Five years after Ontario’s auditor general uncovered an issue with the way the province was including pension assets in its financial statements, the office is proposing changes related to accounting in defined benefit pension plans. The auditor general’s 2016 annual report revealed a deficit of $5 billion, while the province’s government set the deficit at […]

With October inflation hitting an 18-year high, inflation risk is back on the radar of plan sponsors providing inflation-linked defined benefit pensions. In the past, it’s been challenging to hedge inflation risk. Fortunately, more efficient solutions have emerged over the last several years. What is inflation risk? For a plan that provides inflation-linked benefits, inflation […]

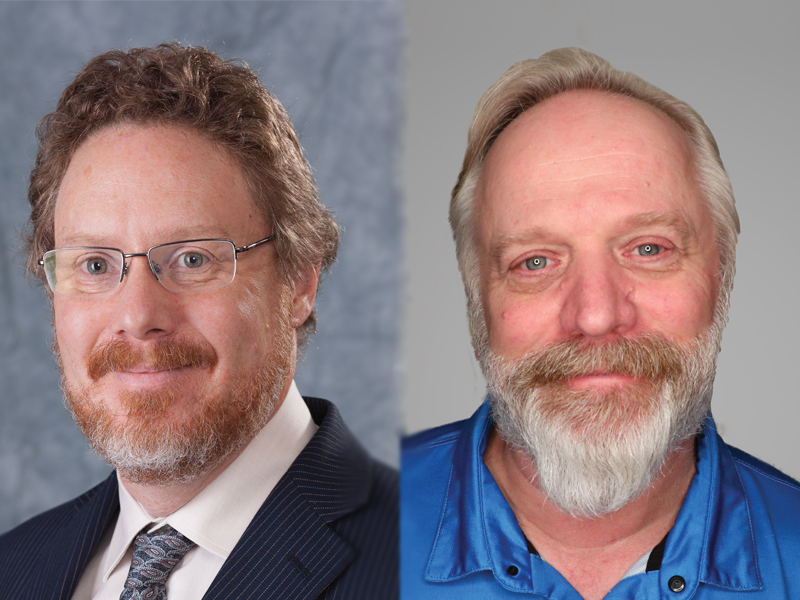

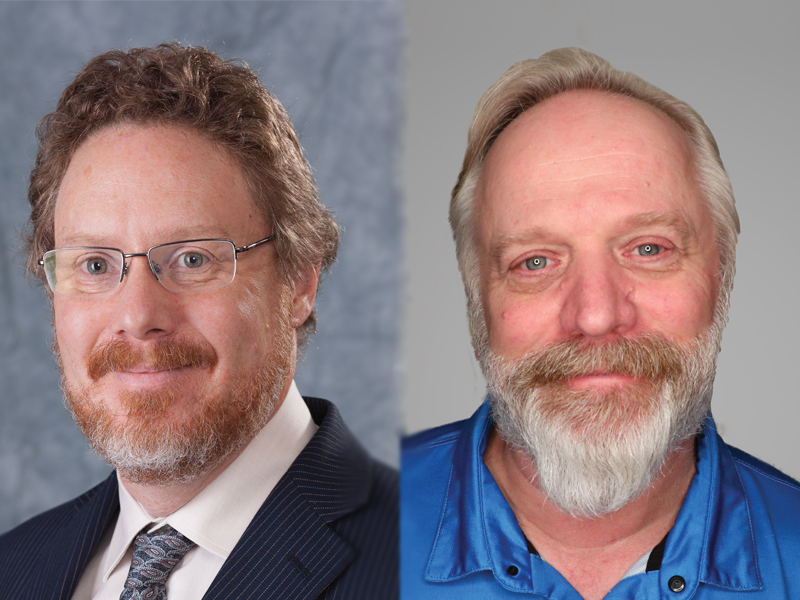

With defined benefit pension solvency reforms gradually coming in across the country, two experts debate whether there’s a better way to ensure DB plan sustainability and security. Todd Saulnier, vice-president, the Association of Canadian Pension Management’s board of directors The answer is mostly yes. A floor of 85 per cent of solvency liability might be […]

Ohio’s largest public employee pension fund is suing Facebook — now known as Meta — alleging that it broke U.S. federal securities law by purposely misleading the public about the negative effects of its social platforms and the algorithms that run them. The lawsuit by the Ohio Public Employees Retirement System specifically claims that Facebook buried inconvenient findings […]

Some four decades ago, parliamentarians voted to restrict pension funds’ ability to borrow money without losing their tax-exempt status, though their reasoning has been lost to time. “These rules have been around forever, but . . . their intended purpose [remains obscure],” said Matias Milet, a partner at Osler, Hoskin and Harcourt LLP, during a […]

As places of economic activity, flood plains have their advantages — just ask the ancient Mesopotamians or the staff of the Winnipeg-based Teachers’ Retirement Allowance Fund. “Those of you who have been to our offices will know we’re right at the intersection of the Red and Assiniboine rivers. We are right in the flood plain […]

The recent emphasis on environmental, social and governance issues among pension investors will continue to dominate industry conversations in the future, according to a panel discussion with three high-profile figures in Canada’s investment sector during the 2021 Global Investment Conference. “If I could rename ESG, it would be GES,” said Alain Malaket, chief executive officer […]

The end of Canada’s quantitative easing strategy and higher than expected interest rates will be beneficial to Canadian defined benefit pension plans, according to Sebastien Betermier, an associate professor of finance at McGill University’s Desautels Faculty of Management. On Wednesday, Tiff Macklem, governor of the Bank of Canada, announced plans to end its quantitative easing policy and […]

After being off of Canadians’ radar screens for years, the re-emergence of inflation in recent months is receiving significant attention for many, including pension plan professionals. Some believe the inflationary increases will be transitory because recent price increases are primarily due to short-term disruptions in the Canadian economy caused by the emergence from restrictions due […]

The U.S. Department of Labor is proposing new rules that would give pension plan fiduciaries the ability to make investment decisions based on environmental, social and governance factors. If adopted, the rules would amend the Employee Retirement Income Security Act of 1974. In its summary of the proposed changes, the Department of Labor said they’d […]