Disappointingly few Canadians are participating in their workplace retirement savings plans. Those who do aren’t paying much attention. So capital accumulation plan (CAP) sponsors are constantly searching for ways that inspire employees to save enough for retirement. One potential solution involves signing employees up by default.

"Engage, engage, engage” is an apt mantra for the capital accumulation plan (CAP) industry. With disappointing levels of employee engagement in Canadian retirement savings plans, plan sponsors continue to search for ways that inspire employees to save enough for retirement. One potential solution is automatic enrollment with automatic escalation—features that some believe could boost participation rates, particularly among younger workers, and address the engagement issue, too.

Everybody likes money, and everyone likes a good story. This should be welcome news, considering the alarming level of financial ignorance among DC plan members and our obvious inability to address and engage a captive audience in clear need of financial education.

In large part, the current move by many plan sponsors to a DC pension plan has been fuelled by a desire to escape the inherent risks (and costs) associated with sponsoring and administering a DB plan.

Canada’s CAP suppliers had a pretty good year in 2010. Overall, the Top 10 CAP Providers showed double-digit growth (up 16.1% from 2010), as did the Top 10 DC Plan Providers (up 15.9%), the Top 10 Group RRSP Providers (up 15.8%), and the Top 10 DPSP Providers (up 16.2%).

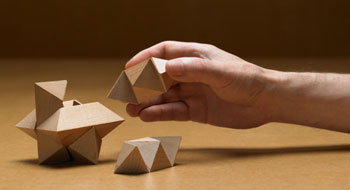

Which factors do you consider when educating your members on their DC plans? Take our poll! A DC pension plan is a wonderful thing: with money from the company, steady investment performance over time and a sprinkling of pixie dust—voilà!—employees can make regular contributions from their own salary and grow a nice lump sum to […]

Watch this video At Unisource Canada, the DC plan is made up of two parts: a basic component and an optional component, and it’s a hit with employees. Larry Ketchabaw, manager, pension and benefits, with Unisource Canada, says the company measures the success of the plan by participation rates. With 90% of employees contributing to […]

Plan members, as investors, appear to remain skittish and nervous about the stock market despite the relatively strong rebound in stock prices over the past two years. Notwithstanding a bump or two along the way, Canada’s TSX has regained all but about 10% of the losses it incurred in the six months following the bursting […]

Plan sponsors often determine their DC plan’s investment structure around what the industry is offering, rather than what is best suited to their own plan objectives and members. It’s time for sponsors to step back and consider the structure that makes the most sense in their particular circumstances—and for the industry to respond accordingly. For […]