In considering changes to its retirement savings programs, Rogers Communications Inc. is generally focused on three main internal and external factors: regulatory changes, employee feedback and demographics. “As we see the millennial and gen Z workforce grow quite a bit, we’re really trying to understand what that’s going to do to our plans in terms […]

The Halifax Port ILA/HEA found a way to provide its defined contribution pension plan members with a defined benefit upon retirement — and it’s been doing so successfully for 35 years. As a private sector multi-employer plan, the pension has about 450 active members, 300 retirees and about $210 million in assets. The DB plan […]

Benefits Canada is proud to announce the finalists of the 2020 Workplace Benefits Awards. While this year’s entry and judging process occurred during the coronavirus pandemic, almost 100 leading employers embraced the opportunity to share their organization’s innovative initiatives and strategies. In fact, Benefits Canada even introduced a new category — Coronavirus and benefits — which received the most entries, so we divided […]

The U.S. Department of Labor is taking jabs at the inclusion of environmental, social and governance products in capital accumulation plans — and it could be to members’ detriment. In late June, the Department of Labor proposed new rules around ESG products in retirement accounts. “The proposal is designed, in part, to make clear that . […]

Janitors working at Loyalist College in Belleville, Ont. have a new ratified contract that includes a pension plan, sick days and a wage increase. The employees, represented by the Services Employees International Union Local 2 and working for the food services company Compass Group Canada Ltd., entered bargaining with major concerns around the lack of sick […]

Over the last several years, a small group of faculty members at the University of British Columbia has been calling on its pension plan’s board of trustees to consider divesting from fossil fuels. As support for divestment grew, the board of the UBC faculty pension plan, which is defined contribution, agreed to assess whether there […]

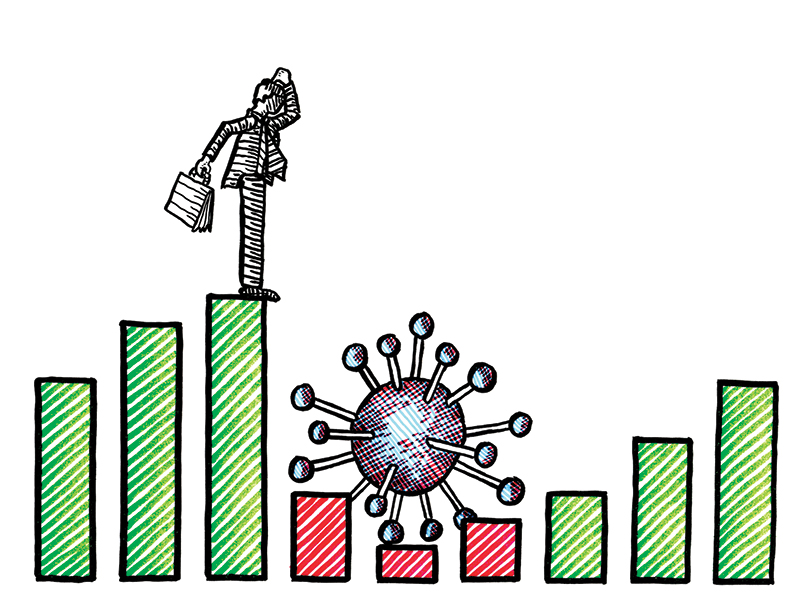

For defined contribution plan members who were intending to retire in the first half of 2020, the market crash caused by the coronavirus may have upended those plans. Markets reached a trough in March, followed by some recovery, but with little clarity on what investments will do next, it’s a challenging time for plan members […]

Much debate remains as to whether private equity is an appropriate option for members of capital accumulation plans. Canada’s neighbours to the south have been examining the potential legal pitfalls of these allocations. A recent information letter from the U.S. department of labor set forth a framework plan sponsors can use to consider the prudence […]

Canadian defined benefit plan sponsors are holding an almost equal amount of fixed income and equity in their portfolios, according to the Pension Investment Association of Canada’s 2019 asset mix report. The report found the PIAC’s membership reported a total of more than $2.2 trillion under management last year, up from just under $2.1 trillion in 2018. As well, […]

The Association of Canadian Pension Management is calling on the Ontario government to consider amending the Employment Standards Act and the Pension Benefits Act to allow for auto-enrolment and auto-escalation features in capital accumulation plans. Specifically, it’s suggesting the government allow employers to automatically deduct employee contributions from payroll to facilitate these features. “The shift […]