CPPIB Credit Investments Inc., a wholly owned subsidiary of the Canada Pension Plan Investment Board, is selling 10 million shares in Battle North Gold Corp. The shares of the Canadian gold mine developer, formerly known as Rubicon Minerals Corp., sold for $1.85 per share for a total aggregate sale price of $18.5 million. Read: Caisse buying return royalty […]

Diversified pooled fund managers had a positive second quarter of 2020, posting a median return of 11 per cent before management fees, according to the Morneau Shepell universe of pension manager’s pooled funds. Despite the strong results, the return was 1.2 per cent lower than the benchmark portfolio used by many pension plans. Further, the […]

Canadian defined benefit pension plans recovered some of their losses from the start of 2020 in the second quarter off the back of strong public equity gains, according to the Northern Trust Canada universe. With stimulus spending to tackle the economic impacts of the coronavirus pandemic taking effect in many countries, stock markets rebounded with double-digit […]

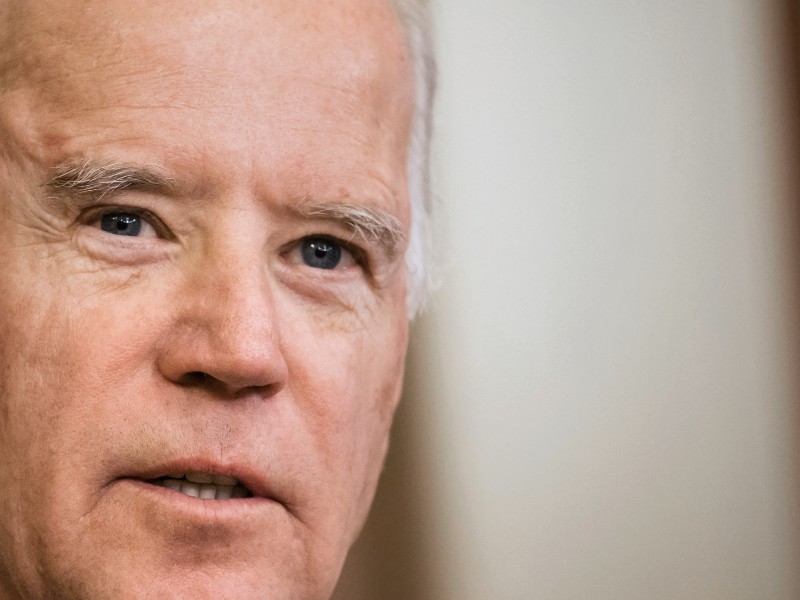

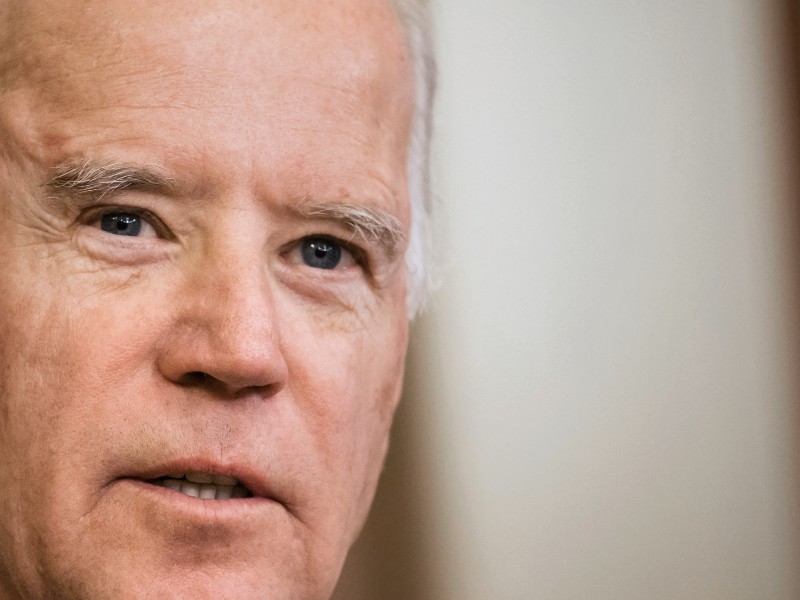

Former vice-president Joseph Biden will inherit an economy beleaguered by the battle against the coronavirus if he wins the election in November. The recession will influence his legislative priorities in both the short and long term; however, Biden has indicated that he would raise an array of corporate and personal taxes to finance domestic programs, […]

The Canada Pension Plan Investment Board is adding Boon Sim to its board of directors. Sim held senior leadership roles at Singapore-based investment house Temasek International between 2012 and 2017, most recently as president for the Americas, head of markets groups and head of life science and credit portfolios. Prior to his time at Temasek, he […]

During 2020’s second quarter rebound, U.S. equities saw stronger performance than other developed markets like the U.K. and the rest of Europe. However, during the coronavirus pandemic so far, factors have moved largely in tandem in those geographies, according to Philip Lawlor, managing director and head of global investment research at FTSE Russell, during a webinar […]

The Public Sector Pension Investment Board saw a negative 0.6 per cent return for its last fiscal year, which ended March 31, 2020. Severe market declines in the lead up to the end of March took a heavy toll. However, the fund did outperform its reference portfolio’s benchmark, which posted a negative 2.2 per cent […]

Canada’s 11 largest pension funds should be able to maintain their current credit ratings through ongoing market turmoil, according to Fitch Ratings Inc. Nevertheless, return expectations are under significant pressure from the economic fallout of the coronavirus pandemic, said the ratings agency in a new report. “Fund performance will depend on asset mix, which is largely […]

With its recent acquisition of environmental, social and governance data analytics provider Sustainalytics, Morningstar Inc. is taking aim at the disparate ESG disclosure requirements still hampering the investment industry. In a recent report, Morningstar sussed out some of the issues hindering ESG measurement tools. “Simply put, ESG disclosures from issuers are all too often inconsistent and […]

The Ontario Teachers’ Pension Plan’s 2019 climate change report contains its first-ever, independently assured portfolio carbon footprint. Even as the plan’s assets grew in 2019, it’s overall carbon footprint fell by about 15 per cent, driven in large part by the sale of a particularly high-emitting private asset, according to the report, which was assured […]