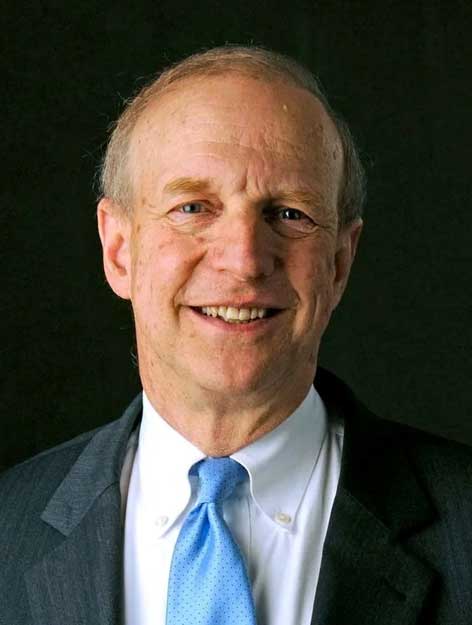

Speaker

Mark Iwry, non-resident senior fellow, the Brookings Institution; visiting scholar, the University of Pennsylvania’s Wharton School; and former senior advisor to the U.S. secretary of the treasury for national retirement and health policy

Mark Iwry has served as senior advisor to the U.S. secretary of the treasury from 2009 to 2017 and as the U.S. treasury department’s deputy assistant secretary for national retirement and health policy. He currently is a non-resident senior fellow at the Brookings Institution, a visiting scholar at the Wharton School and advises plan sponsors, financial firms, fintech startups, governmental, academic, research, nonprofit and other organizations. Iwry also provides policy and legislative advice to members of congress and congressional staff on both sides of the aisle.

He has been recognized by various publications as one of the nation’s most influential individuals in finance, pensions and saving, including world’s 30 top financial players (Smart Money); 20 individuals expected to have a major influence on the financial services industry (Investment News) and the 100 most influential people in 401(k) (401(k) Wire). He was formerly a partner at Covington & Burling LLP, of counsel to Sullivan & Cromwell LLP, a research professor at Georgetown University and benefits tax counsel to the U.S. Department of the Treasury. He has testified before U.S. Congress on 27 occasions, has provided policy advice to various presidential campaigns, has served as an expert witness in federal court litigation and has assisted in resolving significant differences or disputes within the retirement community.

He has authored, co-authored or been involved in numerous U.S. retirement policy initiatives and reforms – many expanded by or otherwise featured in the SECURE 2.0 legislation – including 401(k) automatic enrollment; the national movement to expand coverage and reduce racial, ethnic and gender savings disparities through state-facilitated automatic IRA programs; the nationwide federal automatic IRA proposal; the Saver’s Credit (used by some 10 million individuals) and Saver’s Match; the SIMPLE-IRA plan (covering three to four million plan members); the QLAC longevity annuity; QDIA-embedded annuities; the “myRA”, curtailing leakage by replacing plan cashouts of small balances with automatic rollovers to IRAs; the new plan startup tax credit for small businesses; expansions of pension portability; and direct deposit of tax refunds into IRAs and U.S. savings bonds. He also has played a significant role in U.S. health care reform, including implementation of the Affordable Care Act.

Iwry has received awards for leadership, innovation and major contributions to retirement security and to the nation’s pension, health care and tax systems from a broad spectrum of organizations. He graduated from Harvard College, Harvard Law School and Harvard’s Kennedy School of Government, which recently honoured him as the recipient of its annual Alumni Public Service Achievement Award for having significantly improved the human condition and for his extraordinary public service on behalf of the people of the United States.