Retirees with defined benefit pension plans are less likely to draw down their savings to cover their spending than those with a defined contribution plan, according to a new report by the University of Michigan. It found while most employees born between 1920 and 1940 had access to a DB plan, this percentage dropped dramatically […]

As employers increasingly customize their human resources, benefits and pension communications campaigns, how are these methods connecting with employees? Long gone are the days of chunky tomes of group benefits and pension information. Once the norm, those pages and pages of minutiae have gradually been replaced by more personalized and targeted communications. “Direct communication is […]

As the move away from traditional defined benefit plans continues and intensifies, Canada’s multi-employer pension plans are providing employers with another retirement savings option for their employees. And despite facing a number of challenges, from industries in decline to legislative obstacles, MEPPs continue to attract plan sponsors from across the country. Read: Canadian MEPPs facing challenges […]

Pension coverage in the public sector is high, with the vast majority of public sector employees covered by a defined benefit pension plan. However, the story is very different in the private sector as pension coverage is much lower and is trending downwards. Only 22 per cent of private sector employees participated in a registered […]

Earlier this year, I received an email from a Canadian National Railway Co. employee who had recently learned their defined benefit pension plan was winding up and they’d be moved into a defined contribution plan. According to the plan member — who will remain anonymous — CN closed the DB plan to new hires more […]

As the default funds in defined contribution plans evolve, two experts weigh in on the merits of more customized options. Olivia S. Mitchell, professor and director of the Pension Research Council at the Wharton School at the University of Pennsylvania Although DC plan sponsors are legally responsible for selecting and overseeing the investment options offered […]

In 2021, Foresters Financial redesigned its retirement and benefits plans to be more flexible, relevant and competitive, modernizing the plans with the recognition that employees have varying financial priorities. “Overall, we have a very diverse employee base,” says Ken Adams, the financial services company’s vice-president of total rewards. “Someone who is a few years out […]

The vast majority of U.S. employers are eyeing enhancements to their defined contribution pension plans in an effort to boost their employees’ retirement security and financial well-being, according to a new survey by WTW. It found 75 per cent of DC plan sponsors made a change to their plans in the last two years and […]

In the fall of 2021, 39-year-old Krista Lehman quit her job as a program assistant at a Vancouver post-secondary institution to take a mental-health break and pursue other career options. When it came to her defined benefit pension plan, her employer’s human resources department provided her with a package that offered her the choice of […]

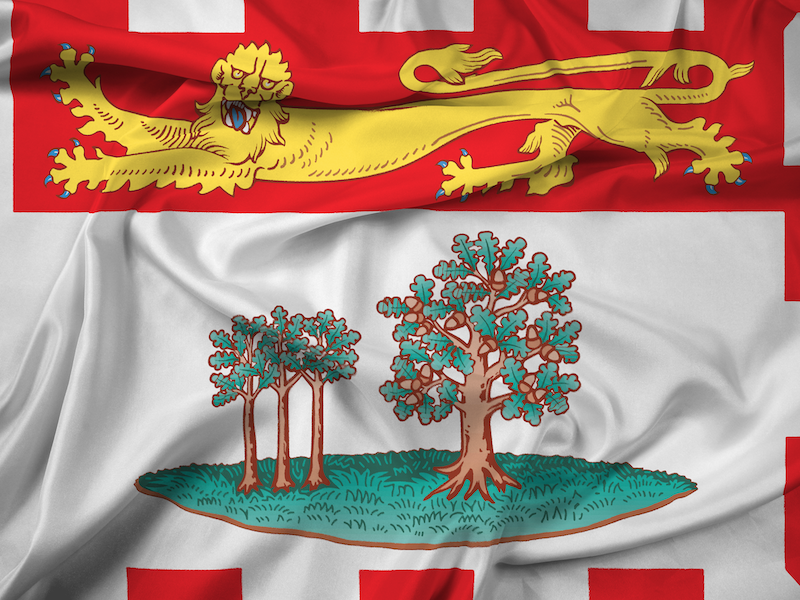

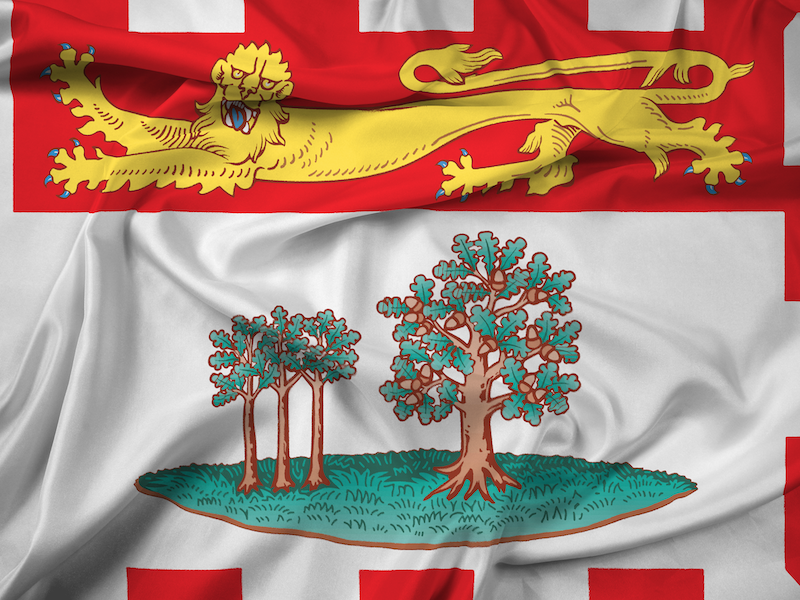

The Association of Canadian Pension Management is calling on Prince Edward Island’s pension regulator to amend the Employment Standards Act to facilitate auto-enrolment and auto-escalation features in workplace pension and savings plans. The current legislation includes language that would prohibit pension plan administrators from introducing automatic features in workplace plans, including capital accumulation plans such […]