The average funding ratio for U.S. public pension plans increased to 77.8 per cent in 2022 with the majority (68 per cent) of pensions’ revenue coming from investment returns, according to a new survey by the National Conference on Public Employee Retirement Systems. The 12th annual public retirement systems study received responses from 195 state and […]

Despite the challenging economic environment, Canadian defined benefit pension plans saw a median return of 4.27 per cent in the fourth quarter of 2022, according to BNY Mellon’s Canadian master trust universe. The universe, which is based on $290.3 billion worth of assets under management across 84 corporate, public and university pension plans, found the one-year median […]

The Caisse de dépôt et placement du Québec is partnering with an asset manager to provide a credit facility to an electric vehicle subscription service. Through its partnership with Pollen Street, an alternative asset management firm, the investment organization has established a $153-million line of credit for Onto, a U.K.-based company that provides its subscribers […]

Nearly two-thirds of institutional investors say they’re planning to increase their allocations to real assets over the next two years, amid a backdrop of inflation and sustainability challenges, according to a survey by Aviva Investors. The survey, which polled 500 institutional investors from around the world, found nearly half (47 per cent) said they have […]

Cadillac Fairview, the real estate arm of the Ontario Teachers’ Pension Plan, is redeveloping the former home field of the Winnipeg Blue Bombers into a mixed-use space. The investment organization is partnering with Shindico Realty Inc. to transform Polo Park, which housed Canad Inns Stadium from 1953 until 2013. The site was acquired by Cadillac […]

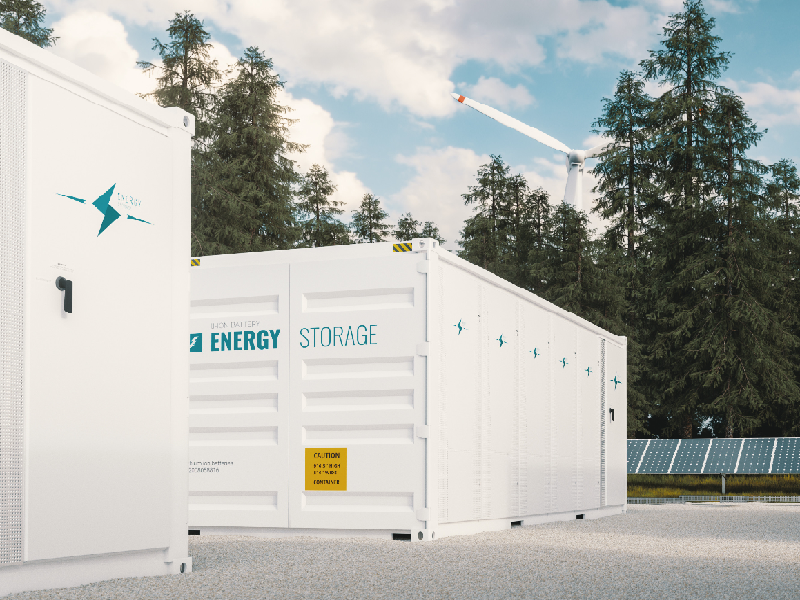

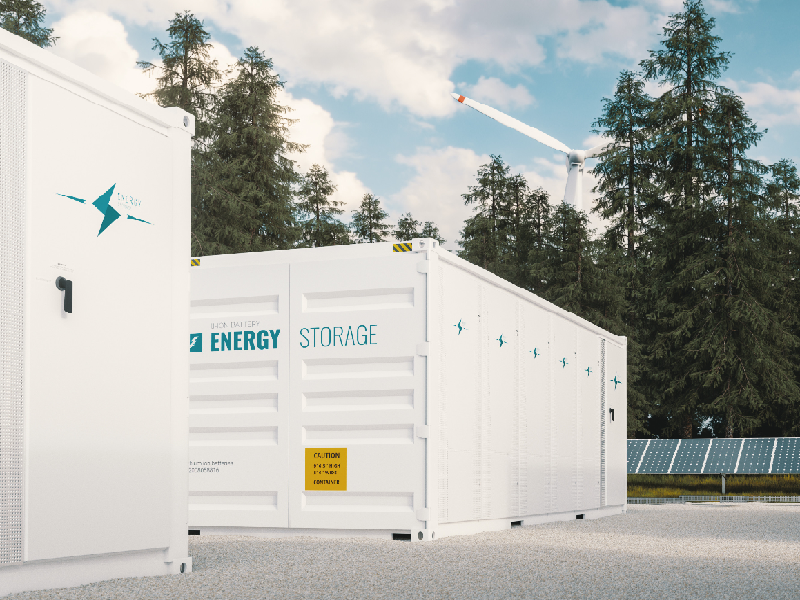

The British Columbia Investment Management Corp. is acquiring a battery storage provider. The investment organization will acquire Eku Energy from Macquarie Asset Management. The company designs electrical storage systems and operates a portfolio of these in projects in Australia, Europe and Japan. In the release, Lincoln Webb, executive vice-president and global head of infrastructure and […]

During history’s turning points, fortune favours the innovators. As the world moves beyond the coronavirus pandemic and the global workforce entrenches the improved labour conditions it created, the need for businesses to welcome new ideas is at an apex. At the 2022 Investment Innovation Conference at the Fairmont Scottsdale Princess in Scottsdale, Ariz. on Nov. […]

Institutional investors should be adopting innovative thematic approaches to derive more value from private markets, according to Nelson Lam, senior vice-president of equity and alternative investments at Trans-Canada Capital Inc., during a session at the Canadian Investment Review‘s 2022 Investment Innovation Conference. “Why private markets? There’s at least 10-times as many private companies as public […]

Environmental, social and governance investment strategies can improve a portfolio’s ability to generate alpha, according to Patrick Vizzone, managing director of global private equity at Franklin Templeton, speaking during a session at the Canadian Investment Review‘s 2022 Investment Innovation Conference. “Impact investing is sometimes regarded as being a drag on financial returns, but we believe […]

“What we’ve observed year to date is nothing short of historic in nature,” said Steve Guignard, senior director of client solutions at Sun Life Capital Management, referring to the poor performance of the FTSE Canada Universe Bond Index, which dipped 12 per cent in 2022. “The market’s erratic and unpredictable behaviour is very similar to […]