Variable payment life annuities and the impact of gender identity on actuarial standards are among the issues the Canadian Institute of Actuaries is monitoring in 2025, says Simon Nelson, a principal at Eckler Ltd. and chair of the CIA’s pension practice committee. A CIA task force on VPLAs will present its findings early this year, […]

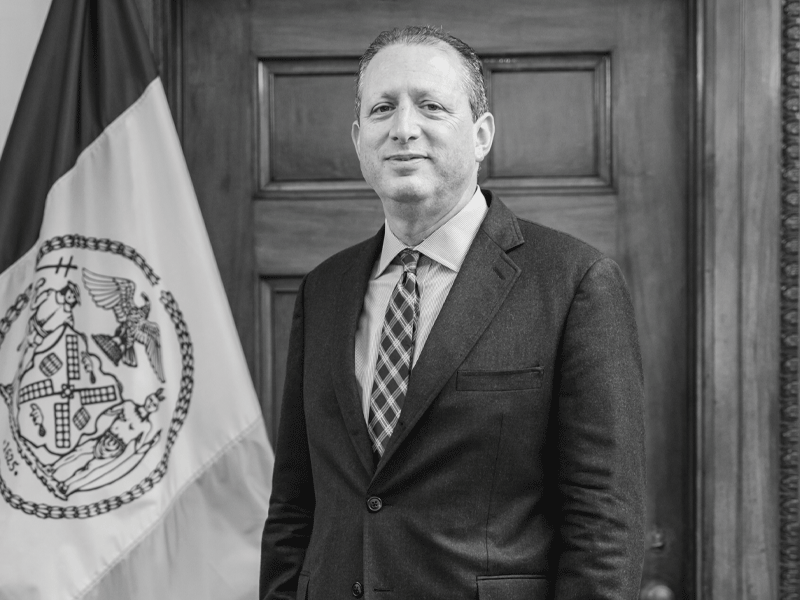

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

Climate risk and energy transition present huge investment opportunities for pension plan sponsors seeking to invest for the long term, said Bertrand Millot, head of sustainability at the Caisse de dépôt et placement du Québec, speaking during a panel session at an event hosted by the United Nations’ principles for responsible investment in Toronto earlier […]

Institutional investors are disclosing the environmental impact of their assets through increasingly sophisticated sustainability reports that use the latest disclosure metrics. While some of Canada’s largest pension funds are at the forefront of how to leverage responsible investment mandates and attempt to enact change through leadership in global organizations, the shortcomings of data reporting standards […]

The Pension Investment Association of Canada supports closely aligning the Canadian Sustainability Standards Board disclosure standards with the International Sustainability Standards Board’s requirements but recommends it only make necessary Canadian-specific modifications to the guidance. In an open letter to the CSSB, the PIAC noted alignment between financial and sustainability reporting supports “a connectivity that is essential […]

Institutional investors are preparing for a bumpy return risk space where volatility is higher for all assets and real returns are much lower than what has been the norm over the past 10 years, said Robertas Stancikas, a senior research associate of institutional solutions at AllianceBernstein, during the Canadian Investment Review‘s 2023 Investment Innovation Conference in […]

The Pension Investment Association of Canada is calling on the B.C. Financial Services Authority to reconsider implementing new standards for climate-related risks analysis guidelines, noting it would be extremely challenging for most pension plans to meet a potential new climate and transition risk review system. In an open letter, the PIAC recommended a principles-based approach to […]

The Canadian Association of Pension Supervisory Authorities’ new risk management guideline allows for additional flexibility amid evolving issues such as cybersecurity and environmental, social and governance considerations, said David Bartucci, head of pension regulations and regulatory effectiveness at the Financial Services Regulatory Authority of Ontario and a member of the CAPSA’s risk management committee, during […]

There’s no one-size-fits-all approach for pension funds looking to use an environmental, social and governance lens in their investment approach, according to a new publication from the pension research council at the Wharton School of the University of Pennsylvania. Olivia Mitchell, a professor and executive director of the pension research council at the University of Pennsylvania’s Wharton […]

Approaches to climate scenario analysis are currently based on “implausible” assumptions that could delay action and create fiduciary duty challenges for investors, according to a new study by the Institute & Faculty of Actuaries. Sandy Trust, head of organizational risk at M&G, a global investment manager headquartered in London, England and one of the authors […]