The end of the federal government’s real return bond program will deprive institutional investors and pension plan members of a valuable investment tool that can help protect against inflation, according to a new report by the C.D. Howe Institute. It found a majority of Canada’s largest institutional investors are interested in investing in real return bonds and […]

Ontario’s proposed regulatory framework for target-benefit pension plans includes requirements that are more prescriptive than other jurisdictions and could result in additional costs and reduced benefits for plan members, said the Association of Canadian Pension Management. In an open letter, the ACPM noted the inclusion of policies — such as those determining funding and benefits, […]

Eduard van Gelderen, the Public Sector Pension Investment Board’s senior vice-president and chief investment officer, is stepping down after six years with the organization. Effective immediately, Alexandre Roy, PSP Investments’ senior managing director of total fund management, will assume the CIO’s responsibilities on an interim basis, according to a press release. Read: PSP Investments appointing Oliver […]

The Ontario Teachers’ Pension Plan is appointing Mabel Wong as its chief financial officer, effective immediately. She officially enters the role after serving as acting CFO following the departure of Tim Deacon in April. Her responsibilities include financial management and reporting, valuation, risk analytics, financial operations and strategic finance initiatives. Read: Tim Deacon leaving Ontario Teachers’ for Sun Life […]

The Ontario Teachers’ Pension Plan earned a net return of 4.2 per cent for the first six months of this year. The result came as the pension fund earned net investment income of $10.8 billion for the period. The Ontario Teachers’ had $255.8 billion in total net assets at June 30. Read: Ontario Teachers’ returns 1.9% for 2023 The results for […]

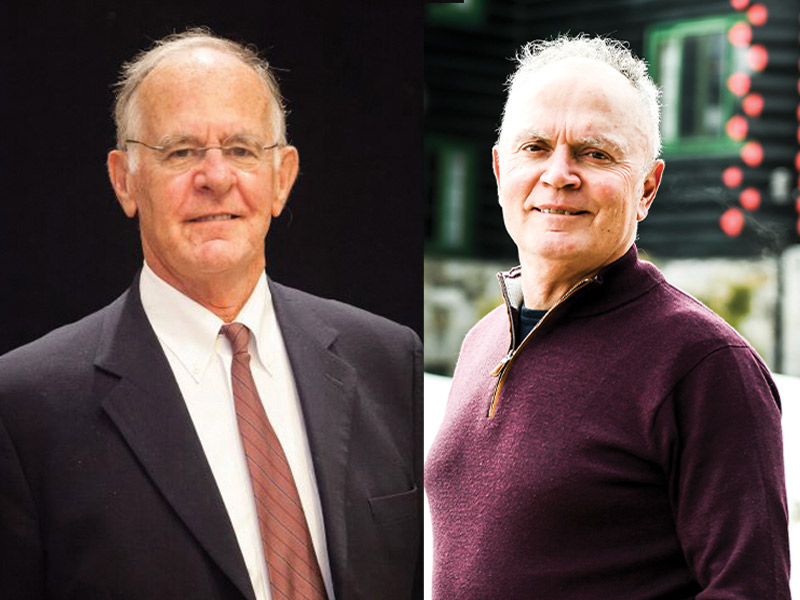

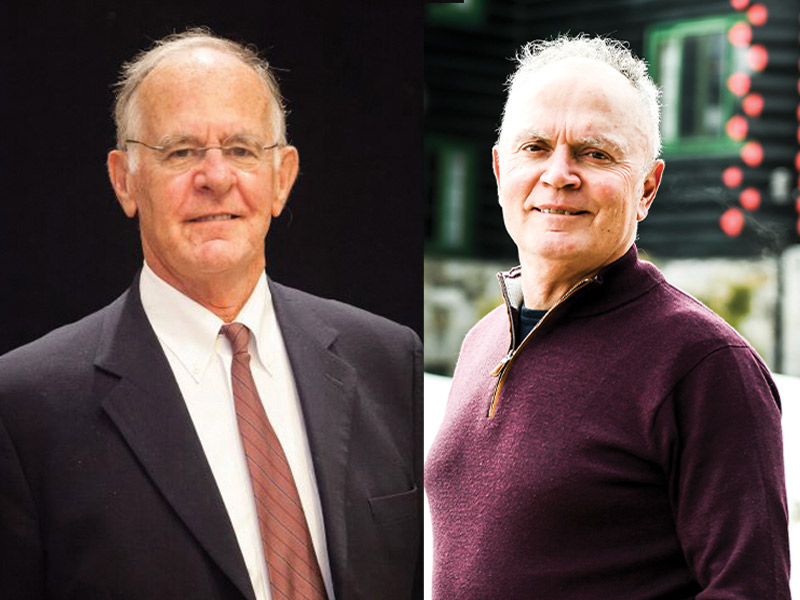

One actuary says social and technological factors are changing the concept of retirement, while another notes the fundamentals remain the same. Michel St-Germain, retired actuary, fellow and past president of the Canadian Institute of Actuaries Yogi Berra once said: “The future ain’t what it used to be.” Millennials will be retiring in 25 years, but not […]

Amid an increasingly volatile global economy, many institutional investors are employing innovative investment strategies to deliver returns, but Suncor Energy Inc. views a methodical adoption of new trends as key to plan stability. A conservative approach and a balanced portfolio has allowed Suncor to deliver sustainable contributions and growth to its pension plans. At the […]

The Association of Canadian Pension Management is urging the Ontario government to ensure its proposed amendment to the Succession Law Reform Act doesn’t introduce unintended confusion or ambiguities that would make it challenging for pension plan sponsors, administrators and trustees to carry out their duties. In an open letter, the ACPM said the language of the […]

The average Canadian defined benefit pension plan posted a median return of 1.1 per cent in the second quarter of 2024, according to a new report by RBC Investor Services. The report, which tracks performance and asset allocation across Canadian DB plans, also found that the plans saw a return of 4.4 per cent for […]

The Nova Scotia Pension Services Corp. — which administers the investment assets of the Public Service Superannuation Plan and the Teachers’ Pension Plan — reported an increase in net assets to $13.7 billion, a year-over-year increase of about $670 million, for the fiscal year ending March 31, 2024. The PSSP saw an investment return of 7.93 […]