The U.S. economy has already sustained a soft landing, according to Michael Arone, chief investment strategist and managing director at State Street Global Advisors, during the Canadian Investment Review’s 2024 Investment Innovation Conference. The U.S. economy saw 4.9 per cent annualized growth in gross domestic product in the third quarter of 2023, he said, highlighting […]

Evolving expectations, a shifting interest rate environment and the need to manage increasingly large asset bases for performance and for national and societal impact are transforming how and where institutional investors allocate capital, according to a new report by the Boston Consulting Group. It found in 2024, sovereign wealth funds and public pension funds accounted […]

The rapid rise in the cost of living in 2022 and into 2023 underscored the need for target-date funds to not just protect against standard inflation, but inflation shocks as well. The problem that presents is the more inflation protection that’s added into a portfolio, the lower the returns, said Nick Nefouse, managing director, global […]

An acceleration of significant weather events are impacting the risk premium earned from insurance-linked securities, providing a significant inflation hedge for institutional investors, says Bernard Van der Stichele, senior portfolio manager of insurance-linked securities at the Healthcare of Ontario Pension Plan. “ILS investments earn a risk premium that is directly proportional to the level of risk […]

It’s important for institutional investors to view risk mitigation as a way to improve the risk-return proposition and not as a way to express a bearish view on markets, said Rémi Tétreault, associate vice-president at Trans-Canada Capital Inc., during the Canadian Investment Review‘s 2024 Global Investment Conference in April. “It’s about performing well in a […]

As global markets navigate turbulent economic waters, active management is proving once again to be a lifeline for institutional investors to ensure their portfolios ride out the storm. Pension funds are currently operating amid uncertainty and potential risk, says Ruslan Goyenko, an associate professor of finance at McGill University’s Desautels Faculty of Management. “There are […]

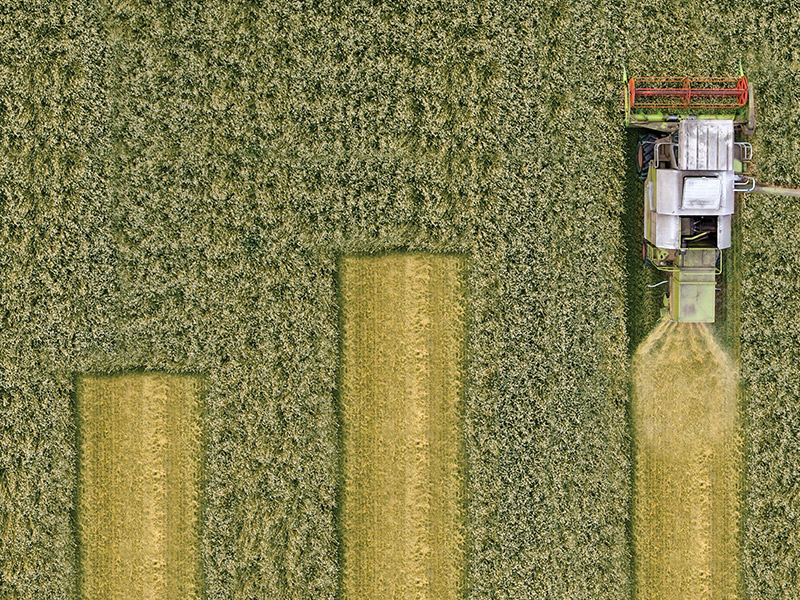

Despite the prevalence of farming in its home province, the Alberta Investment Management Corp.’s agricultural portfolio is just 13 years old, the product of a 2010 investment in converted farmland held by Australian timber producer Great Southern Group. The properties proved too arid for tree growth and were converted back to croplands for canola, wheat […]

Manitoba’s Teachers’ Retirement Allowances Fund returned negative 0.42 per cent in 2022, exceeding its benchmark return of negative 5.04 per cent. “While we are pleased with these short-term results, our longer-term results are equally favourable,” said Jeff Norton, the TRAF’s president and chief executive officer, in its annual report. “Over the past 20 years to […]

While real estate has long been a part of defined benefit pension plans’ asset allocations, its inclusion in investment portfolios has steadily climbed in recent years. But defined contribution plan sponsors and members also stand to benefit from the asset class’ inflation-hedging properties, as well as its ability to boost income and improve portfolio diversification. Pension […]

King Midas’ gold-heavy investment portfolio wasn’t built for long-term growth, rather as an effective hedge against long-term inflation. “The 150-year real return of gold has been plus 0.2 per cent, so it’s not a very attractive asset from a long-term perspective,” said Inigo Fraser-Jenkins, co-head of institutional solutions at AllianceBernstein, during a session at the […]