Rewind to August 2015. The Newfoundland and Labrador Teachers’ Pension Plan was underfunded on both a solvency and going-concern basis, at 43.7 per cent and 65 per cent, respectively. Fast forward to year-end 2018 and it sits at a healthy 101.7 per cent on a going-concern basis.

The turnaround stems from substantial changes to governance, plan design and investments. Most significantly, it moved from a government sponsored to a jointly sponsored plan. While the Teachers’ Pension Plan Corp. is the plan’s administrator and trustee and is responsible for its strategic direction, investment decisions and operations, its joint sponsors are the Newfoundland and Labrador Teachers’ Association and the provincial government.

Read: N.S. moving forward with new DB pension solvency regime

Getting to know Steve Brooks

Job title: Executive director of the Newfoundland and Labrador Teachers’ Association

Joined the NLTA: 2008

Previous role: Assistant executive director of the NLTA

What keeps him up at night: How best to de-risk a mature pension plan

Outside of the office he can be found: Heading for the office or enjoying a walk

To make the change to a JSPP, there was give and take from all parties.

On the plan design front, it moved from a five years’ best average earnings to best eight, eliminated indexing on a go-forward basis and changed the start date for deferred pensions. “Those were the three ‘contributions’ that the employees made in return for becoming joint sponsors of the plan with the employer,” says Steve Brooks, executive director of the NL Teachers’ Association. “And then the employer made a matching contribution of the value of that contribution in the form of a promissory note to the plan.”

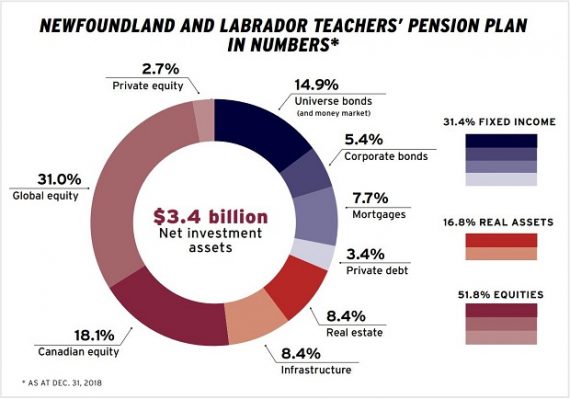

When the Teachers’ Pension Plan Corp. board was set up in August 2016, it inherited an asset mix of about 75 per cent equity and 22 per cent fixed income, with very little real assets. After conducting an asset liability study, it determined it had to diversify and take risk out of the plan.

Read: Several Ontario universities looking to form new JSPP

“We’ve included mortgages, private debt [and] private equity,” says Paula McDonald, chief executive officer of the Teachers’ Pension Plan Corp. “We’ve rebalanced our Canadian equity and global equity, increased our allocation to infrastructure and real estate — all with a view to investing in alternatives.”

While McDonald acknowledges the plan still has work to do when it comes to fixed income, she says taking a global view has been important. And, since the board inherited the plan at 75 per cent equity, it reduced this to 52 per cent as of the end of December 2018.

Getting to know

Paula McDonald

Job title: Chief executive officer and board chair of the Teachers’ Pension Plan Corp.

Joined the TPPCNL: 2016 Previous role: Executive vice-president and chief financial officer at Inmarsat Solutions

What keeps her up at night: Plan demographics

Outside of the office she can be found: Riding her horse and spending time with family and friends

The NL Teachers’ Pension Plan is very mature — 50 per cent of its members are retirees and its funding policy specifies that it must be fully funded 30 years out. “What was really driving the change is the overall objective, through pension reform, of getting to full funding 30 years out and so that’s the objective behind everything,” says McDonald.

This is of great importance, she adds, noting the promissory note, which is treated as an asset of the plan, runs out at 30 years.

Read: 2016 Top 100 Pension Funds Report: Solvency reform on the agenda

Overall, plan members have taken the changes very positively, says Brooks. “One of the things — and I would say this about any plan where you have a sole sponsor and it’s not the employees — is that the employees fall into the trap of simply seeing their job as contributing to the plan . . . and they don’t necessarily understand the importance of being involved or being knowledgeable about how the plan is being run, administered [and] how the investment portfolio is set up.”

But today, as a joint sponsor, the employees have skin in the game and appreciate the moves the plan is making to de-risk, he adds.

Yaelle Gang is editor of the Canadian Investment Review.