Against a backdrop of uncertainty, the OPSEU Pension Trust is guided by an investment strategy with certainty at its core.

In 2015, the plan introduced what it calls a member-driven investing strategy, which is all about efficient risk allocation and earning the returns required to pay pensions at the lowest possible risk. “That’s different from others,” says James Davis, the plan’s chief investment officer. “Others will have a risk target and will try to earn the highest rates of return. We sort of flip it 90 degrees and say, we have a target rate of return that we wish to achieve at the lowest risk possible.”

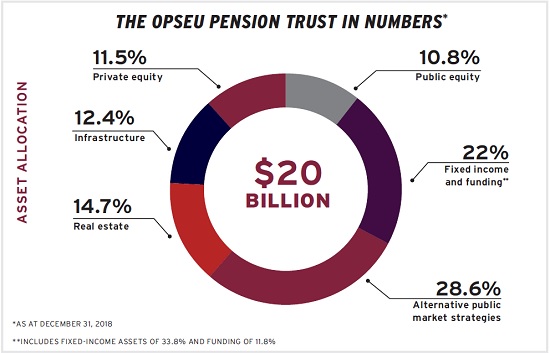

The member-driven investing strategy changed the plan’s asset allocation. Initially, equity risk made up about 80 per cent of the overall risk in the fund. Today, that’s dropped to below 50 per cent.

Read: OPTrust boosts internal management through new in-house trading floor

As part of the new strategy, the OPTrust also diversified by looking at different strategies in alternatives. “OPTrust has been very successful in our illiquid asset strategies for a number of years,” says Davis. “We’ve now diversified into liquid alternative strategies and internalized our capital markets capabilities in order to implement that in a more efficient way.”

GETTING TO KNOW JAMES DAVIS

JOB TITLE: Chief investment officer

JOINED THE OPTRUST: September 2015

PREVIOUS ROLES: Most recently, chief economist and vice-president of strategy and asset mix at the Ontario Teachers’ Pension Plan, although he worked in meteorology before transitioning to investments

WHAT KEEPS HIM UP AT NIGHT:

Maintaining a fully-funded status in a low-return environment

OUTSIDE OF THE OFFICE HE CAN BE FOUND: Participating in his many hobbies, which include gardening, cooking and sailing

The plan uses a completion portfolio, which means it focuses on the asset classes in which it has a very strong track record — like real estate, infrastructure and private equity — and then looks at the unique characteristics of its liabilities to find any gaps. “Given the characteristics that we get from real estate, infrastructure and private equity, what are we missing in order to complete the picture, in order to be able to meet the obligations of our liabilities?”

The completion portfolio has very unique strategies, adds Davis, noting the OPTrust is always researching and evolving the portfolio’s indices and benchmarks to be better and more specific, given the plan’s liabilities and activities in the illiquid markets.

Read: Global investors cite interest rates as key portfolio risk: survey

Another part of the member-driven investing strategy is more focus on plan liabilities and options for mitigating the liabilities’ sensitivity to interest rates, while also earning the rate of return required to keep the plan sustainable over the long term, says Davis.

“We try to do it as holistically as possible. We have created a liability hedge portfolio. Our discount rate is very sensitive to what happens to interest rates, so our goal is to mitigate the sensitivity of that discount rate to changes in interest rates. And the way that we can do that best is, of course, by holding bonds.”

The OPTrust is also focused on avoiding risk it isn’t compensated for, he adds. “If we just accept that risk that’s embedded in the liabilities — that interest rate sensitivity — then . . . that’s a risk in the long run that we’re not being paid to accept. So we are very focused on making sure that we’re earning the return that we should be for any of the risks that we take.”

Read: Currency considerations as plan sponsors grapple with volatility

One example is currency risk. “A change when we went to the [member-driven investing] framework was to say, generally speaking, we’re only going to hold currency exposure when we think it makes sense for us,” says Davis. “And generally, we hold currencies that are risk-mitigating for the portfolio. So the U.S. dollar, the Japanese yen [and] the Swiss franc are three currency exposures that we would have in the portfolio, and also some emerging market currency exposures, because we feel that it just simply doesn’t make sense for us to pay the higher cost of hedging those currencies.”

Overall, Davis says it was fortunate the plan had clear objectives when it introduced its member-driven investing strategy. “And that is to improve the pension certainty of [members’] pensions, despite all of the disruptions that are happening out there in the economy, and in society as well.”

Yaelle Gang is editor of the Canadian Investment Review.