference: A look at evolving retirement trends

“Similar [to] how we’ve seen ESG factors assessments become more comprehensive, DEI will likely trend the same way, as these issues are likely to improve shareholder value over the longer term and failure to identify and mitigate DEI issues may impede long-term performance.”

Since January 1991, Suncor’s two main pension plans have incorporated a hybrid defined contribution/defined benefit model. New employees start in the DC plan and can move into the DB plan once their age plus years of service (including mandatory year of service) reaches 50. Partnerships are crucial for the maintenance of Suncor’s pension plans and it’s particularly important to align with investment partners that can understand the intricacies of the hybrid model, says Lamb.

“With that combination, when you think about the DB swings with the low interest environments [in which] our plans have done very well, there’s strong employer support for them because of that dual responsibility. . . . We have a have a strong belief in that shared accountability with our employees and being there [to] support and continue [offering] long term-financial and retirement well-being for our members.”

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.