Institutional investors in Asia and Europe are at the forefront of adopting environmental, social and governance investment strategies, while North America lags behind, according to a survey by Coalition Greenwich. Globally, the survey found 75 per cent of investors incorporate ESG strategies, with Europe leading at 92 per cent followed by Asia at 76 per […]

An article on how Yellow Corp.’s bankruptcy will impact Canadian workers’ pensions was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. Yellow bankruptcy will have little impact on Canadian workers’ pensions: union 2. FSRA appoints Andrew Fung as EVP of pensions 3. Wildfires crystallizing threats of catastrophic […]

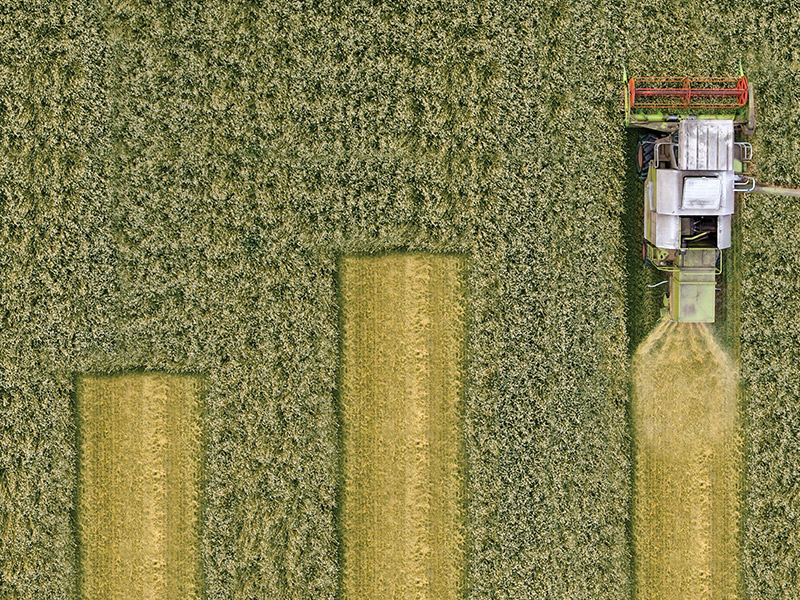

Despite the prevalence of farming in its home province, the Alberta Investment Management Corp.’s agricultural portfolio is just 13 years old, the product of a 2010 investment in converted farmland held by Australian timber producer Great Southern Group. The properties proved too arid for tree growth and were converted back to croplands for canola, wheat […]

British Columbia’s wildfires have crystallized the threats pension plan administrators across that province face from catastrophic climate change events, says Damara Kiceniuk, senior risk analyst of pensions at the B.C. Financial Services Authority. However, these fires are just one catastrophic risk pension funds have to manage. These risks have prompted the organization to release a discussion […]

Approaches to climate scenario analysis are currently based on “implausible” assumptions that could delay action and create fiduciary duty challenges for investors, according to a new study by the Institute & Faculty of Actuaries. Sandy Trust, head of organizational risk at M&G, a global investment manager headquartered in London, England and one of the authors […]

The leaders of 11 of Canada’s largest public sector pension investment organizations are calling on companies to adopt a new framework that would consolidate existing disclosure standards, including those from the sustainability accounting standards board and the task force on climate-related financial disclosures. The framework, which was set out by the International Sustainability Standards Board, […]

The Healthcare of Ontario Pension Plan is recognizing the property managers of nine Canadian buildings among the winners of its Leadership in Environmental Advancement Program awards. The LEAP awards, which were launched in 2011, recognize property managers of buildings in the pension organization’s property portfolio for efforts related to energy conservation and greenhouse gas emission […]

As world markets contend with supply chain issues stemming from climate change, the coronavirus pandemic and Russia’s invasion of Ukraine, environmental, social and governance considerations are slowly taking a more prominent role in pension funds’ risk assessments. In particular, Canadian pension funds are taking a progressive approach to ESG investing. Many have become signatories of […]

When Richard Manley, chief sustainability officer at the Canada Pension Plan Investment Board, joined the organization as managing director and head of sustainable investing in 2019, global financial markets were slowly dialling up the focus and integration of environmental, social and governance factors into investment strategies. Over the last three years — amid the ongoing […]

The Investment Management Corp. of Ontario is reporting that the weighted average net return of its clients’ portfolios was negative 8.1 per cent for the year ended Dec. 31, 2022, which narrowly beat its consolidated benchmark return of negative 8.4 per cent. Over the three years since assets have been managed according to the IMCO’s strategies, the annualized return […]