Following a surprising U.S. presidential election, both major political parties are facing a realignment of priorities, said Lew Lukens, senior partner at Signum Global Advisors, during the keynote session at the Canadian Investment Review’s 2024 Investment Innovation Conference. Lukens was surprised by Donald Trump’s win in November since he projected the democratic candidate Kamala Harris […]

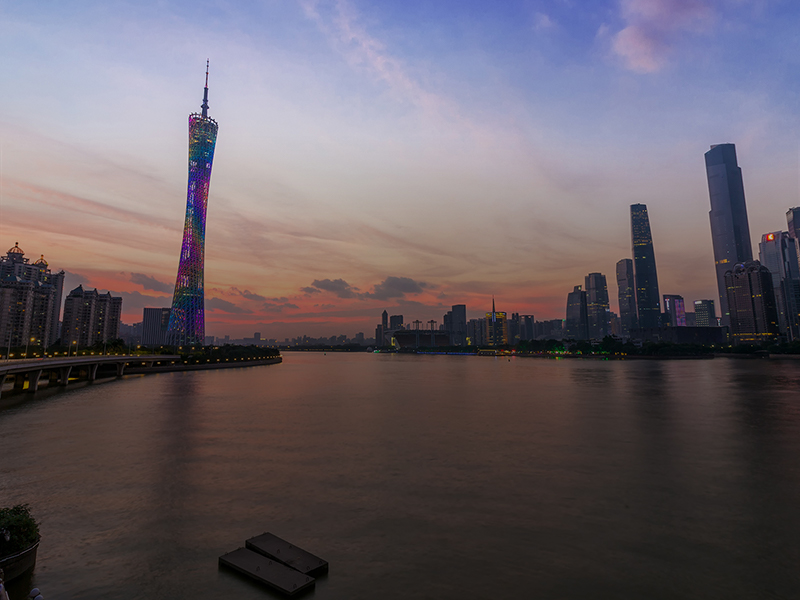

Institutional investors are putting China’s dominance as an emerging market under consideration at a time of economic uncertainty for the country typically known as a staple in the investment category. The uncertainty stems from several structural issues, such as the combination of an ageing population, high debt levels and weak fiscal status for local governments, […]

Walmart Inc. is rolling back its diversity, equity and inclusion policies, joining a growing list of major corporations that have done the same after coming under attack by conservative activists. The changes, confirmed by Walmart on Monday, are sweeping and include everything from not renewing a five-year commitment for a racial equity centre set up […]

The prospect of a Joe Biden presidency with a Republican-held senate is an ideal outcome for markets, said Charles Myers, founder and chairman of Signum Global Advisors, during the Canadian Investment Review’s Investment Innovation Conference in November. Speaking the morning after the election, Myers said Republicans’ expected continued control of the senate would have “very […]

President-elect Joe Biden will inherit a vulnerable economic recovery under threat from a resurgent virus, likely with a divided Congress that will hinder his ability to address the challenges. Yet despite the obstacles, the former vice-president and senator will pursue a drastic shift in America’s economic policy. He has vowed to reverse much of the […]

With U.S. stock prices exceeding pre-coronavirus highs and credit spreads nearly as tight as before the pandemic, investors are signalling overconfidence in the market, says Rob Almeida, portfolio manager and global investment strategist at MFS Investment Management. While polls and betting odds appear to be favouring a Joe Biden win, that doesn’t align with what […]

In China, keeping the novel coronavirus under control is key to maintaining the economic recovery, and there are reasons to be optimistic, despite a breakdown in U.S.-China relations. In the last two weeks of August, there were a total of only 187 new coronavirus cases in China, and none of those were the result of […]

The Federal Reserve took massive emergency action Sunday to try to help the economy withstand the coronavirus by slashing its benchmark interest rate to near zero and saying it would buy $700 billion in Treasury and mortgage bonds. The Fed’s surprise announcement signalled its rising concern that the viral outbreak will depress economic growth in […]

U.S. business economists are slightly more optimistic about economic growth than they were three months ago, and most foresee sales at their companies remaining solid. Those findings emerge from the latest survey by the National Association for Business Economics being released Monday. It found that 67 per cent of the business economists who responded to […]

As talks of U.S.-China trade tensions dominate headlines, many investors are keeping a close watch. On June 29, 2019, U.S. President Donald Trump and Chinese leader Xi Jinping met on the margins of the G20 in Japan. What really stood out from the meeting is that an agreement was reached to resume trade negotiations, says […]