Last year was a strong year for the Canadian annuity market and the start of 2019 is looking promising as well, said Marie Desrochers, director of client relationships and defined benefit solutions at Sun Life Financial, speaking at a CI Institutional Investment Management event this week. While official year-end numbers aren’t out for 2018, Sun […]

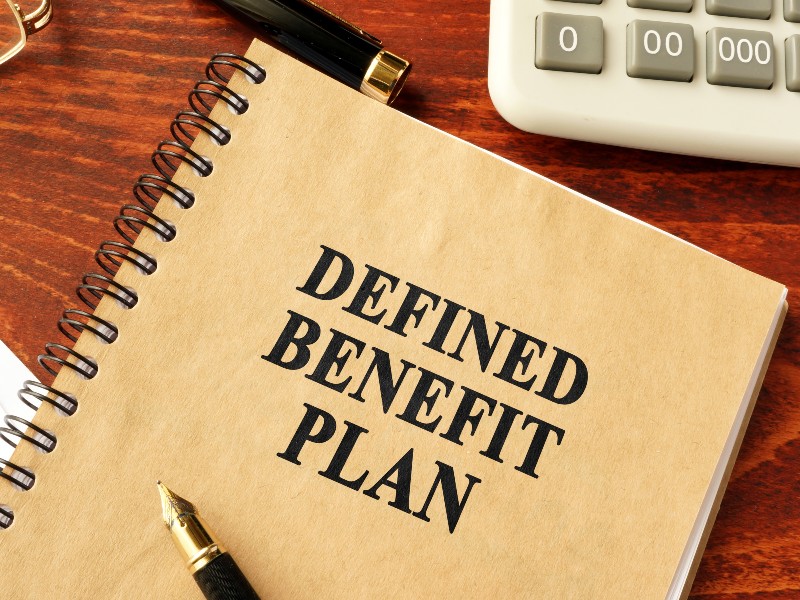

Defined benefit pension plans aren’t just better for Canadian workers, but for the country’s economy in general, according to a new study by the Canadian Public Pension Leadership Council. Statistics Canada data from 2018 showed 37.5 per cent of Canadian workers have some type of pension or retirement savings plan through their workplace, and 25.2 per cent […]

The introduction of more flexible annuity options for capital accumulation plans and reform to prescription drug coverage are among the recommendations by the Canadian Life and Health Insurance Association for the 2019 federal budget. In a letter to the Ministry of Finance, the CLHIA highlighted the increasing need for Canadian retirees to convert some or all of […]

Three-quarters (76 per cent) of U.S. defined benefit plan sponsors with de-risking goals intend to completely divest all of their DB plan liabilities at some point in the future, according to MetLife’ annual pension risk transfer survey. Among all plan sponsors surveyed 10 per cent said they’ll completely divest their plans within the next two years; 24 per […]

In the fourth industrial revolution, technology is changing at a fast pace with a rolling effect on various industries. It’s also changing how people work, spend their money and save, said Jean-Philippe Provost, senior partner and wealth business leader at Mercer Canada. At the consultancy’s annual retirement outlook event on Thursday, Provost walked through current practices in the Canadian […]

Great-West Lifeco Inc. has signed a deal to sell its U.S. annuity and individual life insurance businesses to a subsidiary of Protective Life Corp. for $1.6 billion. Paul Mahon, president and chief executive officer at Great-West Life, says the deal will let the company focus on retirement and asset management markets in the U.S. Protective Life […]

Many defined benefit plans’ funded statuses are in relatively good territory, but with an uncertain investment atmosphere on the horizon, is now a good time for plans to consider taking risk off the table by purchasing an annuity? And for plans looking to de-risk in the future, what considerations are there from an investment perspective? […]

Ontario’s pension regulatory landscape has seen a number of recent changes, with many of these affecting defined contribution plan sponsors, according to one expert. Speaking at the 2018 Defined Contribution Investment Forum in Toronto in September, Mark Eagles, senior manager for pension policy at the Financial Services Commission of Ontario, took delegates through the changes. The […]

Seven major pension stakeholders are urging the federal government to make longevity risk-pooling arrangements available to Canadians. The group includes the Association of Canadian Pension Management, the Canadian Life and Health Insurance Association, the Canadian Institute of Actuaries, the Canadian Association of Retired Persons, Common Wealth, the National Institute of Aging and the Pension Investment Association […]

In the third quarter of 2018, Canadian defined benefit pension plans reached their highest solvency ratio of any quarter since November 2000, according to Mercer’s latest pension health index. Representing a hypothetical plan, the index reached a 112 per cent solvency level as of Sept. 28, 2018, up from 107 per cent at the ned of […]