Like many pension experts, Peter Ballon, the Canada Pension Plan Investment Board’s global head of real estate, will have the early days of March 2020 seared into his memory for many years to come.

As the coronavirus pandemic took hold, grinding domestic and international travel to a halt, he — like the rest of the CPPIB workforce — retreated to the home office that has remained his base ever since.

“During those first few hours and days, it was all a bit of a shock to the system,” Ballon says.

Read: One year later: Institutional investors looking beyond pandemic

The pension fund implemented an immediate pause on investment activities, giving it some time to assess how the spread of the coronavirus and the resulting economic slowdown would affect the financial health of both the CPPIB and its joint venture partners it operates with in the real estate sphere.

Now, as the coronavirus crisis rumbles on at varying degrees of intensity across the nation and around the globe, Ballon is encouraged by the fundamental constancy of the sector throughout a chaotic and convulsive year.

Business as (un)usual during this ongoing crisis

“In pretty short order, we figured out that we were in excellent shape. We’re all still at home, but our activity is really back to business as usual. Real estate has been — and continues to be — an important part of our investment strategy. COVID has not changed that.”

Large institutional investors have traditionally been attracted to the real estate asset class, not only as a source of predictable income, but also as a generator of favourable adjusted returns and as an effective hedge against inflation over the longer term that pensions operate on, says Rob Douglas, the managing director of real estate investments at the OPSEU Pension Trust: “It’s an important diversifier from public markets.”

Douglas served in a senior real estate role at the Healthcare of Ontario Pension Plan before his arrival at the OPTrust in 2004, where he was tasked with growing the fund’s fledgling property portfolio. From a one-man team, the pension’s in-house real estate group has steadily grown to 21 members, managing assets that now account for almost 15 per cent of the total fund.

By the numbers

5.2% — OPTrust’s net return on its real estate portfolio in 2019.

US$625m — Purchase price for Seattle’s Denny Triangle office tower, which the Canada Pension Plan Investment Board bought in a joint venture in late 2020. The CPPIB holds a 45 per-cent stake in the 10-year-old building, which boasts Amazon Web Services as its anchor tenant.

59% — The proportion of Canadian employees working primarily from home during the pandemic, according to a PWC survey.

20% — The proportion of Canadian workers who wish to return to the office full-time once the pandemic has passed, according to the same PWC survey.

45 — Number of shopping centres owned worldwide by the Caisse de dépôt et placement du Québec subsidiary Ivanhoé Cambridge, including 26 in Canada. The firm announced plans to sell off up to one third of its domestic malls last year.

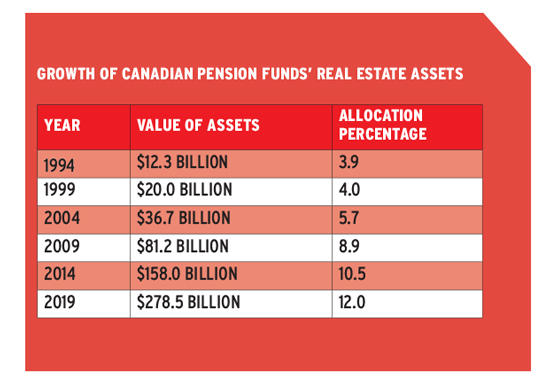

According to striking asset allocation data from the Pension Investment Association of Canada, the OPTrust is not the only fund to have gone big on real estate investment over the last few decades.

Read: Institutional investors urged not to overlook Canadian real estate opportunities

The PIAC’s annual survey of members shows that real estate’s share tripled from four-to-12 per cent of funds’ total assets between the years of 1999 and 2019, while the actual value of all that property ballooned over the same period from $20 billion to almost $280 billion.

And with interest rates back on the floor, Gaurav Mathur, an analyst in the real estate division at BMO Capital Markets, says that trend looks set to continue well into

the future.

“Pension funds and larger institutional investors have a lot of capital sitting on the sidelines. They’re looking for yield in order to fulfil their obligations to members, which means they’ll be looking towards alternative asset classes — including real estate and private equity — to try to generate returns.”

Indeed, some of that cash has already entered the field of play, if Sabrina Gherbaz’s experience in the commercial real estate group at law firm Torys LLP is anything to go by.

Apart from a brief hiatus in March and April, early in the pandemic — when the focus of Ghebraz’s legal advice turned temporarily to rent relief and insurance contract interpretation— she says the deal flow has rarely been higher.

“By May, investors had regained confidence and the big transactions were picking back up again. In the end, 2020 looked very similar to 2019 for our pension fund clients; we continued to see them actively investing in both income-earning properties and development projects.”

Read: Institutional investors set to pull back on real estate investments in 2020: survey

At the OPTrust, Douglas credits the diversity of the fund’s real estate holdings for largely insulating it from the economic and social upheaval driven by the pandemic. “It has led to structural changes and those won’t be uniform across all property types. I think we held our own because of where we’ve chosen to invest.”

More than half of OPTrust’s real estate portfolio consists of residential apartment buildings and industrial property. “We’ve consciously done that in the construction of our portfolio because those two types have very defensive characteristics and predictable ability to deliver income that we can use to pay our pensioners in retirement.”

He identifies the industrial-property sector as a major pandemic winner, with repeated lockdowns propelling online shopping levels through the roof and introducing new generations to the concept.

“Even our grandparents understand e-commerce,” Douglas says, predicting that demand will remain high in the sector well into the future, especially near large cities like Toronto. Industrial users are moving away from just-in-time to just-in-case, which means they need more space to build their inventories.”

It’s not all rainbows amid the pandemic storm

On the flip side of the e-commerce boom, existential questions are being raised about the future of physical retail, according to Michael Kitt, head of private markets and real estate equity investments at RBC Global Asset Management.

Key takeaways

• Real estate portfolios have become increasingly important to pension funds’ investment strategies over the last 20 years and will remain crucial in the future thanks to low interest rates and the need for inflation protection.

• The coronavirus pandemic has accelerated existing trends in real estate, in particular, the decline of the retail sector and the growth of demand for logistics and industrial property.

• Debate rages on about the long-term outlook for the office sector, due mainly to uncertainty about how work-from-home trends will shake out post-pandemic.

“This is not a new idea, but a longer-term trend that has been accelerated — and distorted, quite frankly — by COVID,” he says, noting that it’s hard to tell how enduring the behavioural changes of shoppers will be post-pandemic, since malls and shopping centres were forced to shut altogether or operate at reduced hours and lower capacity.

Read: How coronavirus will affect real estate investing long term

“The crisis has hit all the pension real-estate divisions hard, but it was worst for the ones with large exposure to the retail sector,” says Leo Kolivakis, an investment analyst based in Montreal.

That includes the Caisse de dépôt et placement du Québec’s subsidiary, Ivanhoé Cambridge, which owns 45 malls globally, more than half of which are in Canada.

The firm had already signalled a desire to reduce its retail allocation, announcing plans to sell one third of its Canadian shopping centres in February 2020, shortly before the pandemic took hold in this country.

“The hope will be that things go well with the vaccine rollout, and down the road, you can write retail assets back up again,” says Kolivakis.

In the longer term, Kitt sees physical and online retail reaching a new equilibrium, according to the needs and desires of consumers and merchants. “At the end of the day, there’s going to be winners and losers. Some assets and locations will hurt more than others.”

Read: Caisse posts 7.7% return in 2020 as real estate underperforms

Still, the flexibility of retail property offers a silver lining to the owners of unfashionable sites, adds Kitt. “Typically, these assets are very big pieces of land in very good urban locations. It can be converted quickly to different uses that are actually relevant and needed, whether it’s last mile distribution, self-storage or medical offices.”

While market observers broadly agree that the pandemic has been favourable to owners of industrial real estate and hostile to those in the retail business, the jury is out on the office sector.

“Again, work-from-home is not a new idea,” says Kitt, noting that many office tower owners have spent the last decade keeping up with slow-but-steady growth in remote-working arrangements by building flexible or shared workspaces into units for employees who spend only part of their time onsite.

However, no one could have foreseen the explosion in work-from-home we all witnessed since last March. A recent survey by PriceWaterHouseCooper Canada revealed that just six per cent of employees worked primarily remotely before the pandemic struck, compared with 59 per cent by the summer of 2020, when the poll was conducted. When questioned on their ideal arrangement, just 20 per cent of respondents said they would opt to work at an office on a full-time basis. Another 12 per cent said they’d aim to work entirely from home if allowed, with the rest picking some combination of the two.

In addition, a number of high-profile companies — including Twitter Inc., Facebook Inc. and Shopify Inc. — have made peace with concerns about employees’ reduced productivity and social interaction, indicating a willingness to make remote working permanent for those who want to continue after the pandemic passes.

Read: Shopify moving majority of employees to permanent remote work

“If we do end up with some kind of hybrid model, office demand is going to decline over time,” says Kolivakis.

“And with a lot of firms in cost-cutting mode, I also think they’re not going to be looking to increase their leases. Well-capitalized anchor tenants — I’m thinking of accounting and legal firms — might ask for more room, but they’ll be negotiating their rents very strategically and aggressively.”

“The office sector probably has the least certainty,” concedes the CPPIB’s Ballon. “I don’t think there will be no impact, but I also think that it will vary by region and types of tenant.”

Still, the pension was bullish enough on the future of the office to seal a US$625-million deal for the purchase of a 668,000 square-foot office tower in Seattle’s Denny Triangle, as recently as November 2020. The pension will own a 45 per cent interest in the joint venture, while majority partner Hudson Pacific handles leasing and construction for the building, the majority of which is currently occupied by tech giant Amazon.

“Even in as sector such as office, where one can argue it’s challenged, we continue to see attractive opportunities,” says Ballon.

At the OPTrust, Douglas says the pandemic has given him a renewed appreciation for the value of office space, and cities more broadly. “The fact is we’re social creatures; so we expect there to have been some behavioural changes, but people will want to cluster. It’s likely corporations will rethink how they use their space, how employees move around the space and how technology can be helpful. It may look and feel differently than it has historically, but the office is still very important to businesses.”

Read: What can institutional investors learn from coronavirus crisis?

Whatever the future may bring, Kitt (like the rest of us) says he’s ready to leave the pandemic behind.

“This was a year that nobody saw coming, but through it all, those who stayed diversified, disciplined and focused on core high quality in every respect are the ones who were able to make it through. “There will be opportunities to invest [in 2021 and beyond] and it’s just a matter of being patient and disciplined in identifying the right ones.”

Michael McKiernan is a freelance writer.