In a recent paper, A Post-Crisis Perspective on Diversification for Risk Management, researchers at France’s EDHEC Business School take up the task.

Since the global financial crisis of 2008, improving risk management practices—management of extreme risks, in particular—has been a hot topic. The postmodern quantitative techniques suggested as extensions of mean-variance analysis, however, exploit diversification as a general method. Although diversification is most effective in extracting risk premia over reasonably long investment horizons and is a key component of sound risk management, it is ill-suited for loss control in severe market downturns. Hedging and insurance are better suited for loss control over short horizons. In particular, dynamic asset allocation techniques deal efficiently with general loss constraints because they preserve access to the upside. Diversification is still very useful in these strategies, as the performance of well-diversified building blocks helps finance the cost of insurance strategies.

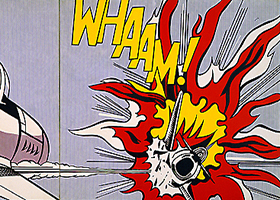

That’s the fun stuff – post-modern risk management. For those up on their classical education, post-modernism makes one of it’s earliest appearances in print in … 1924. So maybe what seems to be new isn’t. Indeed, ever since architecture was going through its “modernist” phase, there has been extensive research into extreme risk modelling in academe since the 1950s, [but] it is only after difficult times that the financial industry becomes more open to alternative methods.

But how would these alternative methods work? Let’s start with the “modern” beginnings of finance:

A landmark publication by Markowitz (1952) laid the foundations for a scientific approach to optimal distribution of capital in a set of risky assets. The paper introduced mean-variance analysis and demonstrated that diversification can be achieved through a portfolio construction technique that can be described in two alternative ways: (i) maximise portfolio expected return for a given target for variance or (ii) minimise variance for a given target for expected return. The portfolios obtained in this fashion are called efficient and the collection of those portfolios in the mean-variance space is called the efficient frontier. Therefore, conceptually, the mean-variance analysis links diversification with the notion of efficiency—optimal diversification is achieved along the efficient frontier.

The problem, of course, is that in a market crash, all correlations head to one – there is a single driver to the efficient portfolio. Still, the paper notes:

diversification is designed to extract risk premia in an efficient way over long horizons, not to control losses over short horizons. Misunderstanding the limitations of the approach can mislead investors into concluding that, since diversification did not protect them from big losses in 2008, it is a useless concept.

There are variations on controlling variance. Using Value at Risk in various forms however, has limited utility for risk management. There is no guarantee against large losses since “we are minimising an average of the extreme losses. Again, having a small average extreme loss does not necessarily imply an absence of large losses in market crashes.”

One solution is to hedge, classically, by combining risky and risk-free assets to achieve a maximum Sharpe Ratio (MSR). Thus:

The efficient MSR portfolio is constructed to provide the highest possible risk-adjusted return. Therefore, it is in the construction of this portfolio that we take advantage of diversification to extract premia from the risky assets. The MSR portfolio is in fact responsible for the performance of the overall strategy. The risk-free asset, by contrast, is there to hedge risk. In fact, the fund-separation theorem implies that there is also a functional separation—the two funds in the portfolio are responsible for different functions.

A maximally risk-adjusted portfolio might then limit drawdowns to 10% in adverse stock markets. But this, the authors report, is a product of static hedging. You decide your risk allocation at a certain point, locate your risk profile on the capital market line, and hope all will go well. If it doesn’t, well, you’ve only lost 10%…. or maybe 20%.

Dynamic hedging – portfolio insurance – can be more productive, by setting a continuous floor on losses.

When the value of the portfolio hits the floor, as it nearly does in the crash of 2008, allocation to the risky MSR portfolio stops altogether and the portfolio is totally invested in the SAFE building block. Since the SAFE asset is supposed to carry no risk, it is not possible, in theory, to breach the floor. In a recovery, the return from the safe asset can be used to build up a new cushion and invest again in the MSR portfolio. In this way, exposure to extreme risks is limited and access to the upside is preserved through the MSR portfolio because it is designed to extract premia from risky assets by taking full advantage of the method of diversification.

Yes, well that’s the theory. But, as many Canadian investors in structured products know, that only works if there is a cash cushion left over to be invested. If the product has been “monetized” to preserve capital, that could mean eight long years of holding a zero-interest bond.

Given how willing investors are to entertain negative yields on safe assets, however, that may not be a bad thing. It could even boost the mattress industry. Periculum longo, somni brevis.