As U.S. President Joe Biden signs an executive order obstructing the departure of domestic capital from venture and private capital into China, it’s raising a red flag for institutional investors interested in significant returns from the advanced technology space.

The executive order, which took effect earlier this month, branded the production of semi-conductors, quantum computers and the advancement of increasingly popular artificial intelligence solutions off limits for investors in venture and private capital. The move is aiming to bring parity in what’s being described as the sensitive technology space.

The U.S. argued the ongoing development of these sensitive technologies in China, with the help of domestic funds, represents a significant national security risk. According to some experts, the move by Biden is the latest escalation tactic in an ongoing economic race between the U.S. and China.

Read: What opportunities does AI offer for institutional investors?

Elliot Johnson, chief investment officer and chief operating officer with Evolve Funds Group Inc., says cybersecurity is the chief concern of this executive order, adding the U.S. is most worried about sharing technological intellectual property with China. “It sounds like partly economic rivalry, but being enacted in the name of national security.”

Fellow technology investment expert Alex Tapscott, managing director with the digital asset group at Ninepoint Partners, calls the new legislation a form of industrial policy and expects it to become a standard for the U.S. moving forward beyond Biden’s presidency.

Institutional investors in Canada will have to monitor the ongoing development of geopolitical risks given the U.S. government’s investment concerns. “It’s a clear signal that the U.S. government is worried about American capital aiding China in developing technologies that could bolster its military prowess, especially in sectors like semi-conductors, microelectronics, quantum computing and specific [artificial intelligence] capabilities,” says Johnson.

Read: Sino-Canadian relations face a slow recovery, but China remains warm to investors: expert

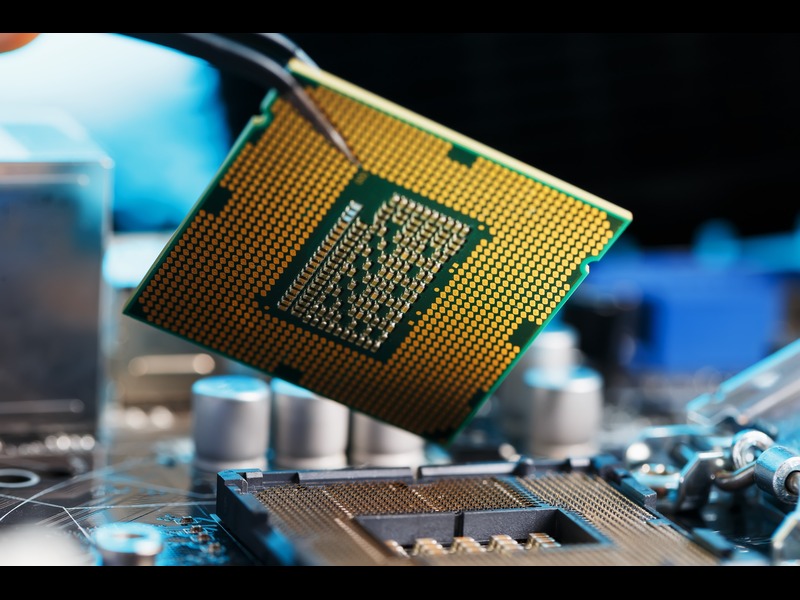

Semi-conductors are materials that carry conductivity, typically silicon, and play a key role in the development of every type of electronics, from mobile devices to the electronic display inside a car. China accounted for about 35 per cent of the semi-conductors produced in 2021, according to data from S&P Global Market Intelligence.

The semi-conductor industry is driving innovation across the board and is expected to reach US$1 trillion in revenues by 2030, says Johnson. The Biden administration has targeted a substantial manufacturing position of semi-conductors by offering US$39 billion to incentivize the development of domestic semi-conductor manufacturing plants.

During a keynote session at the Canadian Investment Review’s 2023 Risk Management Conference, Charles Myers, chairman and founder of Signum Global Advisors LLP, predicted the U.S. will reach self-sufficiency in semi-conductors within the next five years.

Read: 2023 GIC coverage: The investment case for the new China