When Gary Timlick joined the Wawanesa Mutual Insurance Co. as its senior vice-president, chief financial officer and pension committee chair, it had no formal investment department. With responsibility for managing corporate investments and pension assets resting solely on Timlick, he began a journey to build up an investment team.

Though it was a relatively new concept in Canada in 2013, the plan made the move that year to hire an outsourced chief investment officer for its Canadian defined benefit plan’s assets. “It was done more in Europe [and the U.S.] than it was in Canada at that particular point in time,” says Timlick.

The move to OCIO was primarily driven by two factors: time-efficiency and the ability to quickly change managers when required. “I think for smaller plans, it’s a very good option,” he adds.

Read: 2016 Top 40 Money Managers Report: The ins and outs of OCIO

Under the OCIO model, the plan’s management committee prepared the statement of investment policies and procedures and submitted it to the board for approval, says Timlick, noting the OCIO implemented the SIPP once it’s approved. As a result, the plan sponsor didn’t have to go out and search for individual managers and styles. “It was really time-effective and each class of assets always had a number of different managers — three to four.”

When Wawanesa was looking to switch from a particular manager due to staff changes or adjustments in management style, the OCIO could quickly switch and re-assign managers. Internally, this process would have taken up to six months, says Timlick, when accounting for the time required to do a request for proposal, interview candidates and potentially conduct site visits.

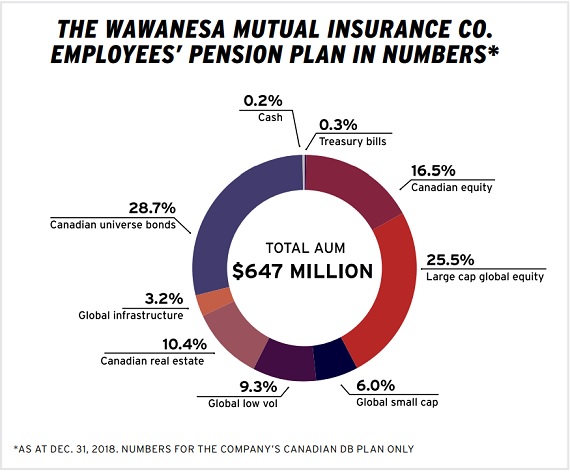

The OCIO also allowed the plan to move into new asset classes, including infrastructure and real estate. “We didn’t have any of those assets when we went to the outsourcing model, so within a short period of time, we were able to achieve our new asset allocation targets . . . because they were able to quickly move us into real estate options and into infrastructure, and that would have taken us a long time.”

Getting to know: Gary Timlick

Current title: Chair of the investment committee for the Winnipeg Civic Employees’ Benefits Program and recently retired senior vice-president and chief financial officer at Wawanesa Mutual Insurance Co.

Tenure at Wawanesa: February 2008 to April 2019

Joined the Winnipeg Civic Employees’ Benefits Program’s investment committee: 2010

What keeps him up at night: The current market volatility and whether the longest bull run in history will end badly with impacts similar to 2008

Outside of the office he can be found: At his cottage with his family in the summer and on British Columbia’s ski slopes in the winter

Read: What makes a good outsourced chief investment officer?

Wawanesa’s only reservation for moving to an OCIO model was that it was more expensive than internal management, says Timlick. “But if I look at it from the perspective of smaller pension plans, this is a very good service because smaller plans sometimes don’t have the time or skill set in-house to be able to do the kind of work that’s required to effectively manage the assets.

“This provided a ready-made solution to get to the point of effective investment management very quickly.” And while it may have cost more, the OCIO was able to help access better management fees, adds Timlick. “Now, they wouldn’t disclose those, but we could tell that they were getting better management fees than what we could do as a stand-alone because we’re part of this bigger group.”

Over the past five years, while the OCIO was up and running, Wawanesa built up an internal process and started to take some of the assets back in-house. “That took five years because . . . the people that I hired were busy working on the corporate assets,” says Timlick. “But we’re in a position now where we’re happy with [what] we’ve got going on corporately, and so they’re starting to take back some of the assets.”

Read: Assets managed by U.S. OCIOs to exceed US$2.7 trillion by 2022: research

The internal investment team now has more time to focus on pension assets in addition to insurance company assets, says Wes Peters, Wawanesa’s current vice-president of investments. “We’re able to lever that to get the scale that we want. It’s not really increasing our governance burden because we are monitoring those investments already and it’s cost-effective. We’re able to piggyback on fee scales, fee schedules for much larger investment — the investment made by the insurance portfolio.

“It has been an evolution, but so far it’s working.”

In 2013, the OCIO managed 100 per cent of the plan’s assets. As of the end of 2018, that’s decreased to 66 per cent. Part of the reason it’s still high is the commitment to longterm investments, says Peters.

Yaelle Gang is editor of the Canadian Investment Review.