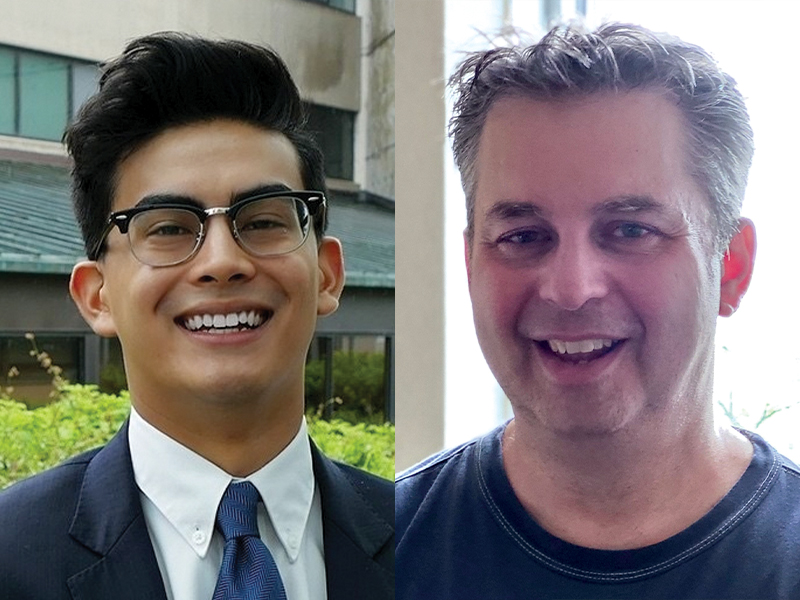

As Canadians face continued economic uncertainty, a recent university graduate and a long-time teacher share their views on balancing different financial priorities. Sul Mahmood, age 24, a product specialist at OpenPhone Technologies Inc. Canadians should be saving for a combination of retirement and other financial priorities. If there’s anything I know (and from all the […]

Nearly three-quarters (71 per cent) of Canadians say saving for retirement is a challenge amid rising inflation, an increase of six percentage points over 2021, according to a new survey by BDO Canada. The survey, which polled more than 2,000 Canadian adults, found 43 per cent said they’ve also cut their savings for retirement. As a […]

Amid rising inflation, airport hospitality services provider OTG Management is supporting employees’ financial wellness through an earned-wage access card. Nearly a third (30 per cent) of the organization’s Canadian employees have accessed the benefit, which allows employees to access their pay and manage their finances whenever and however they prefer, says Alan House, OTG’s executive […]

The majority (84 per cent) of employees who say they’re feeling stressed are saving less than five per cent of their pay, according to a new survey by the National Payroll Institute and the Financial Wellness Lab of Canada. The survey, which polled more than 3,000 Canadian employees, also found workers are saving less than […]

The financial well-being of working Canadians has fallen sharply and is at its lowest point since January 2021, according to LifeWorks Inc.’s latest financial well-being index. It found the number of Canadians reporting a worsening financial situation increased five per cent compared to the previous period and those reporting an increase in financial concerns climbed […]

An article on Canada’s ranking in retiree well-being was the most-read story on BenefitsCanada.com over the last week. Here are the five most popular news stories of the week: 1. Canada drops to No. 15 in retiree well-being global rankings: report 2. Court rules employers must include electronic tips under pensionable earnings 3. Expert panel: How employers can support […]

After a tough couple of years, Canadians continue to face several challenges against an increasingly turbulent economic landscape. While most coronavirus restrictions were lifted in late spring 2022, the seventh wave of the pandemic arrived in July alongside rising inflation, which is compounding prices from the gas pump to the grocery store. Though the 2022 […]

Canada ranks No. 15 among developed nations for retiree well-being, down from No. 10 in 2021, according to Natixis Investment Managers’ annual global retirement index. The index, which provides an overview of the relative well-being and financial security of retirees in 44 countries across four indices, ranked Canada No. 11 in health, No. 12 in […]

In 2019, Nick Smith graduated with $50,000 worth of debt — $30,000 in student loans and $20,000 with a student line of credit. Low-paying jobs and a high cost of living made it hard for Smith to make a dent on his debt until he got hired as a mechanical technologist in Halifax at Dillon Consulting […]

Despite President Joe Biden’s new student loan forgiveness program, nearly two-thirds (60 per cent) of U.S. employers that currently offer a student loan repayment program won’t be changing their policy, according to a survey by the International Foundation of Employee Benefit Plans. The survey, which polled more than 300 U.S. employers, found the majority (74 […]