In search of better risk-adjusted returns, the York University Pension Fund decided to look beyond Canada’s borders, shifting its equity allocation to be 100 per cent global.

The fund is a hybrid defined benefit and defined contribution plan, with the benefit level depending on the rate of return and a minimum guarantee for members. Its investments, which are managed like a DB plan, are made through pooled funds or limited partnerships by a small team of four people.

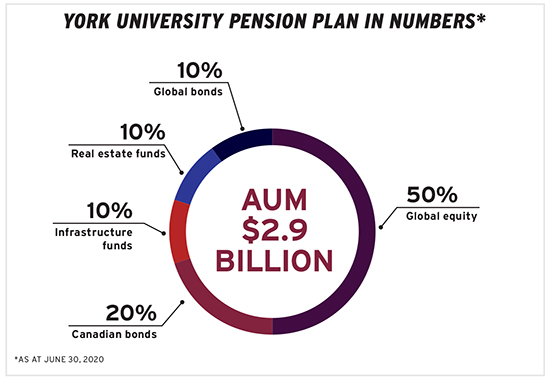

Previously, the plan’s asset mix sat at 30 per cent Canadian bonds, 15 per cent Canadian equity, 15 per cent global equity, 15 per cent international equity, 15 per cent U.S. equity and 10 per cent infrastructure. After a significant revamp, it now sits at 50 per cent global equity, 20 per cent Canadian bonds, 10 per cent global bonds, 10 per cent infrastructure and 10 per cent real estate.

Read: 2019 Top 50 DC Plans Report: What does the future hold for hybrid pension plans?

“Our fixed income allocation used to be fully Canadian,” says Leona Fields, director of the university’s pension fund. “We now have a global aspect to it. We still have a majority of it in Canada and our equity was regional and now it’s all completely global.”

In 2016, a review of the investment policy led to the recommendation for a fully global structure, with the expectation of the same or higher returns with lower volatility.

“Overall, we would have a better risk-adjusted performance and the idea is that, if you give investment managers more flexibility and full [discretion] to invest anywhere in the world where they see the opportunities, then the expectation is that you’re going to have a more efficient portfolio,” says Fields.

Getting to know

Leona Fields

Job title: Director, pension fund, York University

Joined York University: 1999

Previous roles: Consulting

What keeps her up at night: The current bull run in the equity markets and the likelihood of another downturn

Outside of the office she can be found: Camping, reading

and cycling

The actual implementation was a big deal, she notes. “When we had the recommendation to move to global, the next stage of the discussions were, ‘While OK, that’s great, but what does that mean? What will the structure look like? How many managers will we have?’ And so we did a significant amount of work in that area looking at different types of options, number of managers, size of portfolios — and we came up with the recommendation at the end of that process to implement a core satellite structure where we have a low volatility core and satellite portfolios of very active, highly concentrated, benchmark agnostic, actively managed global equity portfolios.”

Read: 10 Canadian pension funds ranked among top global equity investors: report

The ultimate solution is fully active, including the core low volatility component. Prior to the transition, part of the equity portfolio was passively managed and had to be transitioned into the low volatility core over two complimentary portfolios.

Once the core portfolio transition was complete, the organization shifted its focus to the satellite portfolios. “It was really quite a long process where we looked at different managers and we looked at different combinations of groups of managers with different styles to see which had the least correlation and the best diversification if you put them together.”

Next, the organization hired a transition manager because the move was very complex, including changing from seven to five managers and moving more than $1 billion. “It was a huge transition, but it actually went very well and that was completed just over two years ago,” says Fields.

She notes the importance of ensuring the various portfolios fit well together. “It’s all about diversification and complimentary portfolios because if you don’t put them together well, then you just end up with the benchmark. And that’s definitely what you don’t want.”

Generally, since moving to a more global strategy, the changes have met expectations, she says, with the plan seeing lower volatility in its equity portfolio as well as higher returns.

Yaelle Gang is the former editor of the Canadian Investment Review.