As the Canadian Association of Pension Supervisory Authorities looks to update its capital accumulation plan guidelines, the amendments must reflect the changes in the industry, said Angela Mazerolle, vice-president of regulation at the Financial Services and Consumer Services Commission of New Brunswick, during a session at the 2022 Canadian Pension and Benefits Institute Forum in […]

Almost a third (29 per cent) of Canadians believe their employer-sponsored pension plan will be their primary source of retirement income, while 15 per cent said they’re relying on government pension plans, according to LifeWorks Inc.’s latest financial well-being index. The survey, which polled 3,000 Canadian employees, found the overall financial well-being score decreased slightly […]

As the default funds in defined contribution plans evolve, two experts weigh in on the merits of more customized options. Olivia S. Mitchell, professor and director of the Pension Research Council at the Wharton School at the University of Pennsylvania Although DC plan sponsors are legally responsible for selecting and overseeing the investment options offered […]

In 2021, Foresters Financial redesigned its retirement and benefits plans to be more flexible, relevant and competitive, modernizing the plans with the recognition that employees have varying financial priorities. “Overall, we have a very diverse employee base,” says Ken Adams, the financial services company’s vice-president of total rewards. “Someone who is a few years out […]

The vast majority of U.S. employers are eyeing enhancements to their defined contribution pension plans in an effort to boost their employees’ retirement security and financial well-being, according to a new survey by WTW. It found 75 per cent of DC plan sponsors made a change to their plans in the last two years and […]

In 2020, more than 6.2 million Canadians put aside a total of $50.1 billion for their retirement by making contributions to their registered retirement savings plan, according to new data from Statistics Canada. Compared with a year earlier, contributions increased 13 per cent in 2020, while the number of contributors increased 4.9 per cent. In current dollars, the median RRSP contribution […]

In the fall of 2021, 39-year-old Krista Lehman quit her job as a program assistant at a Vancouver post-secondary institution to take a mental-health break and pursue other career options. When it came to her defined benefit pension plan, her employer’s human resources department provided her with a package that offered her the choice of […]

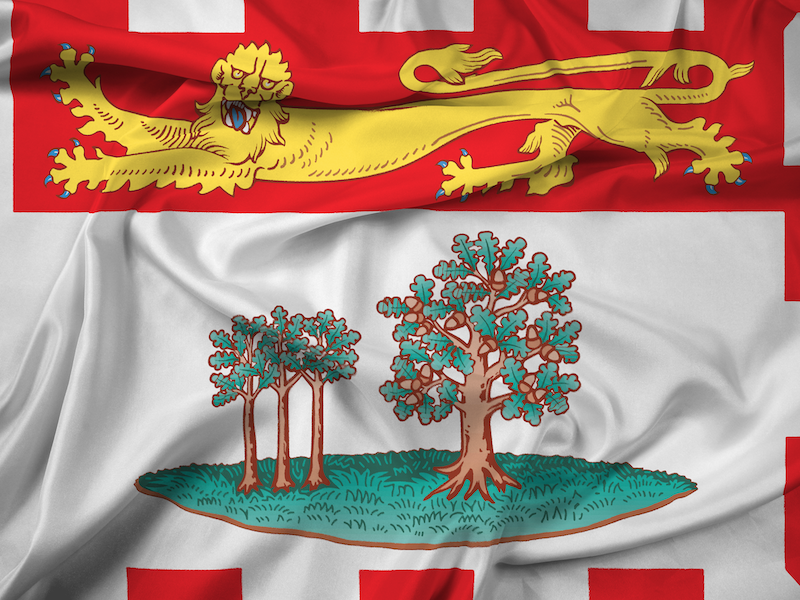

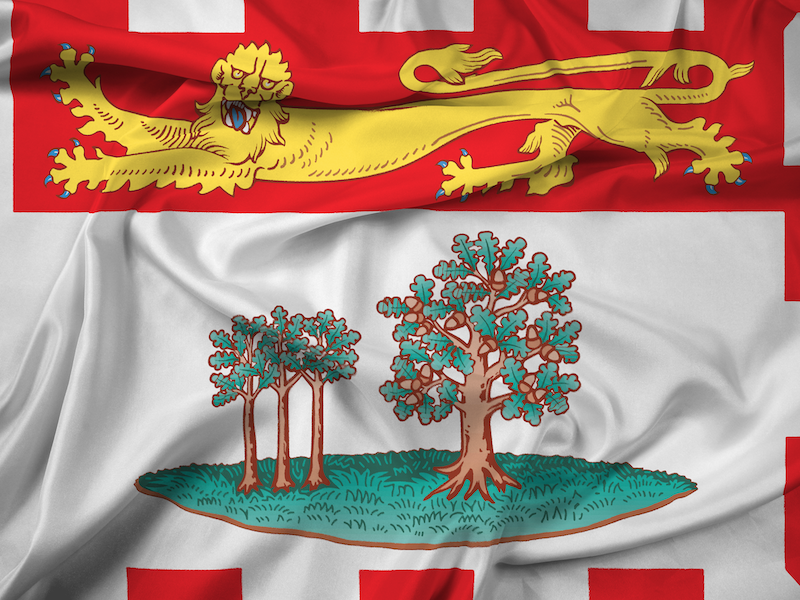

The Association of Canadian Pension Management is calling on Prince Edward Island’s pension regulator to amend the Employment Standards Act to facilitate auto-enrolment and auto-escalation features in workplace pension and savings plans. The current legislation includes language that would prohibit pension plan administrators from introducing automatic features in workplace plans, including capital accumulation plans such […]

In 2020, LifeLabs Inc. embarked on a year-long journey to redesign its group registered retirement savings plan and deferred profit-sharing plan to make them less cumbersome, easier to administer and to boost engagement among employees. Under the original plans, which were in place for more than 10 years and linked to employees’ years of service, […]

Three-quarters (75 per cent) of defined contribution plan sponsors cite reviewing fees as the most important step they took to improve their fiduciary position in 2021, according to a new survey by U.S. investment consulting firm Callan. This was followed by examining the plan’s investment policy statement (63 per cent) and investment structure (61 per cent) […]