After navigating the unpredictable markets of the past two decades, some defined benefit pension plan sponsors could be forgiven for wanting to seek out some certainty.

But a new threat has emerged in the form of rapidly rising inflation and the possibility of rate increases after decades of persistent lows.

The consumer price index increased 4.8 per cent in December 2021 on a year-over-year basis, reaching an 18-year high and continuing a nine-month hot streak that’s been largely driven by increasing gasoline, housing and food costs. According to Statistics Canada, the CPI’s average annual rise in 2021 was 3.4 per cent, the fastest pace since 1991.

Inflation runs

hot in 2021

The CPI increased 4.8% in December 2021 on a year-over-year basis, up from 4.7% in November and reaching an 18-year high. On an average annual basis, the CPI rose 3.4% in 2021, which was the fastest pace since 1991, according to a Statistics Canada report in mid-January 2022.

The surge has been largely driven by rising food, vehicle and home and mortgage costs. Inflation first exceeded the Bank of Canada’s comfort zone of between 1% and 3% in April 2021 and has continued its hot streak since.

Read: Bank of Canada raises interest rate to 0.5%, warns of volatility

After initially calling rising inflation “transitory,” the Bank of Canada said in December it was “closely watching” inflation expectations and labour costs to ensure against a wage-price cycle taking root. While it held its overnight rate steady in January, at the historic low of 0.25 per cent, it raised the rate to 0.5 per cent in early March.

What could these new developments mean for pension plan sponsors as they seek to de-risk?

Rushing for the exits

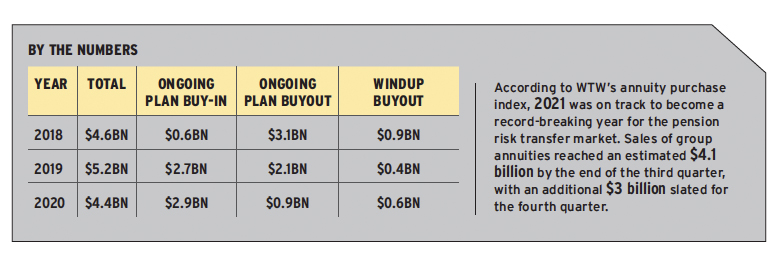

Last year was a blockbuster one for the Canadian pension risk transfer market, with sales of group annuities reaching an estimated $4.1 billion by the end of the third quarter and an additional $3 billion slated for the fourth quarter, according to WTW’s (formerly Willis Towers Watson) annuity purchase index.

Group annuity purchases were already on the rise long before the coronavirus pandemic, as a way for plan sponsors to offload some risk or close their plans entirely. Between 2008 and 2019, the index found, annuity sales shot up from $1.1 billion per year to $5.2 billion. While 2020 saw a brief lull in sales, it recorded the largest ever group annuity transaction: General Motors of Canada Co.’s $1.8-billion annuity buyout for more than 6,000 members of its salaried pension plan who retired prior to June 1, 2020.

Brent Simmons, head of DB solutions at Sun Life Financial Inc., says 2021’s record-breaking deal volume was the result of pension plan sponsors looking for an out after 20 years of market volatility. “The pandemic has been the straw that broke the camel’s back for many plan sponsors. These pension plans have turned out to be much riskier than they thought and so they’re looking for a way to de-risk.”

Read: Pension annuity transactions in Canada totalled $4.45BN in 2020: report

Last year also presented the perfect opportunity for many plan sponsors to buy annuities, as they improved their funded statuses off the back of strong equity market performance and slightly improved longer-term bond yields. According to Mercer Canada’s pension health index, Canadian DB pensions hit their best funded position in 20 years at the end of March 2021 and held steady through the year.

“One of the biggest events of last year from a DB pension plan perspective is the improvement in funded status,” says Marco Dickner, retirement risk management leader for Canada at WTW. “When we think about de-risking, the No. 1 criteria is ability — do I have enough assets to pay for future benefits? When the plan is fully funded, that offers opportunities to de-risk.”

While some of the de-risking activity was among plan sponsors that had already frozen their plans and were looking to windup, he notes about 80 per cent of purchases were for ongoing pensions that were reducing the size of their obligations to retired members.

Planning ahead

Plan sponsors thinking about a future annuity transaction should plan ahead by getting approvals in place from their governance bodies and reviewing what’s necessary to conduct a purchase, says Kyle Weeden, a principal at Eckler Ltd.

“Many times, [plan sponsors] move toward a position to conduct an annuity purchase, but they don’t act quickly enough, the market turns and they’re back to being underfunded.”

These pre-purchase strategies should include an investment glide path to progressively take risk off the table and beef up on bonds as the pension nears the necessary funded status, as well as a determination of whether the plan sponsor would be willing to make a payment to bring the plan up to 100 per cent.

Read: What do historically low interest rates mean for DB pension de-risking?

“The de-risking is not just on the day [the transaction] happens,” says Weeden. “It’s how you implement those strategies up until the point of the annuity purchase.”

The B.C. Teachers’ Federation has nearly reached the final step of its de-risking journey and is currently waiting to make an annuity purchase. It first shifted active employees to a multi-employer pension plan in 2014. Retired members or those who couldn’t join the new plan remain legacy members in the closed DB plan, which the organization began working to bring up to a fully funded status in 2019.

As the plan got closer to reaching full solvency, it gradually moved away from equities and into real estate, mortgages and, in the last two or three years, real return bonds. “The goal of the fund is not to earn as much as possible, but to be able to provide a pension benefit as promised to the beneficiaries of the plan.”

Some plan sponsors may think twice about pulling the trigger on an annuity purchase when rates are low and transactions are likely to be more expensive, but that’s the wrong frame of mind, says Dickner. He compares it to a homeowner waiting to purchase a new property until housing prices decline. “If you already own a house, the price of your house will also drop. For plans that are de-risking and invested in bonds, this question is a bit irrelevant.”

He encourages plan sponsors to focus on their underlying strategy and investment profile, pointing out that pension plans that are heavily invested in bonds will see their liabilities move in tandem with their assets.

Read: What options are available for de-risking DB pension plans?

Yung is curious to see how interest rates will affect the quotes for the BCTF’s annuity transaction, but the organization isn’t in a hurry. “We want to give ourselves a lot of time to see what’s the right timing for this,” he says, noting the federation also plans to make additional contributions to the pension beyond what’s required.

Weeden cautions plan sponsors against comparing their pensions to other plans’ investment strategies or staying invested in equities longer than necessary. “What can happen — I think it’s human nature — [is] the tendency to let things run when times are good. When equities are performing so well the last few years, why would I move to bonds that are going to be negative returning, especially long-term bonds? But if your goal is to move towards a windup and a fully funded plan, it meets your goal regardless. When you’re doing this, you’re making an investment strategy specific to you.”

Pension plan sponsors that offer indexation benefits will have to be prepared for rising inflation to increase the cost of their annuity transactions, says Simmons, as it requires the insurer to take on more risk. Yung notes the BCTF’s plan is indexed, but the federation has accounted for the additional cost in its planning.

Taking the long-term view

While it’s still unclear whether rising inflation will prove a short-lived phenomenon, Simmons says it’s caught many plan sponsors by surprise.

With inflation remaining consistently within the Bank of Canada’s comfort zone for several decades, some plan sponsors haven’t properly hedged for it. Instead, they’ve relied on a fixed inflation rate or return-seeking assets to pay for any cost-of-living increases to pension benefits, he says, which could hurt them if inflation continues to rise.

Read: Equities, inflation, legislative changes push annuity transaction volume to record highs

Weeden says many of the plan sponsors his firm works with that are focused on a long-term, going-concern view of their pension are “very concerned” about future market movements.

“If you’re in that long-term view . . . and you’re investing in traditional asset classes, it’s a rock and a hard place. Your bonds are facing these rising interest rate headwinds and, on the other side, inflation is not usually positively correlated with equities. If you’re only living in the traditional world, it’s very difficult for those plans.”

Brendan George, a partner at George & Bell Consulting Inc., says his plan sponsor clients have significantly reduced their exposure to traditional fixed income over the past few years, a move that wouldn’t have historically been thought of as de-risking.

“If you’re thinking about getting a five per cent absolute return at the lowest volatility and your main concern in today’s world is increasing interest rates and increasing inflation, fixed income returns have not been good in that environment and are not expected to be good in the next few years if inflation remains high and interest rates go up.”

Alternative asset classes have continued to be a big focus, says Weeden, including private fixed income that can “form a bridge” between fixed income and equities. Infrastructure, real estate, agriculture and commodities serve a dual function of yielding decent returns at a lower risk while also acting as inflation hedges, says George. “Our clients were going in that direction anyway, they were looking to invest from a risk-return perspective. The inflation component was a secondary objective.”

Read: CBC Pension Plan stays the course with liability-driven investment model

A liability-driven investing strategy first deployed in 2005 has helped the Canadian Broadcasting Corp.’s pension plan maintain a healthy funded status amid market volatility and persistent depressed interest rates, says Duncan Burrill, the fund’s managing director and chief executive officer. While the plan still has a significant fixed income exposure, it has gently edged it down over the years and slightly reduced its bond overlay hedge under the expectation that future rate changes are inclined to be upwards.

“We don’t really feel like we have the capability of predicting interest rates . . . so we don’t spend a lot of time trying. We’re better off sticking to our strategy and optimizing the implementation of that strategy.”

The CBC pension is an indexed plan with a cap and has hedged a portion of its inflation risk with a large amount of real return bonds, says Burrill, noting the pension has assumed a long-term inflation rate in line with the central bank’s preferred range, but with some expected fluctuations. The plan hasn’t revisited its assumption yet, feeling it will ultimately remain within that range and isn’t currently adjusting its asset mix. “We’ve seen this situation many times in the past, so we’re not changing [our strategy].”

Teaming up

Another way for DB plan sponsors to de-risk is by consolidating with a larger plan, says Barbara Sanders, an associate professor in statistics and actuarial science at Simon Fraser University.

The Colleges of Applied Arts and Technology pension plan’s DBplus, the OPSEU Pension Trust’s OPTrust Select and the University Pension Plan are examples of this trend. These “attractor” plans can provide access to alternative assets that reduce inflation risk and make it more affordable to provide pension benefits in a low rate environment. They also have the scale to offer plan members more “complex” pension benefits, such as target benefits and conditional or guaranteed inflation protection, which smaller DB plans have typically avoided, she says.

Key takeaways

• Group annuity purchases reached a historic high in 2021, largely thanks to improved funded statuses that made it possible for pension plan sponsors to de-risk.

• Plan sponsors considering an annuity transaction should secure governance body approvals well ahead of time and introduce a liability-matching investment strategy to take risk off the table as the plan reaches certain funded status targets.

• Plan sponsors are turning to alternative assets such as private equity, real estate, infrastructure, agriculture and commodities to achieve yield at a lower risk while hedging against inflation.

Read: University Pension Plan launches multi-employer DB pension plan

“It’s clear that very few sponsors can actually take on full guaranteed inflation — everyone in Canada and worldwide is moving away from doing that because it’s super expensive and really risky. Insurers are not even keen on inflation-protected annuities. The next best thing is conditional indexation; it’s light-years better than none at all. . . . [But] a higher level of expertise is needed and that’s going to happen in a larger plan.”

Changing landscape

With interest rates poised to rise to keep inflation in check, Weeden expects to see a significant shift in the landscape, making it particularly important for pension plan sponsors to review their goals, investment beliefs and investing horizon.

“I think a lot of plans are at the precipice. The 2020s are going to look a lot different than the 2010s in that we’re facing rising interest rates for the first time in [recent memory]. It’s going to change what the landscape looks like. So taking the time now to really invest in understanding why you want to invest and what are the asset classes you want to invest in, is going to pay dividends down the road.”

Kelsey Rolfe is a Toronto-based freelance writer.