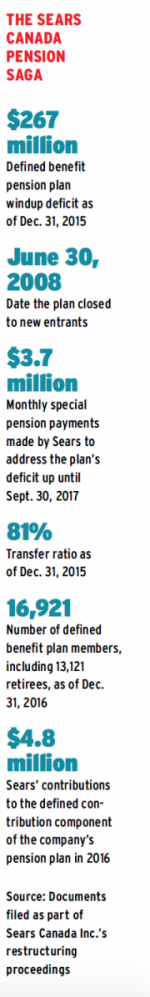

The ongoing Sears Canada Inc. and Wabush Mines restructurings illustrate that there’s perhaps nothing as vexing in insolvency situations as the position that pension deficits occupy in the pecking order of creditor priorities.

Indeed, many observers cite the issues over the status of the deemed trust that most provinces’ legislation imposes on pension deficits as a significant contributor to the delays of almost nine years and costs of more than $2.6 billion that characterized the proceedings following the demise of Canadian corporate icon Nortel Networks Corp.

Read: Should pensions take priority in bankruptcy situations?

Ontario’s Pension Benefits Act, for example, creates a deemed trust in favour of pension plan beneficiaries for any deficit in the plan on windup. The province’s Personal Property Security Act gives priority to the deemed trust.

And in 2013, the Supreme Court of Canada ruled in a case known as Sun Indalex Finance LLC v. United Steelworkers that, in Companies’ Creditors Arrangement Act proceedings, the deemed trust takes priority, even over secured creditors, with respect to certain assets of a debtor. The deemed trust, then, is a vital remedy for members of an underfunded pension plan seeking to avoid losses.

The many complications

Still, the courts have struggled with the application of Indalex to individual insolvencies. So whether or not the deemed trust argument would succeed in the Sears matter is very much unclear.

Complicating the issue further is the fact that Indalex doesn’t apply in a bankruptcy proceeding under the Bankruptcy and Insolvency Act. “The Supreme Court has ruled that, if a defined benefit plan is not wound up prior to bankruptcy, the deemed trust is gone,” says D.J. Miller, a lawyer at Thornton Grout Finnigan LLP in Toronto, an insolvency boutique law firm.

Read: Lawyer asserts priority claim for Sears retirees in CCAA proceedings

There’s no doubt the deemed trust priority is a formidable negotiating tool. In Indalex itself, the deemed trust priority netted pensioners up to $4 million more than they could have obtained as unsecured creditors. The Timminco Ltd. restructuring several years ago also saw pensioners in Ontario and Quebec benefit from the deemed trust argument.

Wabush casts a doubt

Still, even in the context of a restructuring under the CCAA, the status of the deemed trust is unclear. For example, although the Ontario courts confirmed the existence of a deemed trust in the Timminco proceedings, a recent ruling from Justice Stephen Hamilton of the Quebec Superior Court in the Wabush matter cast doubt on the applicability of the deemed trust in the Sears scenario.

Hamilton ruled the deemed trust that gives priority to pension claims under Newfoundland and Labrador’s Pension Benefits Act wasn’t effective in a liquidating CCAA proceeding, which is precisely where the Sears matter is now. Adding to the uncertainty is the fact that the Quebec Court of Appeal has granted leave to appeal in the Wabush case, with the hearing tentatively scheduled for June 2018. What’s clear is that should Hamilton’s ruling survive appellate review, pensioners throughout Canada won’t have fared well.

Read: Court decision in Wabush restructuring the ‘worst-case scenario’ for pensioners

“If we’re thinking about what type of pension protection retirees have, Wabush is the worst-case scenario,” says Simon Archer, a lawyer at Goldblatt Partners LLP in Toronto.

Applying the Wabush case to the Sears situation, however, is a complex undertaking. Although the pensioners’ lawyers, fearing a bankruptcy, sought to wind up the trust, their application became moot after Ontario’s superintendent of financial services concluded a windup was inevitable and appointed Morneau Shepell Ltd. to oversee the process.

The upshot is that a conversion of the Sears matter into bankruptcy proceedings isn’t likely to happen.

Difficulties arise, however, because the CCAA proceeding is now, in fact, a liquidation. The courts, however, haven’t enunciated a bright line separating a restructuring from a liquidation under the CCAA. Deemed trust and priority problems don’t arise in the case of a restructuring because that situation contemplates a plan of arrangement — a negotiated, court-approved compromise between the debtor and the creditors. But they do arise in the case of a liquidation, which the courts have held is akin to a bankruptcy under the Bankrupcty and Insolvency Act.

Deemed trust a ‘blunt instrument’

According to Archer, it’s the practical, as opposed to the legal, consequences of a trust during an insolvency proceeding that have created the uncertainties surrounding deemed trusts.

“Insolvency legislation removes pensions that are deemed to be true trusts from the property of an insolvent debtor,” says Archer. “Where the amounts are small, the consequences of that removal are contained, but pension deficits have often been very large and would substantially reduce assets available to all other creditors. In this context, a deemed trust is a blunt instrument, so courts don’t like it.”

Read: Creditor challenges regulator’s move to wind up Sears Canada pension plan

Ultimately, then, Sears’ pensioners’ prospects for recovery will depend on what the company realizes from the liquidation, the outcome of any negotiations and, failing agreement, a court ruling on the availability of the deemed trust in the particular circumstances of the company’s insolvency.

According to Archer, the pensioners will get first priority on the proceeds if the deemed trust argument succeeds; otherwise, the pension plan will be an unsecured creditor and the pensioners will receive only cents on the dollar, if anything remains, after the secured creditors receive their payments.

Either way, the likelihood is that, until the Supreme Court revisits the issue, the lingering complexities of deemed trusts will continue to be the wild card for pensioners and other creditors seeking to maximize their rights in an insolvency.

Julius Melnitzer is a freelance writer based in Mississauga, Ont.