The Association of Canadian Pension Management is urging the Financial Services Regulatory Authority of Ontario to apply a best practices approach for the pension sector in its information technology risk management guidance. In an open letter to the FSRA, the ACPM said a real-time reporting framework for material IT risk incidents could result in a […]

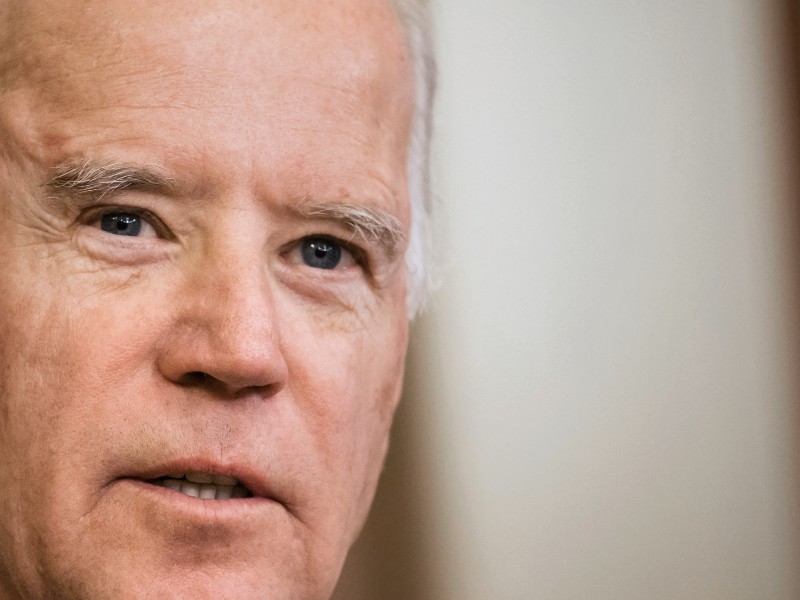

A resolution to reverse a rule allowing U.S. pension investors to consider environmental, social and governance criteria has been blocked by President Joe Biden. “It would put at risk the retirement savings of people across the country,” the president said after issuing his first-ever veto. Through the office’s veto power, a president may block any […]

A British Columbia court has dismissed an appeal of a Supreme Court of B.C. decision that upheld the B.C. Credit Union Employers’ Pension Plan’s choice to increase its normal retirement date to age 65 from age 62. In its decision, the court found the appeal — brought by a group of plan members — alleged […]

Canada requires clear, consistent guidance on the integration and reporting of sustainability factors into investment decisions, according to a new report from the United Nations-based principles for responsible investment. “There are currently no consistent regulatory requirements for sustainability reporting that apply to all investors and issuers across Canada,” noted the report. “Without such a tool, […]

As the University Pension Plan increases its focus on climate change, its responsible investment policy considers environmental, social and governance factors as essential to sound long-term investing. “We’ve seen a lot of evidence from a variety of service providers — from investment banks to investment managers — that have demonstrated [the climate] is getting warmer […]

Slightly more than a third (35 per cent) of U.S. institutional investors are incorporating environmental, social and governance factors into investment decisions, down from a high of 49 per cent in 2021, according to a new survey by investment consulting firm Callan. The survey, which polled more than 100 institutional investors, found 50 per cent […]

Canadian investment managers had $3 trillion in assets using responsible investment strategies as of Dec. 31, 2021, down slightly from the $3.2 trillion reported in 2019, according to a survey by the Responsible Investment Association. The survey, which polled 77 asset managers and 13 asset owners, found more than nine in 10 (94 per cent) respondents are […]

An article on the Canadian Federation of Pensioners’ response to proposed legislative and policy updates for Alberta’s private sector pension regulations was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. CFP urging Alberta government to reconsider transfer of pension risk to plan members 2. Walmart […]

A new report from the C.D. Howe Institute says pension plan fiduciaries shouldn’t ignore climate change and other environmental, social, and governance factors that are relevant to financial purposes. However, when plan fiduciaries use ESG factors to prioritize social or environmental concerns, such as those expressed by plan members, they put themselves on shaky legal […]

The Canadian Institute of Actuaries is advising the Canadian Association of Pension Supervisory Authorities to strengthen its proposed guideline on risks related to environmental, social and governance factors, including consideration for pension plan liabilities and climate-related disclosure. In an open letter to the CAPSA, the CIA suggested including a section on how ESG factors should […]