Over the past several months, much attention has been paid to the coronavirus pandemic’s impact on financial markets and, subsequently, defined benefit pension plans’ financial conditions — but what about the potential financial implications arising from the virus’ effect on mortality rates?

The mortality assumption

When performing a pension plan’s actuarial valuation, the actuary uses a number of assumptions, including one regarding the future rates of mortality of the pension plan population. Since a DB pension is payable for the lifetime of the plan’s retirees and beneficiaries, the mortality assumption is important because it affects the length of time pensions are assumed to be paid from the plan.

Read: Pension plans’ 2020 financial results impacted by coronavirus pandemic

An assumption of lower rates of mortality will increase a pension plan’s liabilities because it’s assumed they’ll be paid for a longer period of time. Conversely, an assumption of higher mortality rates will decrease a plan’s liabilities because pension payments are assumed to end sooner.

In the case of a going-concern valuation used to determine a plan’s funding requirements, the actuary selects the assumptions, including the one connected to mortality. For accounting valuations, the plan sponsor selects the assumptions, often based on advice from an actuary.

Looking backwards

The first mortality-related financial effect of the coronavirus crisis on a pension plan to consider is the impact of excess deaths that may have already occurred among the plan population since the onset of the global pandemic in early March 2020. If the actual number of deaths has exceeded the assumed number of deaths in the actuary’s most recent valuation of the plan prior to the onset of the pandemic, then a mortality experience gain and a reduction in plan liabilities — all else being equal — will be revealed when the next valuation is performed. For example, if the number of deaths of a pension plan’s retirees and beneficiaries in 2020 was significantly higher than expected, a Jan. 1, 2021, valuation of the plan will likely reveal a mortality experience gain.

Read: How are global retirement systems faring in the wake of coronavirus?

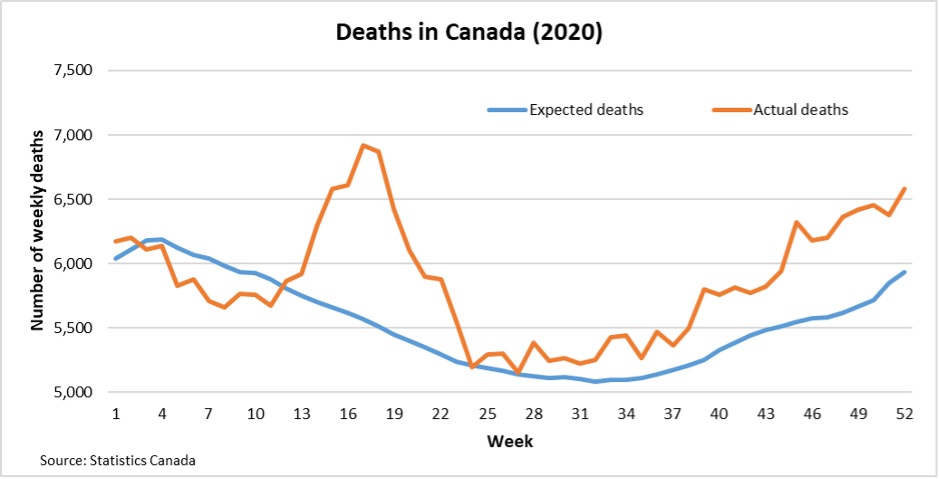

Unfortunately, the pandemic has had a significant effect on the number of deaths in Canada. The chart below shows the weekly actual number of deaths compared to the expected number of deaths in Canada during 2020. It should be noted that the information in the chart doesn’t attempt to identify deaths caused directly by the coronavirus. Therefore, it also captures possible indirect effects of the pandemic, such as potential deaths due to delays in the diagnosis and treatment of other illnesses and increases in deaths due to overdoses.

During 2020, actual deaths in Canada were approximately six per cent higher than expected, according to Statistics Canada. However, the effect of the coronavirus on mortality rates has varied significantly depending on the population studied, including between Canadian provinces. For example, based on StatsCan data, actual 2020 deaths were higher than expected, at approximately nine per cent in Quebec, six per cent in Ontario, eight per cent in Alberta and six per cent in British Columbia However, in Nova Scotia and New Brunswick, actual deaths in 2020 didn’t exceed the expected number.

One would also expect the variation of excess deaths between individual pension plans is large. Anecdotally, some pension plans have experienced excess deaths in 2020 and early 2021, while other plans have seen no such effect. The financial impact of excess deaths also depends on the ages and sizes of the pensions of the retirees and beneficiaries who died during this period. Therefore, it will be difficult for a plan sponsor to anticipate the effect the pandemic has had on the mortality experience of their pension plan without first examining updated membership data.

Looking forward

The second effect of the coronavirus crisis for DB pension plan sponsors to consider is the impact the virus may have on mortality rates in the future. If the plan actuary, or pension plan sponsor, has a view as to how the pandemic may affect future mortality rates, this could lead to a change in the valuation mortality assumption, which will affect the plan liabilities.

Read: Plan sponsors to consider new mortality improvement scale

The following are a few thoughts regarding the potential effects of the pandemic on future mortality rates:

1. The mortality assumption used for pension valuations includes a provision for future mortality improvement (i.e., an assumption that mortality rates will decrease in the future). However, even in the absence of any effects of the pandemic, the evolution of future mortality rates is highly uncertain and there are differing views about the rate at which mortality rates will improve over the medium and long term.

2. There’s a possibility mortality rates will increase in the future due to the pandemic for reasons that include the following:

- Future waves of the pandemic caused by the emergence of new variants that are resistant to the vaccines currently being rolled out;

- The possibility that individuals who survive the coronavirus may still suffer future health effects from contracting the virus that may reduce their longevity; and

- Potential additional mortality due to indirect effects of the pandemic, such as delays in the diagnosis and treatment of other illnesses, the effects on mental health and any future austerity measures implemented to manage the significant government debt incurred in reacting to the economic consequences of the pandemic.

3. It’s also possible that because the most severe effects of the coronavirus are often experienced by individuals with pre-existing conditions, individuals who survive the disease will tend to be those who don’t have pre-existing conditions and may therefore exhibit lower mortality rates in the future. We may also see reductions in mortality rates due to new patterns of behaviour and public policies influenced by the pandemic, such as wearing masks in public and possible reforms to health-related protocols at long-term care homes.

When monitoring a pension plan’s financial condition and selecting valuation assumptions for the plan, actuaries and plan sponsors should consider the effects of the pandemic, including any mortality-related effects. With regards to these effects, both the excess deaths due to the coronavirus crisis that may have already occurred and the potential effect on the future mortality rates of the plan population should be considered.

Read: How are pension plan sponsors’ fiduciary duties evolving in the time of coronavirus?

Different conclusions can reasonably be drawn as to whether valuation mortality assumptions should be adjusted due to the pandemic. However, given the uncertainties about the future effects of the disease, the preferred approach at this time may be to maintain an unadjusted mortality assumption, while closely monitoring mortality patterns of both the plan sponsors’ pension population and, more broadly, adjusting the assumption in future valuations if warranted.