Nearly two-thirds (63 per cent) of Americans say they worry more about running out of money than death, up from 57 per cent in 2022, according to a new survey by the Allianz Life Insurance Co. of North America. The survey, which polled more than 1,000 employees with $150,000 investable assets, found generation X was […]

Retiring baby boomers are in an era of decumulation anxiety, as they convert their pension assets into income that they fear won’t hold up over the entirety of their retirement. The decumulation problem is complex for defined contribution pension plan sponsors because it involves transferring lump sum pension assets to retirees who may lack investment […]

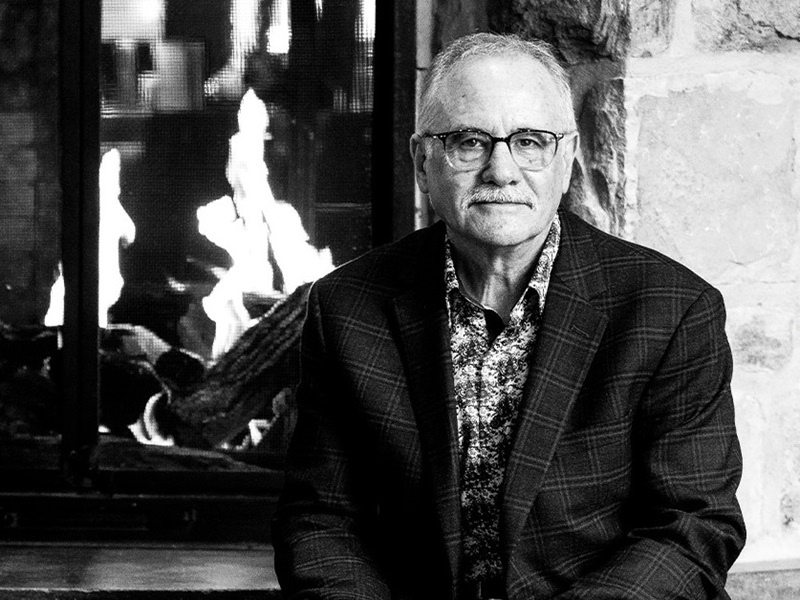

While Blair Richards understands why the industry is moving away from defined benefit pension plans, he worries about what may be lost in the process. When Richards — the chief investment officer at the Halifax Port ILA/HEA pension plan — joined the institutional investor 40 years ago, DB plans were an attractive hiring and retention […]

While the term decumulation may sound very technical and often leads to confusion among pension plan members, it’s actually quite simple — effectively, it’s the opposite of accumulation. These two terms make up the typical retirement savings journey — the accumulation phase is the working years when capital accumulation plan members put away their nest […]

A new retirement plan design could allow more public employees in the U.S. to accrue retirement benefits regardless of their length of service, according to a report by think tank the Reason Foundation. The plan, which blends elements of defined contribution and defined benefit pension plans, focuses on providing employees with the target retirement income […]

After a tough couple of years, Canadians continue to face several challenges against an increasingly turbulent economic landscape. While most coronavirus restrictions were lifted in late spring 2022, the seventh wave of the pandemic arrived in July alongside rising inflation, which is compounding prices from the gas pump to the grocery store. Though the 2022 […]

As a new year dawns, our attention turns to what’s ahead, the following are a few of my predictions for trends in the world of pensions in 2022. Volatility We’re entering the year in an environment of considerable economic and financial market uncertainty. Supply chain problems, elevated price inflation and labour shortages in certain industries […]

Among all the legal issues facing DC plan sponsors and administrators, questions around contribution errors is top of mind. “The industry has been speaking with [the Department of] Finance Canada on the tax side to see what can be done to help support us in fixing these errors,” said Susan Nickerson (pictured, left), a partner […]

In a letter to the tax branch of the Department of Finance, the Association of Canadian Pension Management said it would be reasonable for certain large defined contribution pension plans to be issuers of advanced life deferred annuities. According to the current Income Tax Act, only a licensed annuity provider can issue an ALDA. However, the ACPM […]