The Investment Management Corp. of Ontario is reporting that the weighted average net return of its clients’ portfolios was negative 8.1 per cent for the year ended Dec. 31, 2022, which narrowly beat its consolidated benchmark return of negative 8.4 per cent. Over the three years since assets have been managed according to the IMCO’s strategies, the annualized return […]

The Alberta Investment Management Corp. is revealing details of how environmental, social and governance factors are used alongside traditional financial analysis in its investment strategy. According to its first standalone report on ESG integration, the AIMCo first screens potential investments against exclusion guidelines set forth by each of its clients, a group that includes nine […]

The Public Sector Pension Investment Board is updating its proxy voting guidelines to communicate its views on sound corporate governance practices and climate change. According to the guidelines, boards of directors at the companies in which PSP Investments invests, are expected to ensure climate risks and opportunities are integrated into their strategy and operations. They […]

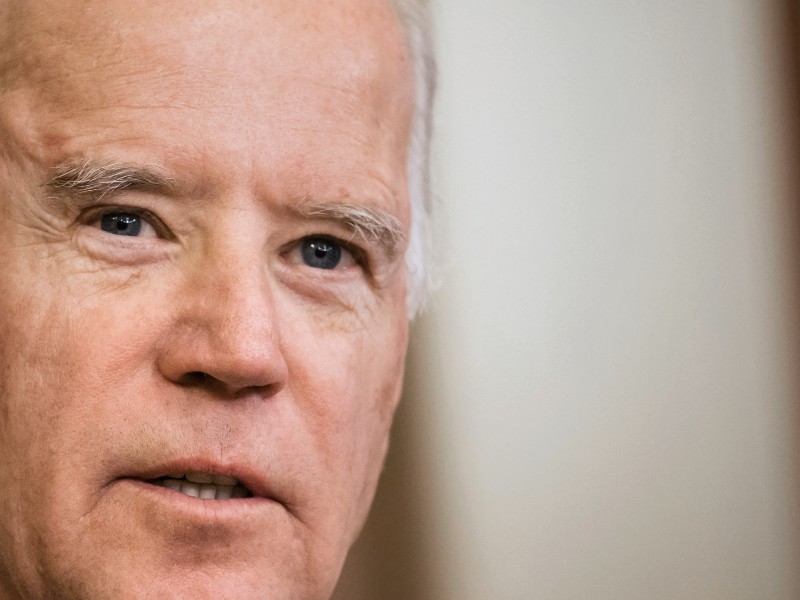

A resolution to reverse a rule allowing U.S. pension investors to consider environmental, social and governance criteria has been blocked by President Joe Biden. “It would put at risk the retirement savings of people across the country,” the president said after issuing his first-ever veto. Through the office’s veto power, a president may block any […]

The answer is complicated because environmental, social and governance investing is a relatively new risk, not all ESG factors are material for every industry and the return profile ultimately depends on whether a policy successfully incorporates material factors into investment decisions. Chris Reynolds, manager of pension policy at Canada Post Corp. ESG investing, often referred […]

Demand for international pensions and savings vehicles is continuing to grow as employers try to optimize their benefits packages for different groups within their global workforce, according to a new survey by WTW. Its 15th annual international pension plan survey, which covered more than 1,000 international pension and savings plans sponsored by 955 organizations, found […]

A new report is calling on Canada to develop a sustainable finance taxonomy in order for it to reach its carbon emissions targets. “Many countries have developed, or are in the process of developing, taxonomies as a foundational tool within a broader policy framework to help mobilize and accelerate the deployment of capital to combat […]

Canada requires clear, consistent guidance on the integration and reporting of sustainability factors into investment decisions, according to a new report from the United Nations-based principles for responsible investment. “There are currently no consistent regulatory requirements for sustainability reporting that apply to all investors and issuers across Canada,” noted the report. “Without such a tool, […]

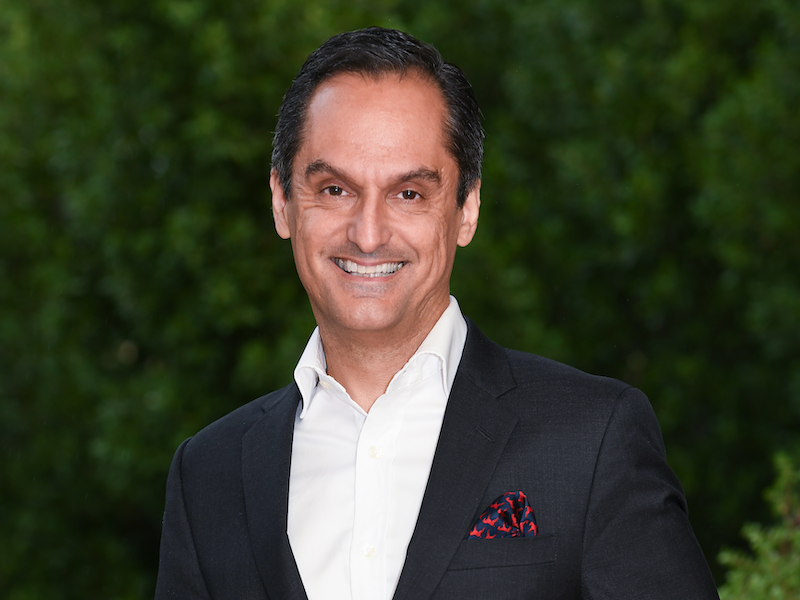

Environmental, social and governance investment strategies can improve a portfolio’s ability to generate alpha, according to Patrick Vizzone, managing director of global private equity at Franklin Templeton, speaking during a session at the Canadian Investment Review‘s 2022 Investment Innovation Conference. “Impact investing is sometimes regarded as being a drag on financial returns, but we believe […]

“As the preceding presentations showed quite clearly, the climate is changing and the impact won’t have a linear correlation with temperature rises,” said Aaron Bennett, chief investment officer of the University Pension Plan, during a session at the Canadian Investment Review’s 2022 Investment Innovation Conference. This once controversial position underpinned the $11-billion multi-employer defined benefit […]