An advocacy group is calling on Canada’s public pension managers to use their financial heft to more publicly work to reduce climate change as political efforts become less reliable. In a new report, Shift Action for Pension Wealth and Planet Health says Canada’s big pension funds need to recognize the power and influence they wield and to […]

Implementation of harmonized minimum funding regulations for federally regulated defined benefit pension plans tops the Pension Investment Association of Canada’s list of advocacy priorities in 2025. Currently, DB plan sponsors are operating amid a patchwork of minimum funding regulations across the country, as most provinces have introduced requirements of their own. “A unified ‘going-concern plus’ regime […]

The urgency surrounding the climate change crisis is pushing institutional investors to focus on stricter measurements in the fight against confusing data that delays meaningful action. But voluntary measurements won’t be enough, as investors have already raised red flags against unreliable climate impact measurements getting in the way of their emissions reduction goals. The start […]

Institutional investors are facing significant barriers to including Scope 3 emissions as part of their disclosure strategy for environmental assets, according to a new report by the United Nations’ Net-Zero Asset Owner Alliance. It found asset owners need to accommodate Scope 3 emission disclosures as part of their overall strategy to create a meaningful climate-centric […]

The Canadian Sustainability Standards Board has released its sustainability disclosure standards that align with global sustainability disclosure guidelines, while addressing specific Canadian circumstances. The framework includes general requirements for disclosure of sustainability-related financial information (CSDS 1) and climate-related disclosures (CSDS 2). Ten of Canada’s largest pension plan sponsors and investment managers, representing more than $2.25 […]

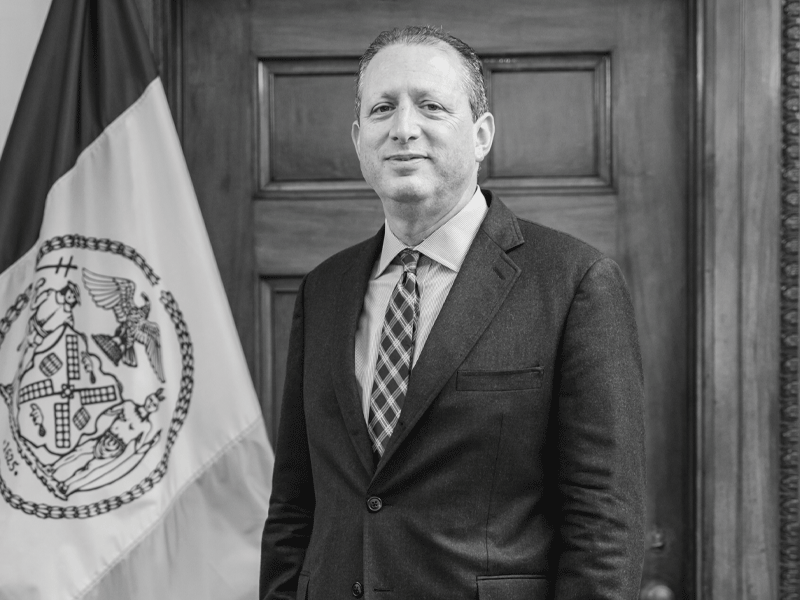

Brad Lander is advocating for public pension funds to enforce their responsible investment mandates even if that pits them against their partners. As New York City comptroller and chief financial officer, he’s the investment advisor and custodian for the city’s five public pension funds. In the role, he oversees the investment guidelines and allocations strategy […]

The Canadian edition of an international set of sustainability investment disclosure standards will be officially released in December, according to the Canadian Sustainability Standards Board. The organization was tasked with creating a set of sustainability investment standards in Canada based on those created by the International Sustainability Standards Board. The two new disclosure metrics — CSDS […]

Finance Minister Chrystia Freeland said the federal government is moving ahead with guidelines around sustainable investing and corporate climate disclosures, but details on the plans are scarce. The move comes as a wide range of investors, asset managers and environmental groups have been pushing the government to roll out such guidelines, also known as green […]

After several years of development, two long-awaited national health-care initiatives are finally taking shape, raising questions about their impact to employer-sponsored benefits plans. In May, the Canadian Dental Care Plan was officially rolled out, providing dental coverage to Canadians who don’t have access to private dental insurance and whose annual net family income is less […]

Institutional investors are disclosing the environmental impact of their assets through increasingly sophisticated sustainability reports that use the latest disclosure metrics. While some of Canada’s largest pension funds are at the forefront of how to leverage responsible investment mandates and attempt to enact change through leadership in global organizations, the shortcomings of data reporting standards […]