In the years following the 2008/09 financial crisis, Dan Langlois realized the allocation strategy for the Calgary Foundation’s endowment portfolio needed a significant adjustment if it planned to meet its annual funding goals.

“I knew we needed to do something in terms of increasing the return in the portfolio to preserve the corpus or the capital,” says Langlois, the organization’s vice-president and chief investment officer, noting the asset mix was overly conservative with only a few real return assets.

Getting to know

Dan Langlois

Job title:

Vice-president and chief investment officer, Calgary Foundation

Joined the Calgary Foundation:

2012

Previous role:

Senior portfolio manager, Mawer Investment Management

What keeps him up at night:

Ensuring his organization has the adequate process and systems in place to address the growing threat of cybersecurity

Outside of the office he can be found:

Enjoying some of what the outdoors in interior British Columbia has to offer with boating, fishing and hiking

Between 2012 and 2013, he took a closer look at the underperformance of fixed income assets and found bond yields were returning less than one per cent. He determined it wasn’t enough to match the Calgary Foundation’s funding requirements.

Read: 2022 Top 40 Money Managers Report: The risks for DB, DC plan sponsors around alternative investments

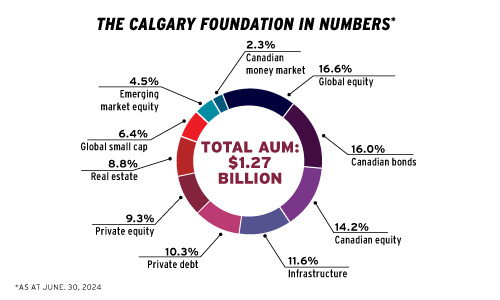

That’s when Langlois turned his attention to alternative assets. He calls alternatives a natural fit for an investor like the Calgary Foundation because its longer time horizon affords it the ability to absorb increased risk from illiquid investments. Currently, the endowment fund holds stakes in private debt, private equity and real assets like infrastructure and real estate.

“What attracts us to that asset class is really returns — the idea that you can capture an illiquidity premium and that those assets you’re buying don’t highly correlate to public market equities.”

Alternatives have played a significant role in improving the risk return characteristics of the portfolio, but Langlois is cautious to crown alternative investments as the ultimate solution for all investment organizations.

“Alternatives aren’t this panacea that’s going to solve all [your] problems. They come with some risks, . . . [such as] higher costs, and you have to have all of the other operational aspects [in place] — due diligence and the right team — to ensure you’re trying to find those first quartile managers.”

Read: A look at the Calgary Foundation’s creative approach to impact investing

Despite the risks associated with alternatives, Langlois suggests his peers in the endowment and foundation space consider deviating from their existing tried-and-true formulas. “I think some of the greatest risks [endowments and foundations] face is having overly conservative asset mixes that do not preserve the corpus of their endowments.”

Moving forward, his team is increasingly interested in the investment of private equity secondaries, which they see gaining momentum and offering strong returns in an environment where private equity funds are facing valuation discrepancy. In addition, secondaries can mitigate the J curve effect, he notes.

Langlois takes pride in adopting a contrarian view and credits this approach for giving the organization a successful runway to where it is now. “We typically try to look for things that are slightly out of favour and allocate capital there.”

Alongside operational costs and taking inflation into consideration, the investment team is responsible for achieving a real return between five and seven per cent to fund the Calgary Foundation’s annual spending on grants and other charitable causes.

As at March 31, 2024, the organization’s endowment portfolio delivered an 8.8 per cent return for the year with infrastructure (nine per cent) and private debt (7.4 per cent) leading the way, while real estate (negative 5.1 per cent) and private equity (negative 3.1 per cent) brought down the overall return of alternatives. The portfolio achieved a 10-year annualized nominal return of 7.9 per cent.

“We have been taking a bit of a pause on real estate, but we have been allocating to infrastructure and, quite significantly, sector specific [information technology] has been particularly of interest to us,” says Langlois.

Bryan McGovern is an associate editor at Benefits Canada and the Canadian Investment Review.