According to Goodyear Canada Inc., pension communications don’t have to be boring — and it’s not afraid to use puns to make its employees pay attention.

The company’s strategy, encompassing targeted messaging and creatively designed materials, netted it the award for pension communications at Benefits Canada‘s 2019 Workplace Benefits Awards on Oct. 17.

Goodyear Canada sends pensions-related missives to segments of its workforce based on their age, position, lifestyle, plan type and other factors. Younger employees will receive messages about taking advantage of the company match, while older employees will get information about the retirement process and investment strategies for protecting the wealth they’ve accumulated. Sometimes, plan members also receive communications through the mail so they can make retirement decisions with their spouses or partners.

Read: Who are the winners of the 2019 Workplace Benefits Awards?

The organization also uses online and social media alongside more traditional methods of communication to make sure all employees receive the information they need.

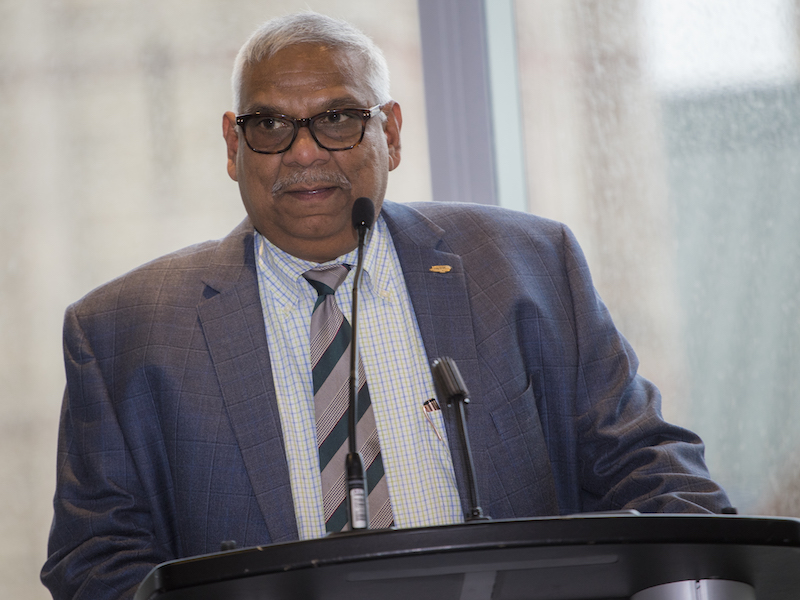

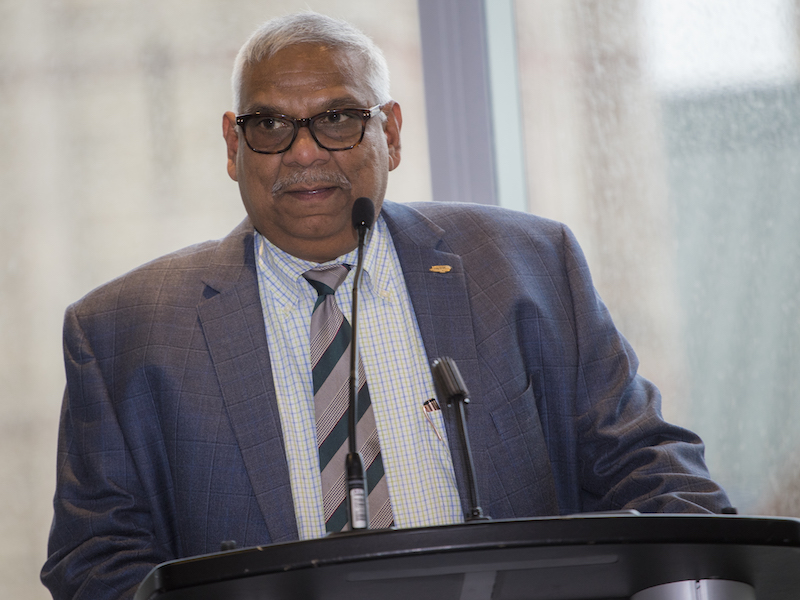

“We were very meticulous in our approach,” says Thak Bhola, Goodyear’s manager of pension, investments and administration. “We’ve got people in factories [who] work 12-hour shifts, so some of them don’t want to hang around and communicate with me when I’m in the factory. But the material that we produce has QR codes, and these guys carry smartphones, so instead . . . they can take a snapshot of the QR code, the document downloads to their phone and then, when they have time, they’ll look at it and, when they have questions, that’s where we come in.”

The company devised three different types of communications to reach its employees: general messages sent to large groups of employees explaining broader concepts such as how the retirement plan works and the company match; encouraging employees to engage and share their feedback at town halls, group information sessions and webcasts; and an interactive employee self-service that allows plan members to model potential retirement scenarios based on the criteria and assumptions they set.

Goodyear also plans to launch a series of five-minute online training modules that cover investment strategies, preparing for retirement and more.

Read: Coca-Cola wins big for successfully communicating complex pension transition

It also cut out text-heavy pension plan booklets and other less engaging forms of communication. In 2015, when it offered former employees who were deferred, vested members of the defined benefit plan the option to take a lump-sum commuted value in a locked-in retirement account or receive a monthly retirement income in the future, it developed materials that were clear, colourful and engaging. This included branded letters, decision guides, frequently asked questions and more. Around 70 per cent of the contacted members chose the lump-sum option.

The company says its most successful communications methods is its series of retirement brochures, because they’re well-designed and easy to understand. They highlight the most important information for employees, including how the program works, how to maximize the company match and what happens when they retire, instead of getting bogged down in excessive detail. The materials are also customized to Goodyear and designed to be relevant to employees through clever wording and puns, such as a definition that asks: “Is inflation . . . adding air to tires or the increase in prices over time?”

Bhola says the inspiration came from attempting to explain the company’s more complex DB plan, which has three elements, a couple of years ago by using the example of Goodyear’s triple-tread tire. “That piece was sort of like the forerunner of everything that we did. The terms that we use in there are terms our people could relate to.”

Read: Dress up pension communications for better impact

Goodyear also paid attention to the diversity of its workforce by highlighting different ideas of retirement in its messaging, such as a multi-generational home with children and grandchildren.

It’s seen positive, measurable outcomes from the communications program. After promoting target-date funds — defined contribution plan members’ default — through the company’s website, brochures, newsletter and more, 64.3 per cent of DC members are now invested in them. The amount of withdrawals from its DC plan dropped six per cent between 2018 and 2019, a result of its messaging around retirement as a long-term strategy.

Bhola says the success of the communications program was in large part due to feedback from employees. “When we find that the same questions keep coming back and perhaps you know the answers might be a little difficult, this is where we focus. We think about, how we could respond in a way that [is effective] and then we get our communications consultant involved and put the images and language and everything together.”

Read: Alberta pension plan wins communications award for approachable, original website