The Bank of Canada held its key interest rate steady at five per cent, but hasn’t ruled out future rate hikes as price pressures remain high. “With clearer signs that monetary policy is moderating spending and relieving price pressures, governing council decided to hold the policy rate at five per cent,” said the Bank of […]

Nearly a third (32 per cent) of U.S. institutional investors say they plan to increase their private asset allocations over the next two years, primarily due to diversification benefits, lower volatility and the potential to garner higher returns than public markets, according to a new survey by Schroders. The survey, which polled more than 100 […]

Institutional investors don’t have to wait for choppy waters to invest in event-driven credit, according to Duncan Farley, portfolio manager on the BlueRay fixed income team at RBC Global Asset Management, speaking during the Canadian Investment Review’s 2023 Risk Management Conference. While the post-pandemic economy has negatively affected several industries, opportunities always exist for investors to […]

Two-thirds (66 per cent) of large institutional asset owners say they plan to increase their allocations to private markets over the coming year, according to a new survey by Mercer. The survey, which polled about 60 global asset owners, found among those planning to increase their private market investments, 50 per cent said they’re pivoting […]

The Alberta Investment Management Corp. is opening its first Asian office, but the Edmonton-based investment organization says it will steer well clear of China to focus instead on markets with less geopolitical risk. The official opening of the AIMCo’s new Singapore office marks the first foray into the Asia-Pacific region for one of Canada’s largest institutional investors, with $158 billion of assets under management as of 2022. Evan Siddall, chief executive officer of the AIMCo, […]

Nearly all (93 per cent) institutional investors believe the Chinese yuan is going to become the reserve currency for multiple countries within the next five years, according to a new study by mining firm Tresor Gold. It found a third (30 per cent) of respondents believe the move will prove highly successful, while only two per cent […]

However long the social, political and economic fallout of the coronavirus pandemic may last, humanity and its economic systems have weathered the storm exceptionally well, said David Frum, a political commentator and senior editor at The Atlantic, during the keynote address at the Canadian Investment Review‘s 2021 Investment Innovation Conference. “We just put the entire world […]

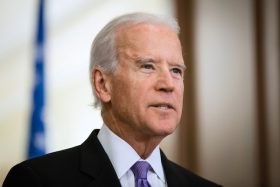

The prospect of a Joe Biden presidency with a Republican-held senate is an ideal outcome for markets, said Charles Myers, founder and chairman of Signum Global Advisors, during the Canadian Investment Review’s Investment Innovation Conference in November. Speaking the morning after the election, Myers said Republicans’ expected continued control of the senate would have “very […]

President-elect Joe Biden will inherit a vulnerable economic recovery under threat from a resurgent virus, likely with a divided Congress that will hinder his ability to address the challenges. Yet despite the obstacles, the former vice-president and senator will pursue a drastic shift in America’s economic policy. He has vowed to reverse much of the […]

U.S. stock futures and markets around the world are mostly holding steady or ticking higher in early Wednesday trading, but only after spinning through an election night dominated by surprises and sharp swings. After rallying early this week amid hopes that Election Day’s arrival could clear the uncertainty that’s been weighing on markets, Treasury yields […]