A Federal Court of Appeal ruling will make it very difficult for executives and employees to treat share transfers from their companies as capital gains rather than income. The decision involved Kitchener, Ont.-based D2L Corp., whose intention was to distribute appreciated shares of the company, held in a trust, to various employees. In turn, the […]

Canada’s new employee stock option tax rules are raising a number of questions for employers, says David Crawford, a partner at Hugessen Consulting Inc. The new rules — part of the 2021 federal budget signed into law on June 29 — include an annual limit of $200,000 that will apply on stock option grants that […]

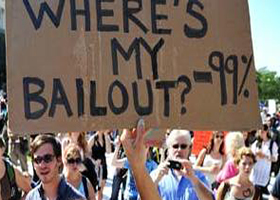

Corporations can't possibly foot the bill for sovereign debt.