The Alberta Investment Management Corp.’s chief executive officer, Kevin Uebelein, is stepping down early, most likely by July 2021. Uebelein and the AIMCo board have agreed to begin the process of a leadership transfer, with the goal of filling the role by June 30, 2021. “This decision is Kevin’s,” wrote Dénes Németh, director of corporate communications, in an […]

The Public Sector Pension Investment Board is part of a group investing $1 billion in Convex Group Ltd., a specialty insurer and reinsurer. In April 2019, Convex launched with $1.7 billion of committed capital. Its initial invested capital was raised from its management team, Onex Partners V, the PSP and a consortium of co-investors. The additional capital has been committed by the original investors, […]

Despite several bumps in the decade since the 2008/09 financial crisis, the swift and brutal crash in global equity prices when the coronavirus was declared a pandemic sent pension investors reaching for their playbooks to implement defensive strategies to mitigate the damage. “People have worked very hard at just acting on the set strategies that […]

Demand for defined benefit pension plan sponsors to focus on environmental, social and governance factors through their investments is growing. Both plan sponsors and members have been increasingly vocal about keeping ESG issues top of mind. For example, the Healthcare of Ontario Pension Plan has worked on balancing this increased appetite for ethical investing with an overall […]

As bond yields drop, many Canadian pension plans are looking at new strategies to increase returns through alternative investments, according to a webinar hosted by the Portfolio Management Association of Canada on Tuesday. “We’re looking for uncorrelated scalable risk, with low or no correlation to major markets like equity or credit,” said Jane Segal, portfolio […]

The Caisse de dépôt et placement du Québec is investing $150 million in CAE Inc., a Quebec-based company specializing in training and operational support for several industries. The investment is part of a $300-million financing drive and will support the company’s expansion plans, according to a press release. This includes the acquisition of Flight Simulation […]

The Canada Pension Plan Investment Board ended its second quarter of fiscal 2021 with net assets of $456.7 billion, up from $434.4 billion, according to a new report. The $22.3 billion increase in net assets for the quarter consisted of $21.6 billion in net income after all costs and $700 million in net CPP contributions. The […]

The Caisse de dépôt et placement du Québec, the Canada Pension Plan Investment Board and the Ontario Teachers’ Pension Plan are entering into subscription agreements with Intact Financial Corp. to support its conditional acquisition offer for RSA Insurance Group. The Caisse, the CPPIB and the Ontario Teachers’ are committing $1.5 billion, $1.2 billion and $500 […]

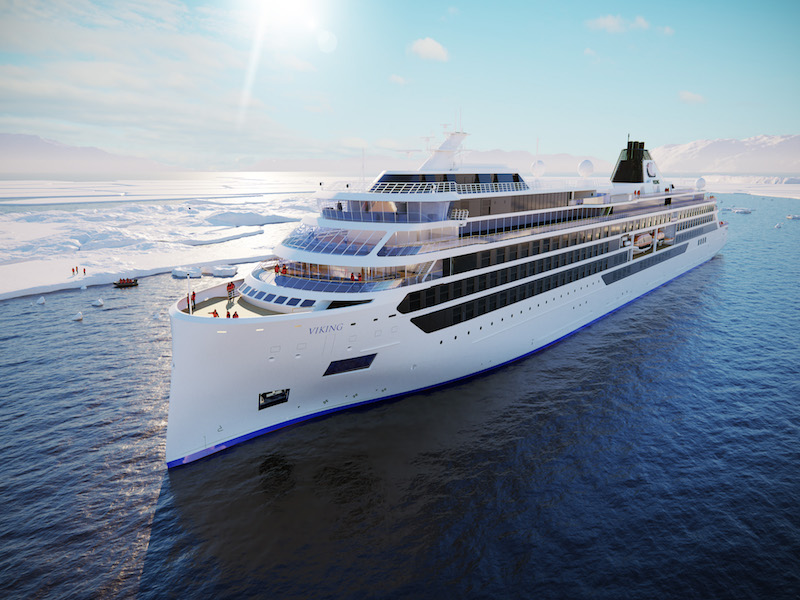

The Canada Pension Plan Investment Board and TPG Capital are increasing their investment in Viking Holdings Ltd. The CPPIB and the private equity platform were already minority stakeholders in the parent company of Viking Cruises. The additional investment means about US$500 million of net proceeds will be available to support Viking Cruises continued development. Read: CPPIB invests in cruise […]

The Caisse de dépôt et placement du Québec is entering a US$300 million warehouse financing agreement with Titan Aircraft Investments Ltd. The warehouse facility will provide debt capital to finance Titan’s acquisition of freighter aircraft leases. The Caisse and BNP Paribas are joint lead arrangers and lenders in the transaction. “This investment is well-aligned with […]