LESLEY MARKS

Chief investment officer, equities, Mackenzie Investments

STEVE LOCKE

Chief investment officer, fixed income and multi-asset strategies, Mackenzie Investments

Policymakers continue to face hard decisions as they work to tame inflation and maintain economic growth. Steve Locke and Lesley Marks share how they see the coming months playing out. Both are chief investment officers at Mackenzie, with Locke responsible for fixed income and multi-asset strategies and Marks responsible for equities.

What’s your view on inflation and interest rates going forward—and how will that affect your decision-making in the coming months?

SL: A key signal for markets will be how quickly inflation comes down and how broad-based that decline is. The Bank of Canada and U.S. Federal Reserve enacted historic rate hikes in a short amount of time and the bond market is pricing in more aggressive action to come. With the way yield curves are priced today, we’re looking at policy rates peaking in the U.S. above 4.50 per cent. As the Fed pushes the policy rate towards that peak, the yield curve will likely settle into a trading range in the coming quarters. We had a very short duration in our bond portfolios coming into 2022, anticipating a yield rise. Since the summer, we’ve been adding duration because we believe the yield curve now anticipates virtually all the Fed rate hikes to come.

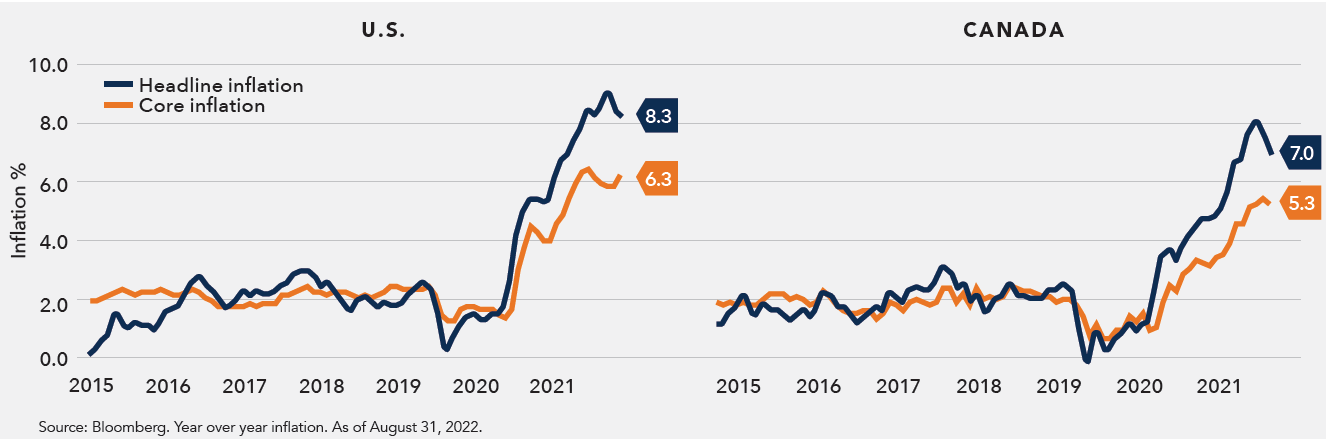

LM: We have a high level of conviction that inflation has peaked, but there’s less visibility on its trajectory from here. In 2021, central bankers were steadfast in their belief that inflation was transitory and their policy moves reflected that. But throughout 2022, there was a realization that inflation was stickier than expected and rising at a faster clip. It’s important to recognize that inflation does not impact all companies equally. Hard assets like commodities, infrastructure and real estate can appreciate in value during inflationary times because their replacement value also rises. On the other hand, companies with little pricing power—or companies with goods subject to substitution or those that are discretionary in nature—usually underperform in inflationary times.

What unique economic challenges does Canada face and what impact are they having on equity and fixed-income markets?

LM: One challenge is the importance of housing to our economy. The real estate sector has been a great beneficiary of the secular decline in interest rates; and rising interest rates will make it difficult for this sector to remain a growth engine for our economy. Also unique to Canada is the importance of the resource sector, mainly energy. Rising energy prices contributed significant cash flows for the energy space, which benefited our economy overall. However, energy prices are highly cyclical, so the sustainability of this trend is a concern for our economy— and, in turn, our equity market right now. Third, Canadian banks also represent an important part of our economy. The financial sector generally benefits from rising interest rates, but the speed at which rates are rising is a concern.

SL: Since June, Canada’s employment picture shows cumulative job losses of over 90,000, with the construction sector losing more than 30,000 jobs in August and September. Construction had seen a surge of renovations during the pandemic, but that trend is reversing as rising policy rates affect mortgage, as well as secured and unsecured borrowing rates for households. Construction represents about eight per cent of employment in Canada—a much higher percentage than in the U.S. Furthermore, while property rents have risen, positively affecting net operating income, central bank policies are curtailing demand. We haven’t fully felt the lagged impact from the rate hikes made earlier this year, but we’re already starting to see effects on Canada’s yield-sensitive economy.

What sectors or subsectors do you think have the most opportunity in the near term?

LM: Because we’re facing a central bank-induced economic slowdown, investors should look for opportunities that don’t rely on a strong economic backdrop. Examples include companies that have the benefit of inelastic demand and can most often be found in sectors like health care and consumer staples. Companies that have excess capital to support dividends and share buybacks will also outperform in this environment, as they generally offer a smoother ride for investors in times of higher volatility. We’re also interested in businesses participating in the energy transition, which is a very strong secular trend. These may exist in the commodities sector (e.g., copper and lithium) or industrial sector (e.g., alternative energy and battery technology).

SL: The rapid repricing of the bond market—in response to quickly rising yields driven by central bank policy— produced dramatically negative total returns in 2022, sending major Canadian bond indices down about 11.75 per cent year-to-date as of the end of September. That said, because of what is already priced into the Canadian yield curve, as well as the widened credit spreads on high-quality corporate bonds, we believe Canadian fixed-income investors will have their best opportunity in 10 to 15 years to pick up short- to medium-term investment-grade corporate bonds at yields in excess of five per cent. We think this will be a relatively stable market area in the context of continuing economic and market volatility throughout the rest of 2022.

What are the biggest concerns you’re hearing from investors?

SL: Investors are concerned about the degree of tightening we’re going to see and how that will impact the economy. They’re also worried about the recent correlation between bonds and equities, which declined simultaneously.

Going forward, I think we’ll see a negative correlation re-emerge and bonds again act as a counterbalance against equity volatility.

What worries you most about the coming year—and what are you most excited about?

LM: While we’ve seen a decline in valuations for equities, there are still speculative pockets in the market. Meme stocks are an example, where share prices rise multiple times within weeks (despite significantly deteriorating fundamentals) merely because of a chatroom mention. That tells me we probably haven’t hit the bottom yet for risk assets. However, from adversity comes opportunity—and more challenging markets force people to become more disciplined investors. This year’s reality check means prices are closer to their fundamental value. Active strategies, with portfolio managers making decisions through a lens of risk-adjusted returns, will do very well in a more discriminating market.