The Canada Pension Plan Investment Board has confirmed the departure of Frank Su as managing director and head of Asian private equity, effective immediately. In an emailed statement to Benefits Canada, a CPPIB spokesperson said the investment organization has “a strong team in Asia who will continue to build on the important portfolio in the […]

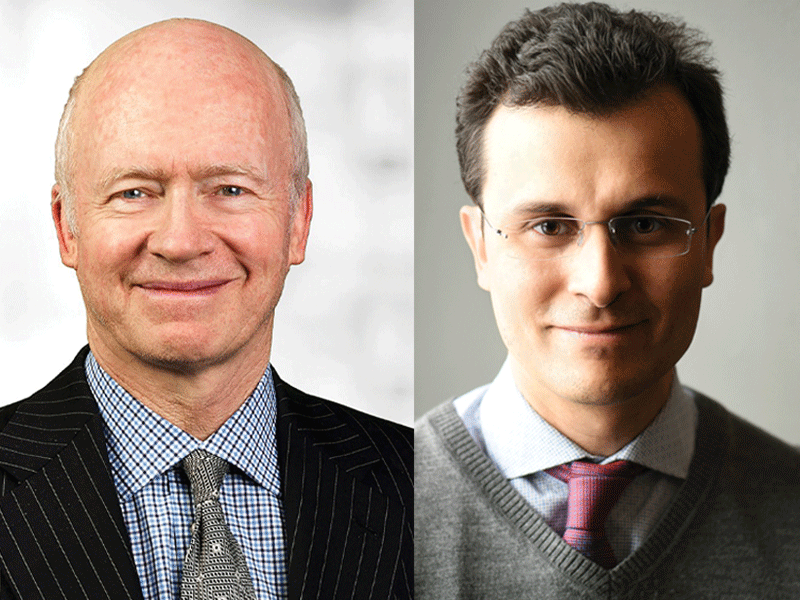

While both experts point to the obligation of the pension promise, one argues that many pension funds are already overweight in Canadian allocations, while the other cites these funds’ risk-return calibrations, highlighting the strategic assets available abroad. Jeremy Forgie, pension lawyer and senior counsel at Blake, Cassels & Graydon LLP Whether our governments should try […]

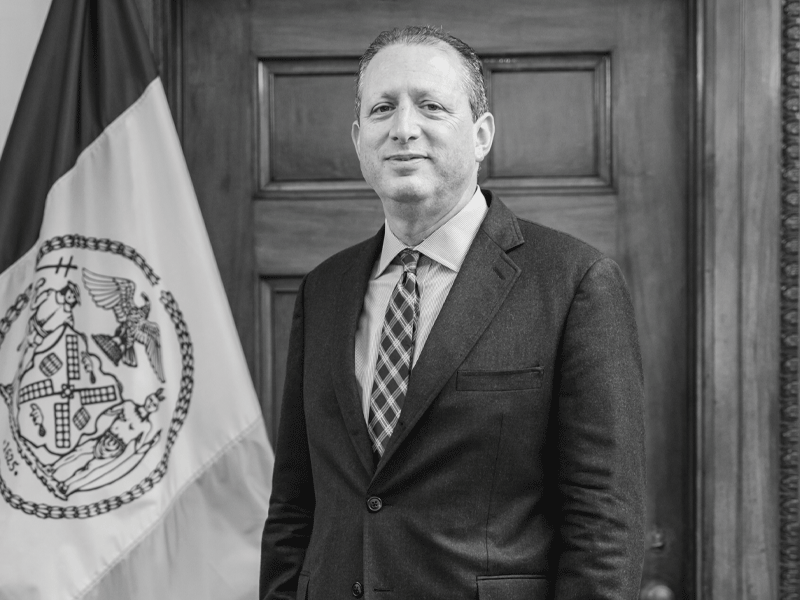

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

The Canada Pension Plan Investment Board is selling a portion of its stake in a real estate joint venture to its partner Unibail-Rodamco-Westfield SE. The investment organization’s partner is buying a 38.9 per cent stake in an off-market transaction, which will bring up its ownership stake to 89.9 per cent. According to a press release, […]

The Canada Pension Plan Investment Board is asking fellow institutional investors to consider the impact of artificial intelligence in investees’ labour patterns beyond a productivity improvement perspective, says Jon Webster, senior managing director and chief operating officer at the CPPIB. In a new report, the investment organization said institutional investors stand at the forefront of […]

The Public Sector Pension Investment Board, along with partner Investcorp, is investing in accounting firm PKF O’Connor Davies LLP. According to a press release, the new investment will give the firm more flexibility to pursue mergers and acquisitions as well as invest in new technology and service lines. The financial details of the transaction weren’t […]

The swift removal of the chief executive officer, three executives and the 11-person board at the Alberta Investment Management Corp. is a dramatic move that raises red flags about the influence of Alberta’s provincial government, says Anthony Guindon, a partner at Koskie Minsky LLP. “We don’t entirely know at this stage but it makes one […]

With 15 different client organizations, including nine public sector pension plans, the Alberta Investment Management Corp. has opted to engage, rather than divest, from certain investments, particularly those in the energy sector. “One of the things we were very clear on, both for ourselves and in talking to clients, is that divestment wasn’t the way […]

In the years following the 2008/09 financial crisis, Dan Langlois realized the allocation strategy for the Calgary Foundation’s endowment portfolio needed a significant adjustment if it planned to meet its annual funding goals. “I knew we needed to do something in terms of increasing the return in the portfolio to preserve the corpus or the […]

The rapid rise in the cost of living in 2022 and into 2023 underscored the need for target-date funds to not just protect against standard inflation, but inflation shocks as well. The problem that presents is the more inflation protection that’s added into a portfolio, the lower the returns, said Nick Nefouse, managing director, global […]