Growing drug plan costs are putting pressure on benefits plan sponsors to move to managed formularies—but industry stakeholders must first work together to change the drug evaluation process to ensure coverage decisions deliver the best value.

Express Scripts Canada has launched a mobile version of its Online Prescription Manager service, accessible at https://member.express-scripts.ca.

Just a year after the Ontario government gave the green light to remote dispensing machines, the fate of the controversial technology is up in the air with the bankruptcy of PharmaTrust.

It was with disappointment that I read about the recent bankruptcy of PCAS Patient Care Automation Services Inc., and the related companies that were commonly known as PharmaTrust, the manufacturer of remote dispensing machines.

Brian Mulroney is wading into the high-stakes debate over patent protection in the free trade talks with Europe, and he's clearly taking sides.

Drug spending in Canada continues to increase and is closely watched by employers. However, a recent report from the Canadian Institute for Health Information’s (CIHI) has revealed some unexpected results.

Drug spend in Canada may have remained flat in 2011, but private drug plans wasted approximately $5 billion last year, according to Express Scripts Canada’s latest Drug Trend Report.

Back in the 1980s, when I worked in my father’s pharmacy, everything was fair game from a drug reimbursement standpoint. It’s incredible to think that, decades later, private drug plans have not become materially more sophisticated in how they manage what is and isn’t paid for.

It’s strange that, in all of this, there has been very little attention placed on the 70% to 75% of private plan spending that is still represented by spending on brand name products. It’s even more surprising that there is less focus on the pipeline of innovation that awaits the marketplace.

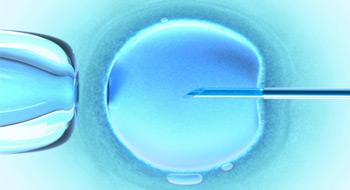

Infertility is on the rise in Canada, as various studies referenced in the March 2012 issue of Human Reproduction indicate. In 2009/10, 16% of heterosexual couples in which the woman is age 18 to 44 are experiencing infertility—nearly double the 1992 figure (8.5%).